If anything has been learnt by the Bitcoin mining industry in the last 12 months, it's that having a strong balance sheet is important for financial stability. It attracts investors and lenders at potentially lower rates, thereby providing flexibility and enhancing reputation. A company with a strong balance sheet will effectively have enough assets to cover its liabilities, which ensures it can continue to operate even during the financial challenges.

Two such miners include Marathon Digital (MARA) and Riot Platforms (RIOT), both well known due to their early listing on the Nasdaq Stock Exchange. They have utilized this advantage to become two of the largest publicly listed Bitcoin miners in North America regularly trading 50 million shares per day.

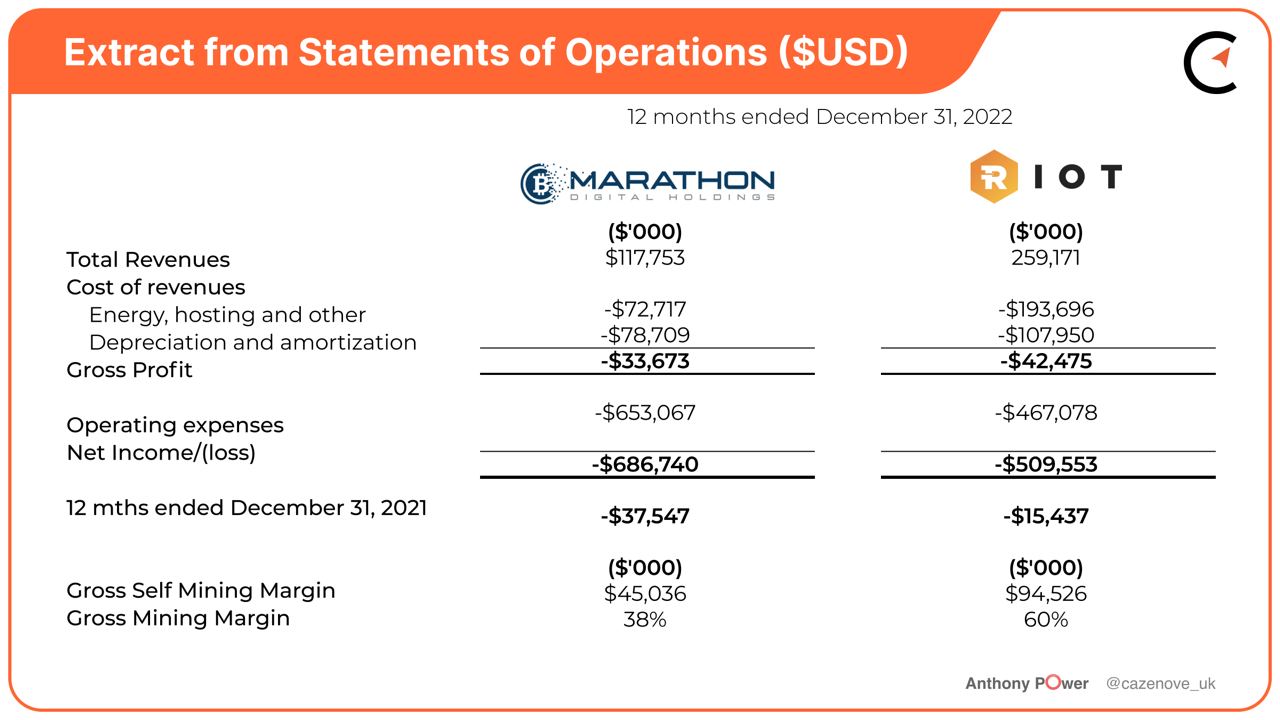

Even still, Marathon and Riot, the two largest publicly traded North American Bitcoin miners, recently issued Form 10-Ks show significant losses for the full year at $687 million and $510 million, respectively. Below, we’ll break down those losses to better understand the strategies of both miners.

Read: Quarterly Analysis: CleanSpark, Hive Blockchain and Iris Energy

Gains and losses

The majority of the losses for both miners were attributed to the increased costs of electricity, the decline in the Bitcoin price, impairment charges related to the carrying value of mining rigs and advances made to vendors and impairment of goodwill.

Marathon Digital had to also deal with the accelerated costs of $54 million when exiting its Hardin site after being damaged by a storm in mid-2022, and the $55.7 million in costs relating to the Compute North bankruptcy.

Riot also had to deal with its own facility issues in December 2022 when a number of buildings housing the immersion cooling technology at their Rockdale farm were damaged during severe winter storms in Texas, impacting approximately 2.5 EH/s and causing $9.7 million of damage. Repairs are ongoing and the company expects its full operational installed capacity to resume in the second half of 2023. This figure, however, does not take account the lost revenues from mining, whilst repairs are ongoing, probably equating to $3-4 million in contribution to operational costs, per month.

There were, however, a few positives to take away from 2022. Marathon Digital were able to benefit from the drop in miner prices to more than double their operational hash throughout 2022, ending the year with 9.1 EHs of machines installed and energized, an increase of 153%. They have since increased their operational hash rate to 9.5 EH/s with a further 4.5 EH/s installed and awaiting energization.

Riot Platforms were also able to grow their hash rate by 185% during 2022 ending the year with 9.7 EH/s of operational hash rate and a further 1.9 EH/s installed in buildings F and G. They also broke ground on their new Corsicana site with the first phase of the facility consisting of 400 megawatts, supporting self-mining and data center hosting operations expected to commence by the fourth quarter of 2023.

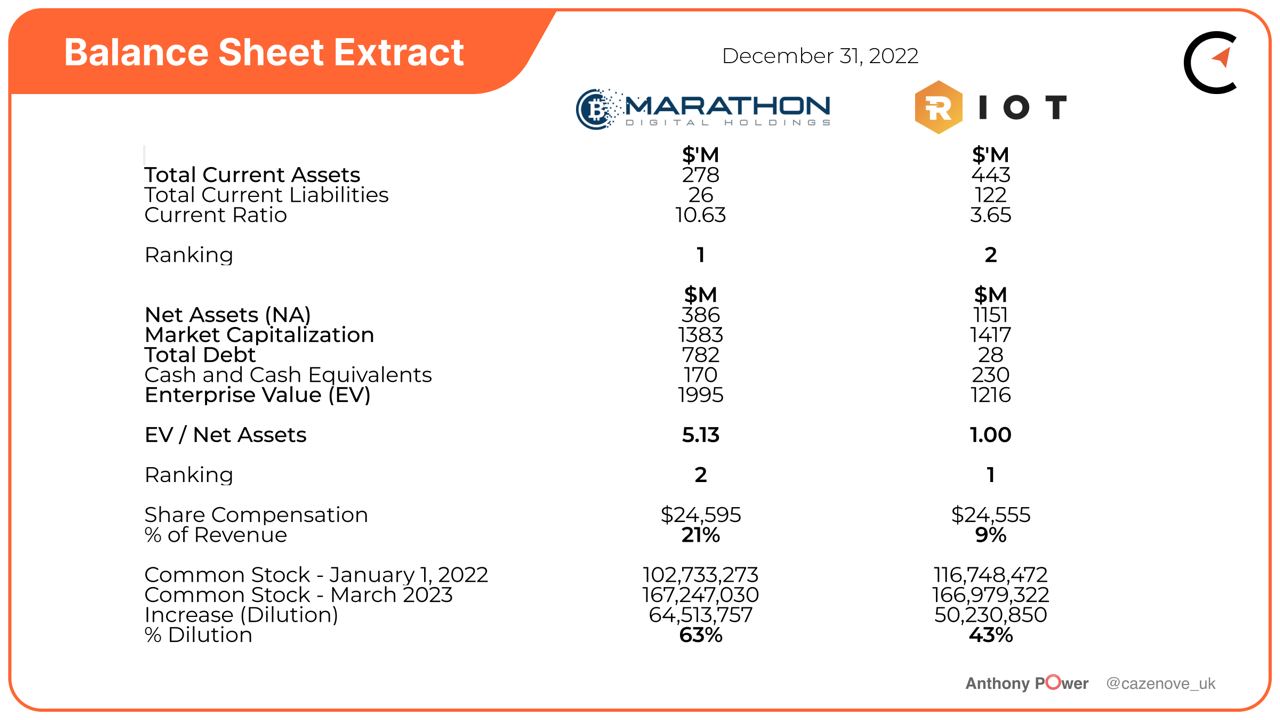

Current Ratio

In terms of liquidity, where a company is required to meet its short term obligations, both companies have an impressive current ratio with Marathon Digital at 10.65 times more current assets than current liabilities and Riot Platforms at 3.65 times. This enables them to manage any financial emergencies and manage risk enabling them to quickly exit investments or positions that have become unprofitable.

Enterprise Value (EV)

The EV provides a comprehensive assessment of a company's overall value, taking into account both its debt and equity components. It is calculated as the market value of a company's equity plus its outstanding debt, minus its cash and cash equivalents.

This metric can be extremely useful as a basis for assessing a company's attractiveness to potential buyers or investors, as it reflects the price that would need to be paid to acquire the company in its entirety, including its outstanding debt. If we consider the two companies, Riot would cost $1.22 billion at today's price, whereas Marathon Digital would effectively cost closer to $2 billion when you take into consideration the amount of debt held on the Balance Sheet.

Both miners have significant unrestricted Bitcoin holdings with Marathon Digital accumulating 11,392 Bitcoin valued at $263.7 million and Riot Platforms with 7,058 Bitcoin valued at $163.4 million.

Share Dilution

To increase their cash balances throughout the period, both companies utilized their at-the-market share offerings over the last 15 months to raise capital for expansion and operational, with Marathon Digital increasing their issued shares by 64.5 million, representing a 63% increase in shares and Riot Platforms diluting 50.2 million (43%) shares over the same period.

Cost of producing a Bitcoin

Marathon Digital produced 4,144 Bitcoin during 2022 and achieved an average revenue per coin of $28,415. The total energy cost per coin was calculated at $17,548 providing a gross mining margin of $10,868 per Bitcoin, or 38%. The other operating ‘cash’ costs such as payroll, rent, equipment repairs, insurance etc., total $14,063 per coin, giving a total ‘cash’ cost of mining a bitcoin in 2022 to $31,610 per coin. The total operating loss per coin is $3,195, and was caused mainly because of poor Bitcoin mining utilization over the reporting period.

Riot Platforms produced 5,554 Bitcoin during 2022 and achieved a gross margin per coin of $17,019, representing 60% per coin. This margin was achieved during the year ended December 31, 2022, as the company achieved $27.3 million in power curtailment credits, as a result of temporarily pausing its operations, equating to approximately 1,815 Bitcoin. The company also provides a Data Centre Hosting Service and Engineering Service to customers to complement mining, which has therefore determined a low operating cash cost when apportioned across all 3 businesses. Riot Platforms produces an overall operating profit of $14,056 per coin representing 50%.

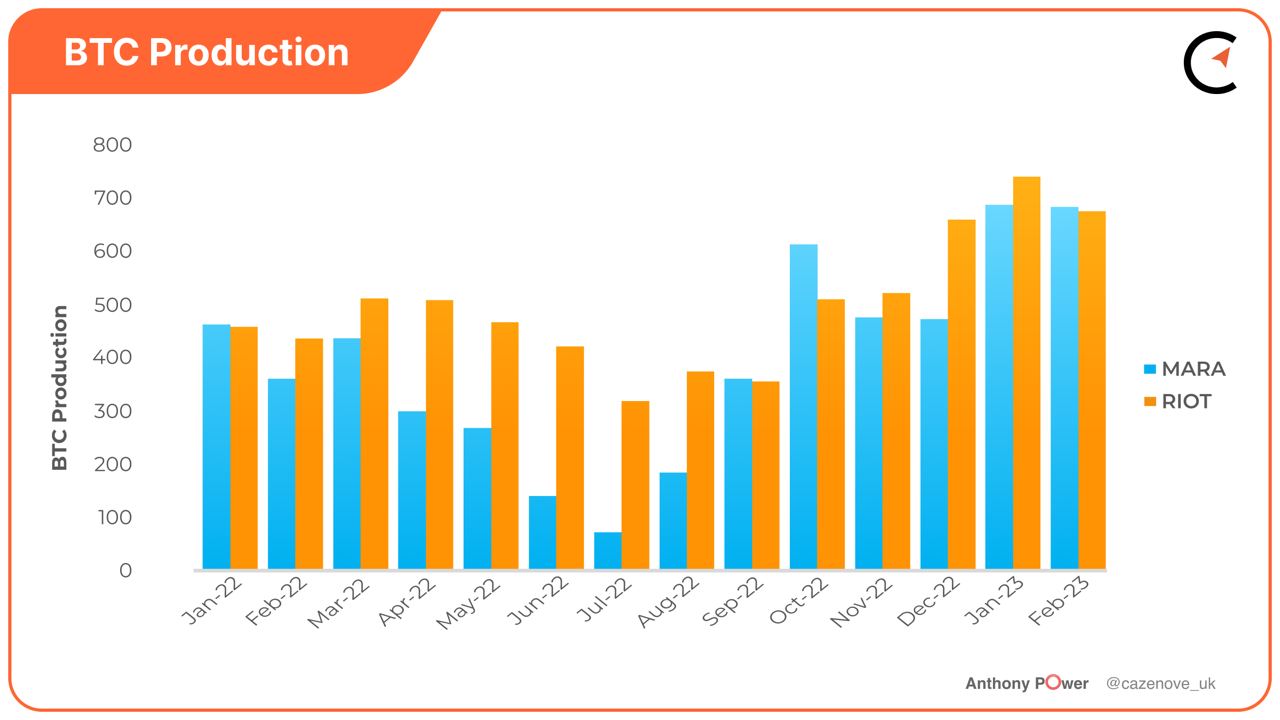

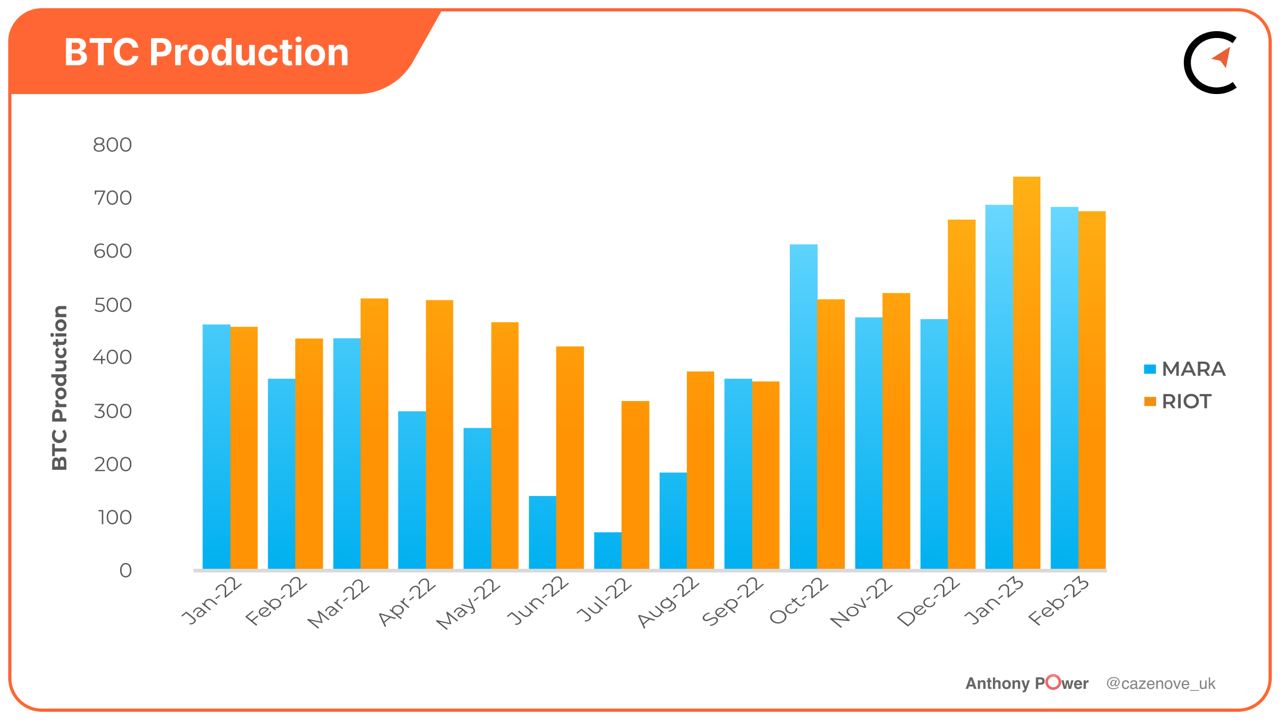

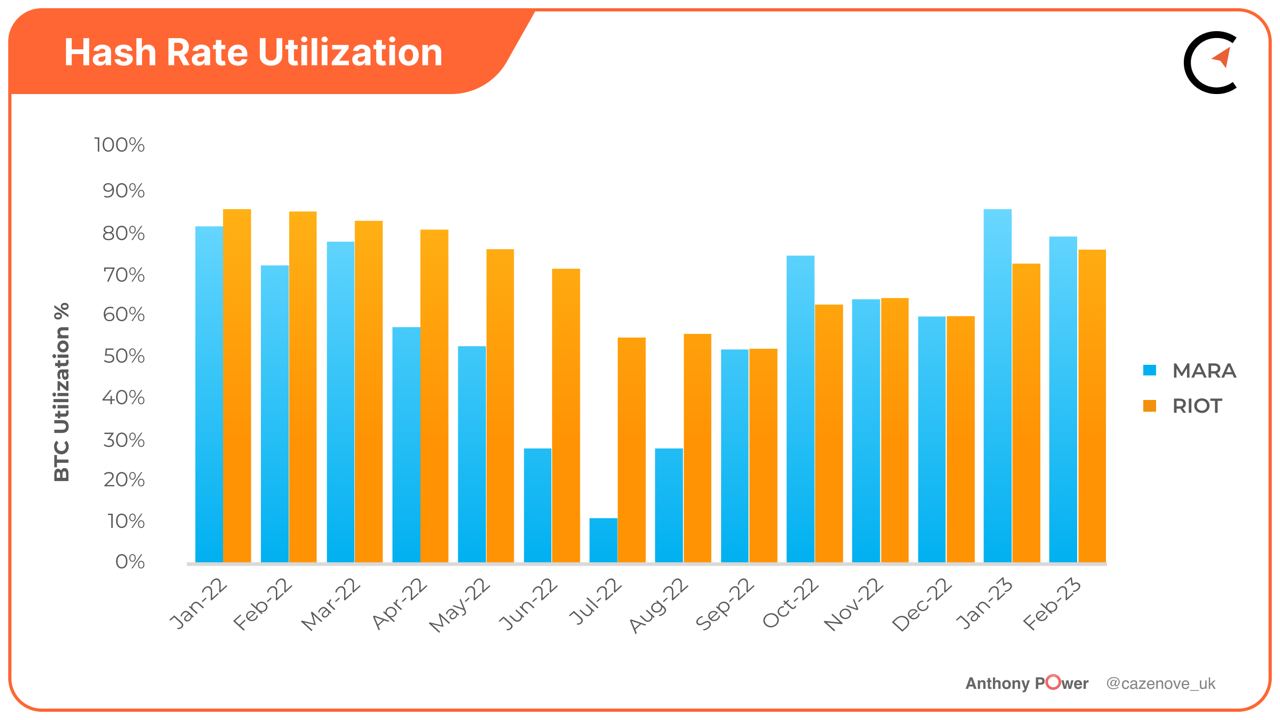

Bitcoin Production and Utilisation in 2022

The graphs below highlight the Bitcoin production and utilization for the last 14 months. The issues surrounding Marathon Digital's performance over this period has already been discussed earlier with regards to the Hardin site and Compute North’s application for Chapter 11 protection. However, the company has provided improved monthly mining production updates over the last 6 months, achieving record Bitcoin production in December and January. The company has a further 4.5 EH installed, awaiting energization and currently plans to achieve 23 EH/s during the current year.

Riot Platforms has also shown improved production in the last 8 months as the hashrate has grown to a current 9.5 EH/s. The company is expecting to achieve 12.5 EH/s in the second half of 2023–a delay of more than 6 months due to the storm damage to Buildings F&G.

In terms of utilization, both companies are starting to achieve 70-80% of installed hashrate. This places them further down the performance table when compared to the likes of Bitfarms (BITF), CleanSpark (CLSK) Hive Blockchain (HIVE) and Iris Energy (IREN), who all regularly achieve in excess of 90% utilization.

To summarize, 2022 was an extremely challenging and difficult year for all miners, and no exception for Marathon Digital and Riot Blockchain, when you consider the level of losses incurred. Both companies appear to be in good financial health with growth in hash rate and improved production continuing to accelerate in 2023, providing the ideal platform in readiness for the next halving in 2024.