A Norwegian town campaigned to shut down a bitcoin mining operation in their town. They got their wish . . . and a huge increase in their power bills. Does the public’s misunderstanding of the role Bitcoin miners play in their energy grids have them paying higher electricity bills?

What happened?

Due to excessive noise complaints, residents in Norway’s Hadsel township banded together to oust the local Bitcoin miners. As a result of their successful ousting, their power bill increased by about $280 USD per year. The town’s cumulative annual cost increased by about $1.4 million USD per year, which, for Hadsel, a small town of only about 8200 people (see image 1), is a significant change to their budget.

Sure, an industrial mining operation is loud, especially if you're used to a quiet fjord in the Arctic. However, the town of Hadsel may serve as a warning to the rest of Norway, which may be eyeing similar banishments.

Why does Norway matter for Bitcoin mining?

Norway is a highly developed country, and, despite their booming oil industry, 99.5% of Norway's energy mix is made up of renewables, with 90% of that being hydro-generated power. As Norway's Scandinavian neighbors, Sweden, increases regulatory restrictions for bitcoin miners, Norway seems to be, unfortunately, following their lead and imposing regulatory limits on bitcoin miners as well.

As Norway strives to improve its environmental footprint and reduce its greenhouse gas emissions, lawmakers have been clear that the point of this regulation is to be selective about projects permitted to operate in the country and to signal that the Bitcoin mining business are not welcomed. So whether or not Hadsel's citizens complained solely about the noise, there were likely multiple factors being considered by the township.

Did Norway make a mistake?

As any bitcoiner would explain, Hadsel made a mistake. If loud noise ruining town vibes were the true reason behind the miner's removal, then some simple sound mitigating measures could have been implemented to reduce acoustic disruptions. Better watch out if you live in Hadsel with a loud Playstation 4 – you might get kicked out of town!

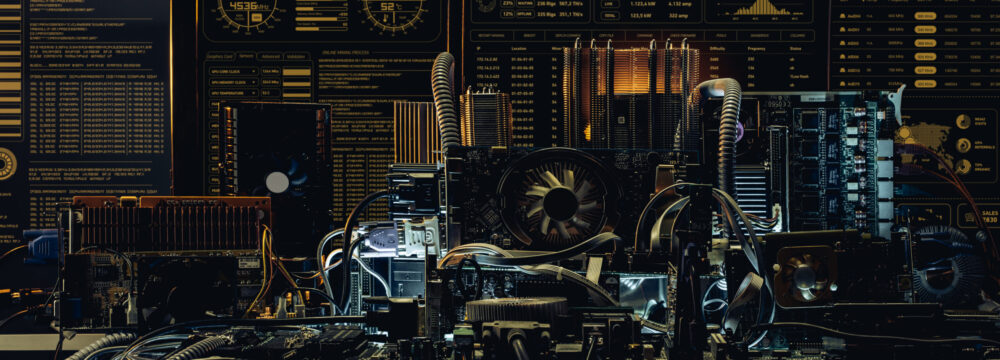

Instead of removing loud bitcoin miners, the town could’ve quieted the mining site for less than the previously cited one year's increased spending on energy of $1.4 million USD. The banishment, however, is just a symptom of the root cause of an overall misunderstanding of Bitcoin mining and ASICs in general. ASICs do not emit carbon dioxide (see image 2), so the environmental claim against them is false.

In fact, from an energy consumption and carbon emission perspective, ASICs are very similar to electric cars, which the Norwegian government loves as evident by their regulations and subsidies. Thus, Norwegians, and Hadsel, should love bitcoin mining (see image 3). Unfortunately, ASICs have been demonized in the media and that intellectual infection appears to have been caught by the Norwegian government. Thankfully, misconceptions are not fatal and can be course-corrected. Bitcoiners around the world hope Hadsel marks a symbolic shift in Norway's policy stance towards bitcoin miners and pull out a win from the ashes of dispair.

How Norway can turn this situation into a win-win

To start, Norway's regulatory agents should closely examine the Hadsel situation. For a nation working towards a zero carbon emission future, bitcoin miners are essential to advance that mission. Bitcoin miners provide an alternate market to privately subsidize energy producers in Norway. Without this alternate market, when the Hadsel population is asleep, and their hydroelectric energy is in prime production, the energy producers fail to monetize their business, which then limits their ability to expand and continue serving their customers with affordable energy.

Hadsel's bitcoin miners subsidized the energy costs by about $280 per household annually. This bitcoin mining annual subsidy not only returns $280 USD in additional Krones per household for local, micro economic stimulus, but it makes the whole town richer from a macro perspective.

To turn Hadsel into a win-win, Norway's government can embrace the economic gains that Bitcoin miners provide their townships to expand renewable energy infrastructure. By supporting Bitcoin miners, Norway could course-correct its misguided regulatory efforts, which would be a win-win to Norway while providing a successful case-study of how Bitcoin Mining can help move forward progressive energy agendas across the globe.