The entire Bitcoin mining industry is often shrouded in a cloak of confusion for onlookers. Mining data is no exception to this. Here we aim to clarify the meaning and utility of a few common forms of mining data. Hopefully, understanding what the following metrics mean will encourage better informed discussions about mining.

What is Hashprice?

Hashprice is one of the most important and least understood mining metrics. Of course, miners understand this revenue measure, but non-mining audiences rarely discuss it. Perhaps the reason for this is because hashprice is derived from several other metrics, making it too confusing.

That confusion can end here.

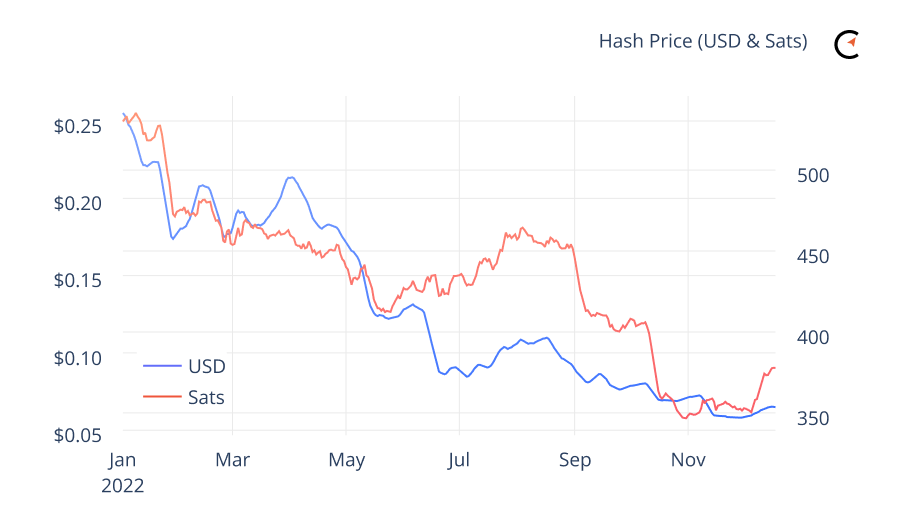

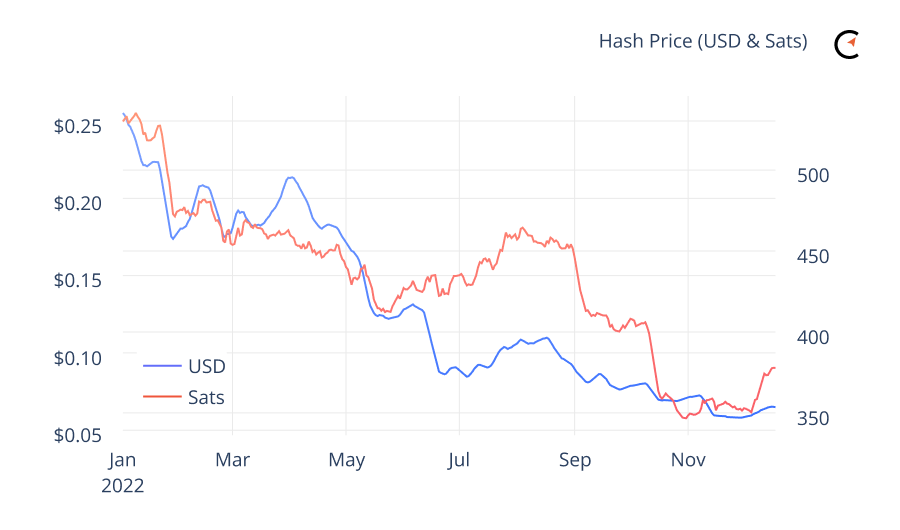

Reducing it to the most basic elements, hashprice is a function of changes in bitcoin’s price and mining difficulty. Block rewards (transaction fees and miner subsidies) also affect hashprice since the value of these payouts are obviously denominated in dollars, and hashprice serves as a dollar-denominated measure of revenue per unit of hashrate. This also means that hashprice changes on a per-block basis, although most hashprice charts calculate on an hourly or daily basis.

One of the most important hashprice characteristics to note is its ability to climb or fall regardless of whether the market price of bitcoin rises of falls. So long as hashrate increases slower than the price of bitcoin, hashprice will go up. Also, if hashrate falls faster than the bitcoin price, hashprice will also go up.

One hop what?

News and social media lose their collective mines whenever on-chain analysts write about significant movements or balance changes from bitcoin addresses associated with mining entities. These data are almost exclusively assumed to be selling behavior, which feeds fear, uncertainty, and doubt (FUD) in the market. These conclusions almost never include important caveats that all on-chain data should have nor do they represent important nuances of mining address data.

Here’s a rundown of important mining address data nuances.

Two primary categories of mining addresses comprise almost all of the on-chain data that feeds mining FUD: zero-hop and one-hop addresses. What does this mean? It simply describes the distance from addresses that receive payouts from a coinbase transaction.

- Zero-hop (or 0-hop) addresses generally represent mining pools themselves. Movements from these addresses can safely be assumed to be spending UTXOs by sending payouts to mining entities.

- One-hop (1-hop) addresses generally represent mining entities paid by pools. Movements from these addresses could include almost any reason someone would move bitcoin: sending to an exchange, shuffling across storage infrastructure, merchant payments, etc.

The “miner balance” data usually aggregates both types of addresses in one large data set, which as explained above, conflates two very different types of addresses. Moreover, assuming any movement from either type of address is with the intent to sell constitutes a massive logical leap that should be heavily discounted.

The price and hashrate riddle

The relationship between Bitcoin hashrate and Bitcoin price is somehow a never-ending discussion topic across the broader crypto industry. Disagreement persists on whether price follows hashrate or vice versa. To be clear: hashrate follows price. Except when it doesn’t.

Hashrate generally follows price for basic economic reasons that can be deduced from mining revenue. When the price is going up, mining revenue generally goes up. This creates stronger incentives for new miners to join the industry and existing miners to expand their operations. When the price goes down, margins contract and miners reduce their hashrate or are squeezed out of the market altogether, which can cause a dip in total hashrate.

This relationship is filled with caveats, however. By looking at a hashrate chart, readers will see that for almost the entirety of bitcoin’s history, hashrate has gone up and to the right. Following downward price movements is often relatively short lived and certainly lags behind. But when price moves down significantly for a sustained period, betting on an eventual hashrate drop is safe.

Mining data will be misrepresented by Twitter influencers and mainstream journalists for as long as Bitcoin exists. In some cases, this is because mining is an inherently confusing business in some regards. But mining is also incredibly simple, and some key metrics deserve a few minutes of attention to be properly understood.