HIVE Digital Technologies: Is HIVE currently the best value among Bitcoin Miners?

Founded in 2017, HIVE Digital Technologies (HIVE), formerly known as HIVE Blockchain Technologies, has emerged as a leader in the Bitcoin mining industry. It is distinguished by its commitment to sustainability and innovation. Under the leadership of Executive Chairman Frank Holmes and CEO and President Aydin Kilic, HIVE has successfully carved a niche for itself in the fast-paced world of cryptocurrency.

A Sustainable and Community-Centered Approach to Bitcoin Mining

Bitcoin mining is often criticized for its environmental impact and high energy use. HIVE addresses this by using green energy sources. HIVE’s data centers run on renewable energy, including hydroelectricity and geothermal power, in regions like Iceland and Sweden, where these resources are plentiful and affordable. This approach not only lowers the carbon footprint but also reduces operational costs. In addition to its sustainable mining practices, HIVE is committed to making a positive impact on the communities where it operates by engaging local communities to create jobs and support local economies.

Operational Performance

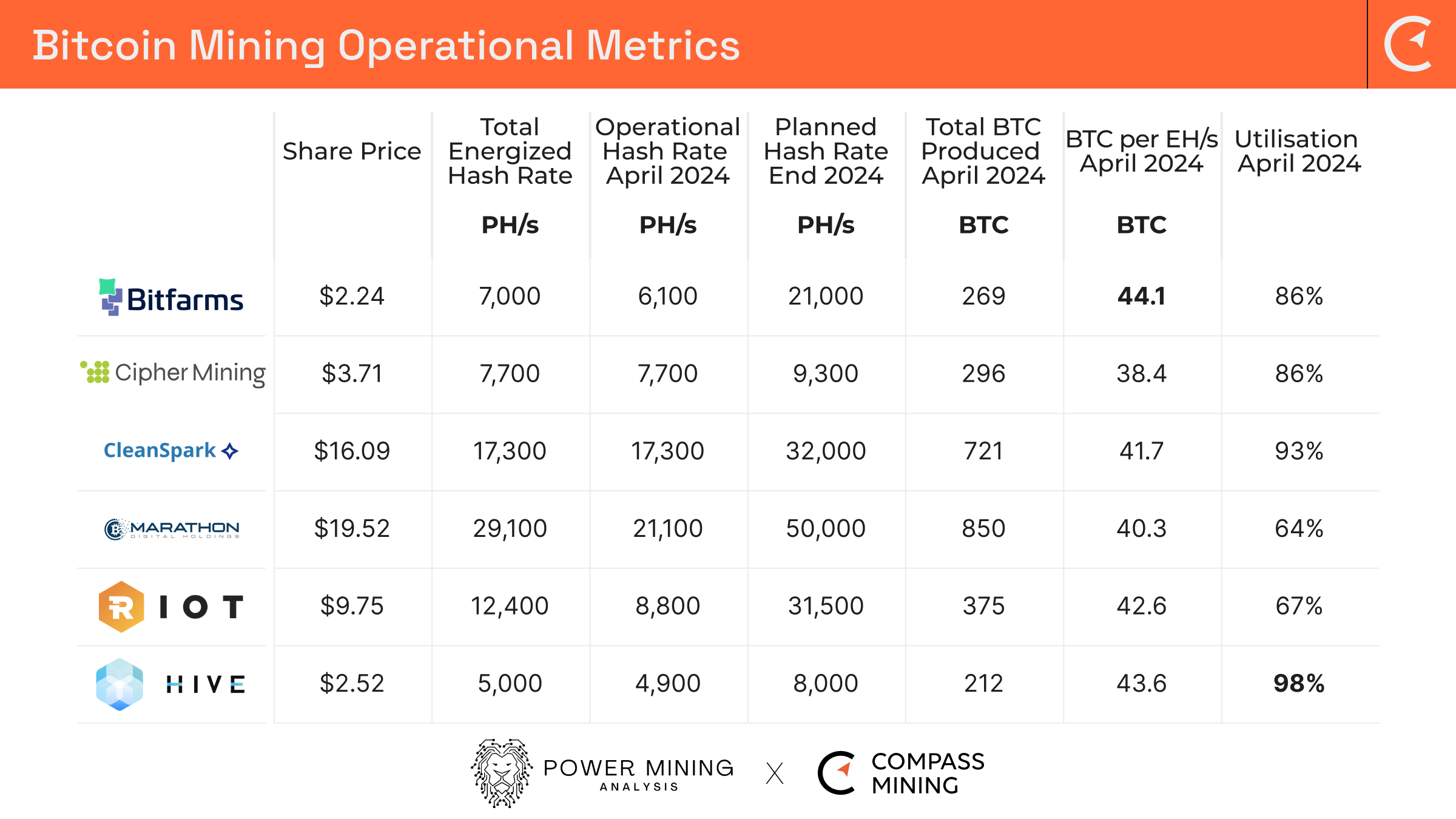

HIVE consistently demonstrates exceptional operational performance in the Bitcoin mining industry. By leveraging its strategic locations in cooler climates like Canada, Iceland, and Sweden, the company has been able to achieve stellar results in terms of Bitcoin mined per EH/s. In April, HIVE reported a Bitcoin mining capacity of 5 EH/s, a significant milestone.

HIVE also maintained a monthly average hash rate utilization above 98% in 2023, placing it among the top performers in North America. In the first four months of 2024, the company remains in the top 3 for both production by EH/s and utilization of energized hash rate metrics.

The table below highlights the 2023 Bitcoin production efficiency of North America’s largest publicly listed Bitcoin miners, a table that the company led throughout 2021 and 2022, highlighting their consistent performance.

Valuation Metrics

The valuation metrics for HIVE suggest that the market may be undervaluing the company. Enterprise Value (EV) is used instead of Market Capitalization (MCAP) because EV includes debt, cash, cash equivalents, and Bitcoin holdings, offering a more comprehensive financial picture.

EV-to-Revenue (EV/R) Multiple

HIVE’s EV/R is 1, compared to Marathon Digital’s 11.9 and Riot Platforms 9.8. This shows that the market is “overhyping” Marathon and Riot relative to HIVE. The disparity in EV/R implies that HIVE may be the more attractively valued growth opportunity among publicly traded Bitcoin miners. The lower EV/R suggests HIVE’s shares could be trading at a discount compared to the market’s perception of other miners.

Price-to-Book (P/B) Ratio

The P/B ratio compares a company’s market capitalization to its book value, with a P/B below 1.0 suggesting potential undervaluation. Based on P/B ratios:

- HIVE and Riot Platforms: Currently appear undervalued.

- Bitfarms, Cipher Mining (CIFR), CleanSpark (CLSK), and Marathon Digital: Exhibit higher P/B ratios, indicating greater market valuation.

Cost per Terahash per Second (TH/s)

This metric is calculated by dividing EV by the current and projected hash rate, providing insight into operational efficiency:

- HIVE: Current cost value is $18 per TH/s, potentially decreasing to $11 if it reaches its target of 8.0 EH/s by the end of 2024.

- CleanSpark: Current cost value is $174 per TH/s, potentially decreasing to $94 per TH/s if the company achieves 32 EH/s by year-end.

- HIVE’s significantly lower cost value per TH/s underscores its operational efficiency compared to CleanSpark.

It would appear in the last 15 – 18 months the market has been acknowledging and rewarding company valuations, that are seen to be growing their hash rate exponentially. CleanSpark has effectively grown from a company valued at approximately $600 million in October 2023 to receive a valuation of $4 Billion by the end of March 2024, having increased hash rate by 70% year to date and forecasting further growth to 32 EH/s by the end of the year.

Operating Profit Efficiency

Considering the operating profit generated relative to each company’s EV, HIVE demonstrates substantial value:

- Despite not having the lowest energy rates, HIVE maintains low levels of general and administrative (G&A) expenses, a controllable cost.

- The ‘Hype Factor 2’, which examines the operating profit generated from EV, further emphasizes HIVE’s efficiency.

Profit Adjusted Hype Ratio

By combining both ‘Hype Factors’—the EV/R multiple and the operating profit efficiency—we derive a ‘Profit Adjusted Hype Ratio’. Setting the miner with the lowest ratio (HIVE) as the baseline (1), this ratio provides a comparative valuation perspective for each miner.

This comprehensive analysis highlights HIVE’s strong position in the Bitcoin mining industry, demonstrating its potential undervaluation and operational efficiency relative to its peers.

Vertical Integration

HIVE stands out by adopting a vertically integrated business model, controlling the production chain from acquiring mining hardware to operating data centers and selling mined cryptocurrencies. This integration enhances efficiency and cuts costs. The company strategically buys high-performance mining equipment directly from manufacturers, ensuring better prices and a steady supply of the latest technology. By managing its data centers, HIVE optimizes operational efficiency and minimizes downtime, crucial for sustaining profitability in the competitive mining sector.

Diversified Business Portfolio

HIVE operates a diverse business portfolio. While many companies focused on Bitcoin mining, HIVE was one of the first public miners to capitalize on Ethereum mining, achieving margins in excess of 90%. When Ethereum switched to proof-of-stake (PoS) in September 2022, the company began using these GPUs to mine alternative coins and convert earnings into Bitcoin.

In August 2023, CEO Aydin Killic revealed that following extensive testing, HIVE is tapping into its fleet of about 38,000 NVIDIA GPUs to launch an on-demand GPU cloud service. This service expansion is approaching an annual run-rate revenue (ARR) of $10 million, aiming to hit a near-term target of $20 million (ARR).

Financial Transparency and Governance

HIVE adheres to stringent regulatory requirements. This includes regular financial reporting, audits, and disclosures, providing investors with a clear and accurate picture of the company’s performance and operations. The Company announced in March 2024 that it had secured the top position in the technology category on the TSX Venture 50 list, which ranks the best-performing companies across five sectors annually. This is the second time HIVE has been awarded top performance on this exchange.

Technological Innovation

HIVE has been at the forefront of innovation in the cryptocurrency mining industry for some years, prioritizing research and development, investing in next-generation ASICs and optimizing data centers to stay ahead. It’s currently leveraging Artificial Intelligence (AI) and machine learning to enhance equipment performance, optimize energy use, and cut maintenance costs, amplifying its competitive advantage.

As the first publicly traded company to mine Bitcoin and Ethereum, HIVE also developed and introduced the HIVE BuzzMiner, equipped with Intel Blockscale ASIC, marking a significant step in its commitment to green energy and mining efficiency.

Strategic Partnerships and Expansion

HIVE is expanding through strategic partnerships with top tech firms, energy providers, and financial institutions, including collaborations with semiconductor manufacturers for advanced mining chips. This ensures its mining rigs are highly efficient. The company is also on track to hit its year-end target of 8.0 EH/s by acquiring new data centers and upgrading current ones, focusing on efficiency and output. Its expansion strategy is based on market analysis and energy availability, aiming for profitability and sustainability.

Conclusion

As the cryptocurrency market continues to evolve, HIVE’s focus on sustainability and innovation will likely remain key drivers of its success. By balancing profitability with environmental and social responsibility, HIVE not only enhances its competitive advantage but also contributes to the broader goal of sustainable development in the digital age.

In comparing HIVE with Bitfarms, CleanSpark, Cipher Mining, Marathon Digital, and Riot Platforms, several key valuation metrics emerge. HIVE stands out for its lower EV/R and cost per TH/s, indicating potential undervaluation and operational efficiency. Its high hash rate utilization and consistent Bitcoin production efficiency further highlight its competitive edge. Combined with a strong commitment to financial transparency, governance, and strategic expansion, HIVE is well-positioned to continue leading in the Bitcoin mining industry.