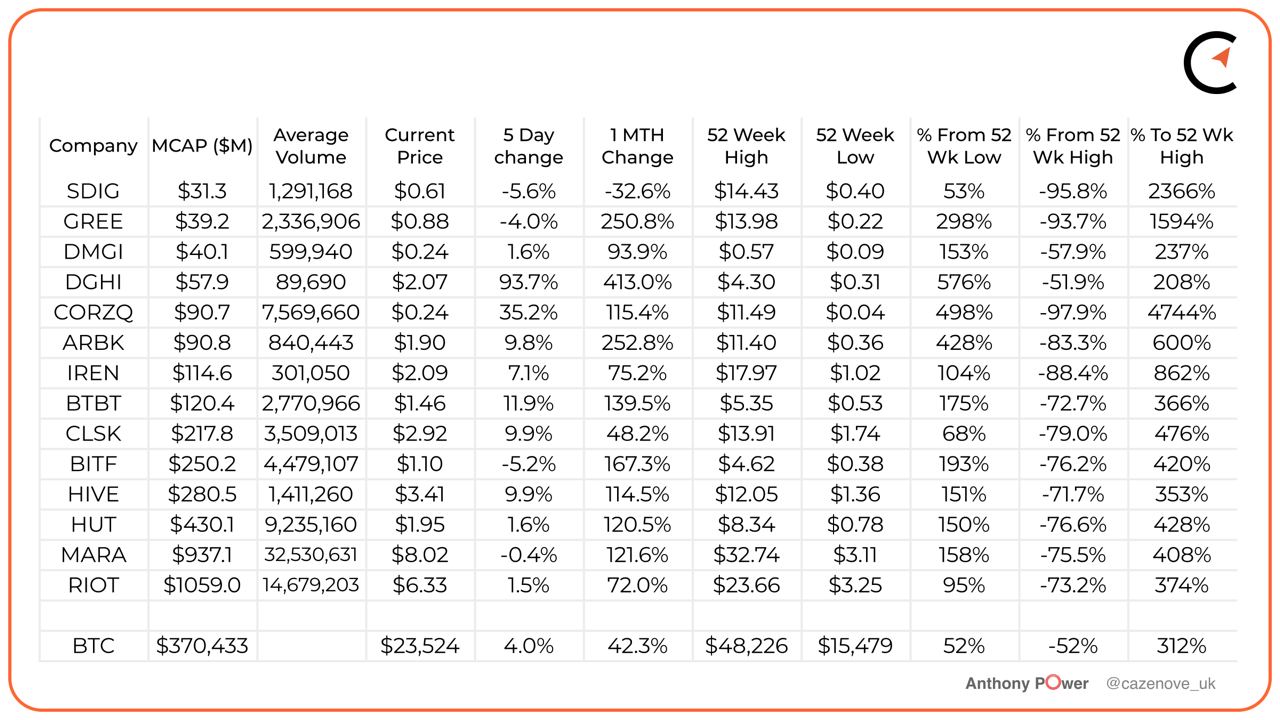

The last 12 months have seen constant pressure on Bitcoin’s price, reaching a low of $15,790 in December 2022–a drop of 77%. Delusional crypto markets were not helped by macroeconomic challenges, such as the war in Ukraine, and a strengthening dollar. Indeed, companies like FTX, Compute North and Core Scientific (CORZQ) were all exposed in various ways and filed for Chapter 11 protection.

Bitcoin miners suffered accordingly, particularly public companies. In the last year the North American-listed Bitcoin miners saw their share prices drop on average between 85-90% with many forced into selling their BTC Hodl to pay for operational and capital expenses.

However, in early 2023 we’ve started to see signs of recovery and as can be seen from the table above. The price of Bitcoin is currently up 42.3% in the last month and 52% higher than its December lows. This recent surge in the price has provided an opportunity for more miners to switch on and this was confirmed with the Bitcoin hashrate increasing by 13.4%, further confirmed by the Bitcoin mining difficulty increasing by 11.3%, over the last 30 days.

The Bitcoin mining shares have equally performed very well during this recent surge in Bitcoin price, with an average increase in the last 30 days of 225%. A special mention for Digihost Technology (DGHI) which has seen its share price increase by 413% in the last 30 days and rise 576% from its December 2022 low.

Argo Blockchain (ARBK), Greenidge Mining (GREE) and Core Scientific (CORZQ) have also seen significant recovery over the last 5-6 weeks, but it should be remembered that their share prices are still -83.3%, -93.7% and -97.9% down from 52 week highs. Their financial positions have been well documented and although Argo Blockchain and Greenidge Mining have currently avoided Chapter 11, Core Scientific filed for Chapter 11 protection on December 20th, 2022.

On a positive note, Riot Blockchain has seen their market capital recently rise above $1 billion again and become the largest publicly traded Bitcoin Miner in North America. However, it should be noted that in February 2021, their market capitalization reached $6.1 billion, so there’s still a way to go to return back to those levels.

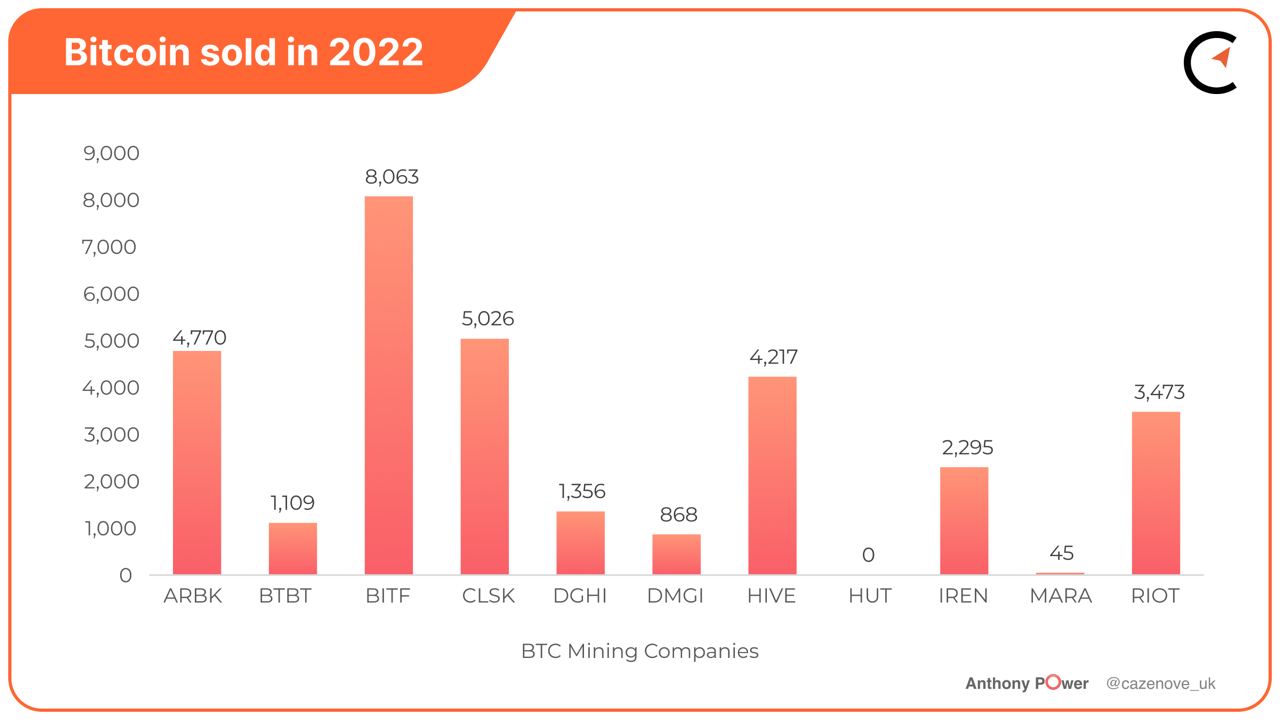

Selling in 2022

In 2021 the majority of the North American Bitcoin miners held onto their mined Bitcoin as the price of Bitcoin rose exponentially. It was during this period that miners were starting to utilize the competitive debt markets, to raise much needed capital in order to grow their hash rate. Two miners, Bitfarms (BITF) and Argo Blockchain even used cash reserves to boost their hodl by purchasing Bitcoin in January 2022, a decision both would soon come to regret.

From May 2022 as the Bitcoin price continued to plummet, the majority of the miners started to liquidate their Bitcoin to pay for operational costs, including debt obligations and capital growth. As can be determined from the table above, Bitfarms and Argo Blockchain sold significant levels of their coins in 2022 to pay down debt.

It wasn’t enough to help Argo Blockchain, who eventually had to sell their flagship Helios site, in Dickens County, Texas, to Galaxy Digital (GLXY), in late December 2022, in a deal that allowed them to restructure their debt, allow their mining rigs to be hosted by the new provider and more importantly provide much needed runway to recover.

Hut 8 (HUT) has not sold Bitcoin in over 2 years and has fervently maintained a cautious ‘balance sheet’ first approach. Their current hodl of 9,086 unrestricted Bitcoin, as at December 31,2022, with a current value of $211.3 million places them in a good position to get through this current bear cycle and consider further buying opportunities in the run through to the next bull cycle.

Marathon Digital (MARA) have also held the vast majority of their Bitcoin over the last 2 years with a hodl as at December 31, 2022 of 12,232 Bitcoin at a current value of $284.2 million. The company has recently entered into a joint venture with FS Innovation, LLC, to form the Abu Dhabi Global Markets creating two mining sites in Abu Dhabi with a total power capacity of 250 MW. This venture provides the company with an initial 20% stake for their share of the initial costs totalling $81.2 million. To raise this amount of funds we may well see Marathon start to sell some of their Bitcoin hodl.

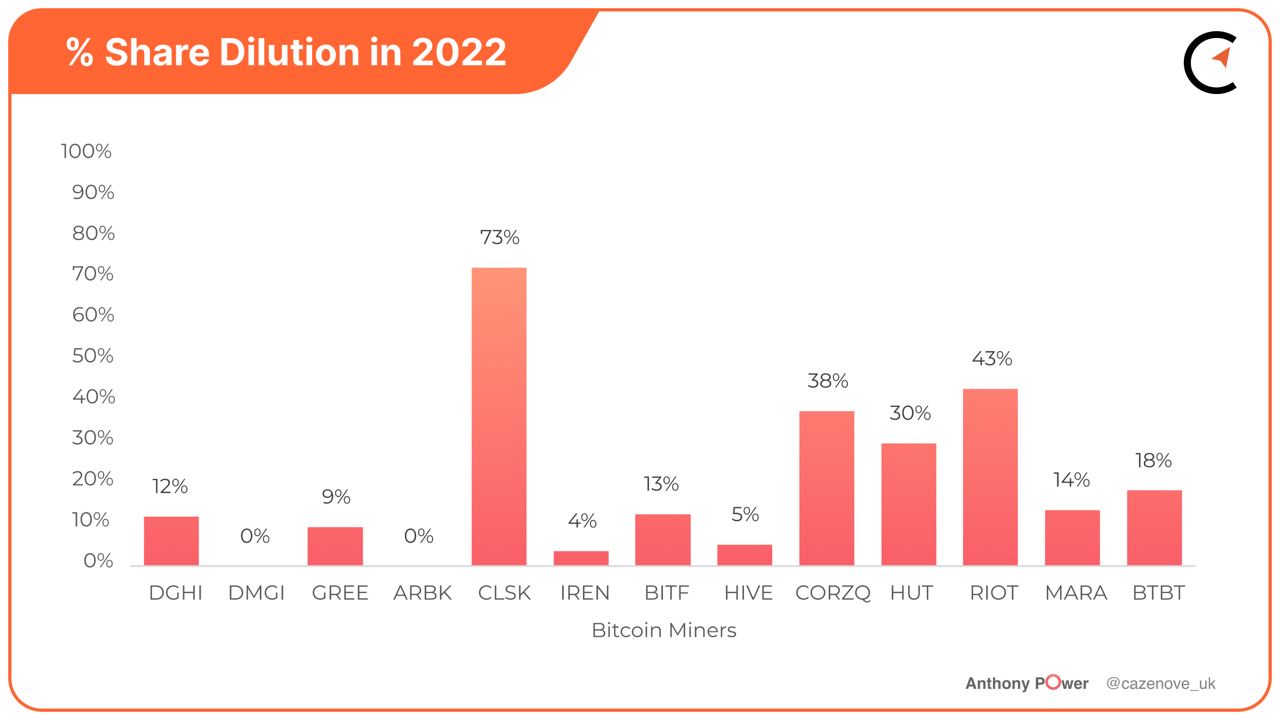

Share dilution

In 2022 we have seen many of the miners choose to raise much needed cash reserves through the process of share dilution, to cover their costs.

CleanSpark (CLSK) increased its shares held on January 1, 2022 by 73%. However, it should be noted they were the only miner to not only achieve, but exceed their 2022 hashrate growth strategy of 5.5 EH/s. In fact they actually increased their hash rate to 6.2 EH/s, an impressive 226% increase and therefore maybe shareholders would view this as a positive outcome.

In July 2022 Riot Blockchain shareholders approved a motion to increase the number of shares of common stock authorized for issuance from 170,000,000 shares to 340,000,000 shares. This will provide the company with a great platform to complete Phase 1, providing 400 MW of power at their Corsicana site in Navarro County, Texas.

A number of other miners have received shareholder approval for ‘at-the-market’ (ATM). This allows companies to incrementally drip sell newly issued shares into the secondary trading market through a designated broker-dealer at prevailing market prices. Digihost Technology approved an ATM equity offering of $250 million on March 04, 2022. They have yet to fully utilize this and will be waiting for the share price to recover further providing an opportunity for greater revenues.

Bitfarms announced in August 2021 the launch of an ATM equity program, to be conducted by HC Wainwright. The financing will see the company raise up to $500 million via the direct sale of common shares on the Nasdaq.

CleanSpark are requesting shareholders to vote on March 8, 2023 for the company to increase the number of shares of Common Stock authorized for issuance under the Current Articles from 100,000,000 shares to 300,000,000 shares which should provide much needed capital for the company to achieve their end 2023 hashrate growth target of 16 EH/s.

Regardless of the method, the purpose remains clear: gain more capital to deploy more hashrate.

Looking forward to 2023, with the debt markets currently in turmoil, after a number of miners, totalling 11.59 EH/s of hashrate through ASIC backed loans defaulted on their payments, Bitcoin miners will look to raise more funds through more dilution and selling bitcoin to enable them to firstly survive and also grow their hashrate.

Even though we’ve seen a rally in the Bitcoin price, many commentators are still suggesting the worst is still to come for some of the North American listed mining companies.