Bitcoin miners enjoyed a solid end of spring, with a further spike in transaction fees, caused by the increased use of Bitcoin Ordinal Inscriptions–an average 15% increase in the daily production throughout the month.

Read: Ordinals, nodes and fees, oh my! How Inscriptions could alter Bitcoin

The price of Bitcoin fell by 7% during the month of May to close at $27,219 while mining difficulty actually increased by 3.2% during May, due to the increased hash rate on the network and overall reducing the amount of Bitcoin achieved by the miners.

Below, we’ll go through each miner’s monthly production information followed by a summary of the most important metrics.

Argo Blockchain (ARB.L, ARBK)

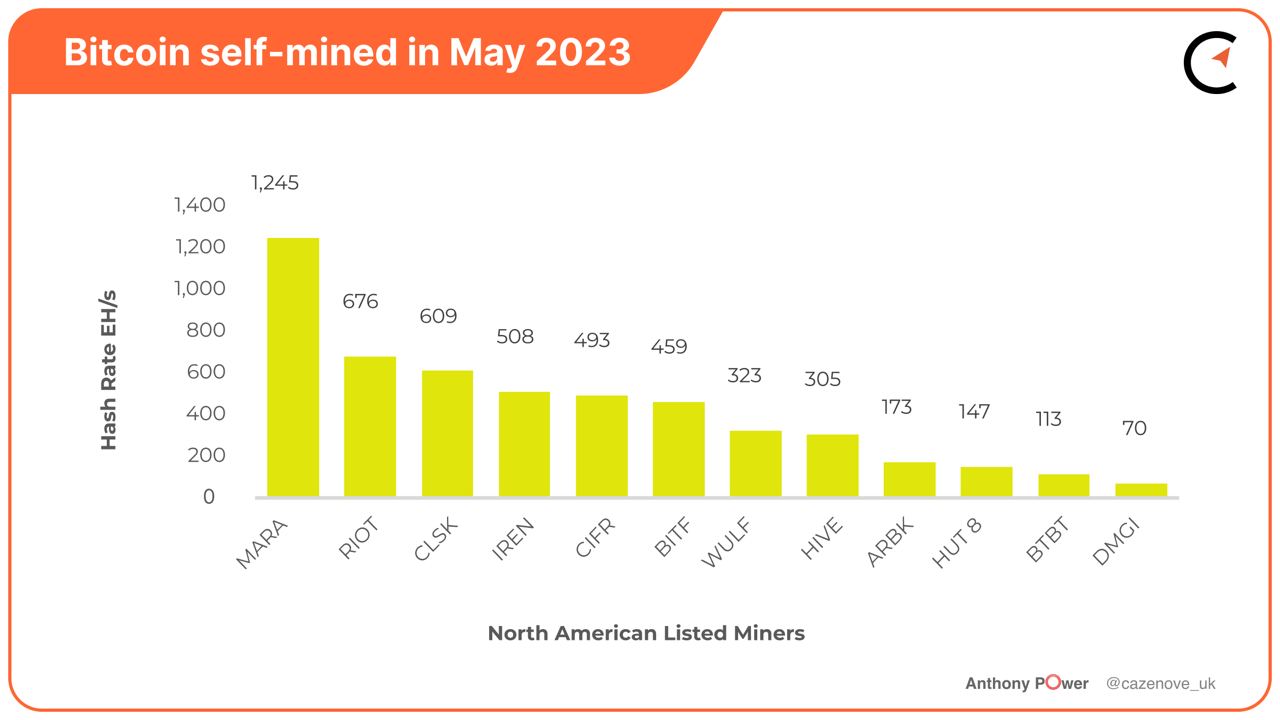

Argo Blockchain produced 173 Bitcoin in May at a rate of 5.6 per day, a daily increase of 16.3% when compared with the previous month, achieving $4.75 million in revenue.

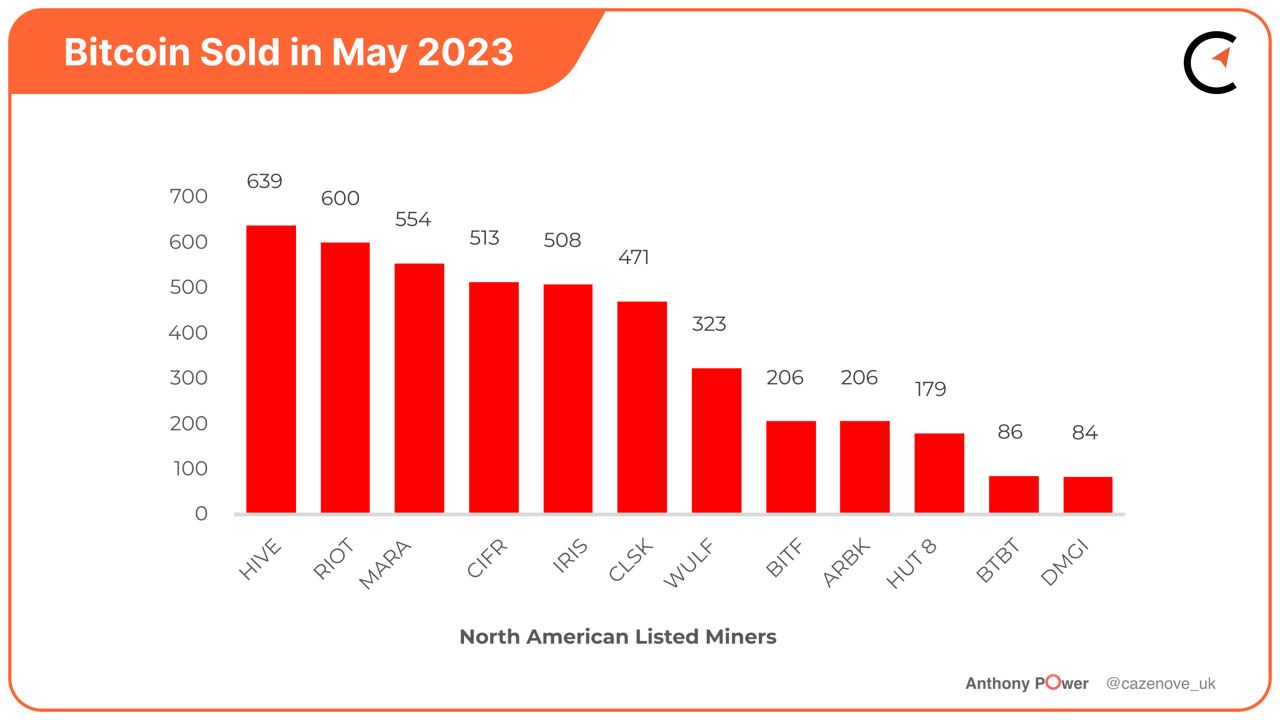

The company held 50 Bitcoin having sold 206 during the month to pay for its operational costs and to reduce its debt.

Although Argo Blockchain has a significant amount of debt on the balance sheet, totalling $79 million as at March 31, 2023, there was some positive news provided at the Quarterly Update held on June 7th, 2023. Having maintained a hashrate of 2.5 EH/s since August 2022, the company announced that an additional 300 PH/s of Blockminer machines will be added to its Quebec facilities, later this year. The company also managed to reduce the non-mining operational expenses by 70%, whilst achieving a gross mining margin of 49% in Q1 2023, comparing favorably with its peer miners in North America.

Bitfarms (BITF)

On May 8th 2023, Bitfarms passed the total of 21,000 Bitcoin mined, since the inception of the company, six years ago and all mined using renewable energy. To put this further into context, that represents 0.1% of all the Bitcoin that will ever be mined–an extraordinary feat.

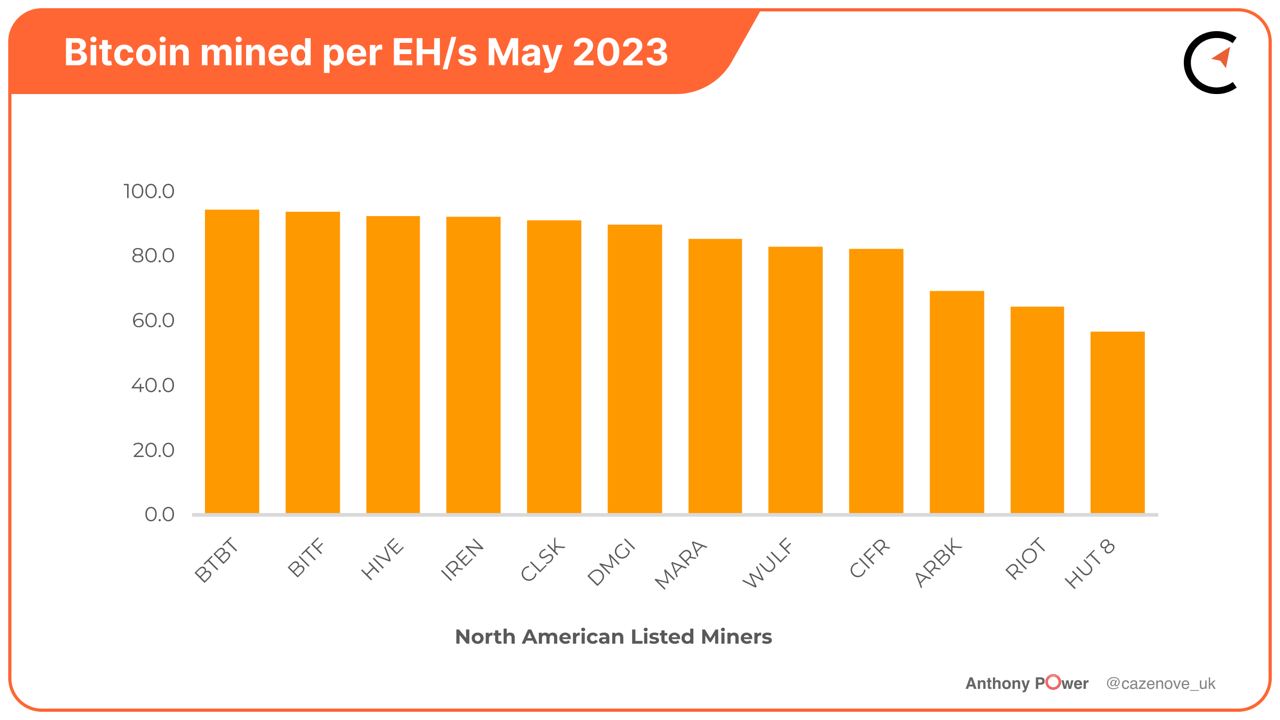

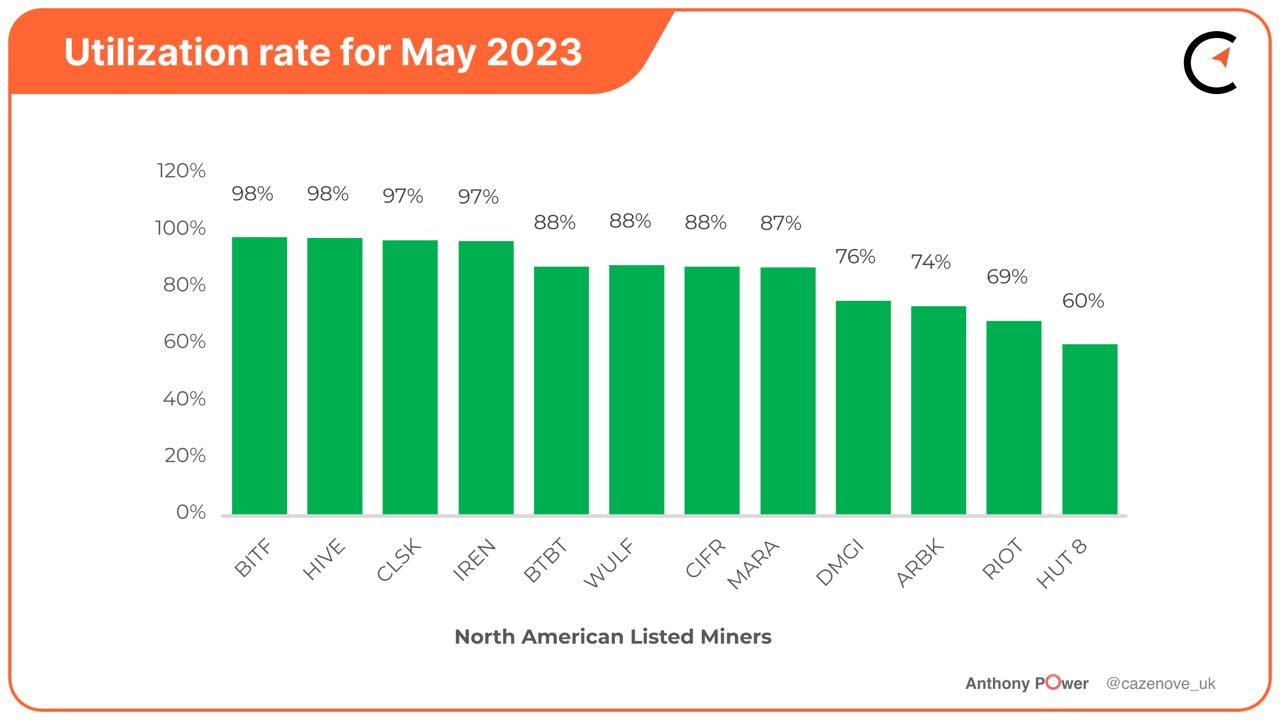

The company produced 459 Bitcoin in the month at a rate of 14.8 Bitcoin per day, an increase of 17.2% when compared with April, and achieving $12.5 million in revenue. This total was achieved with an average operational hashrate of 4.9 EH/s. The firm mined 93.7 Bitcoin per EH/s with a utilization rate of 98%.

After selling 414 Bitcoin during the month, Bitfarms was able to add to their Bitcoin hodl, increasing it to 510 Bitcoin with a value of $13.9 million.

Lastly, the company announced the purchase of 4,660 miners using a blended energy efficiency of 28 W/Th and providing 550 PH/s of new high efficiency for a total of $7.7 million, equating to a cost of $13.94 per terahash (TH). The machines were purchased with a combination of cash and vendor credits. Of the units, 1,500 miners are scheduled to be sent to Argentina–in addition to the 6,200 miners purchased in April–with the remaining 3,160 miners to be shipped to Quebec.

CleanSpark (CLSK)

CleanSpark produced 609 Bitcoin in May at an average rate of 19.6 BTC per day, an increase of 12.5% on the previous month, achieving $16.6 million in revenue, in a month that also saw the company pass 3,000 BTC mined and $100 million in revenue achieved year-to-date.

The company sold 471 Bitcoin to cover operational and capital expenditure and increased their hodl by 44% to 451 Bitcoin, with a value of $12.3 million.

On June 1, 2023, CleanSpark announced the purchase of 12,500 brand-new units of the Antminer S19 XP bitcoin mining machine for a total price of $40.5 million, equating to $23/TH. This will provide an additional 1.7 EH/s in addition to the planned target of 16 EH/s ensuring the company surpasses its growth target for 2023. Of the lot, 6,000 units are due to be shipped in June, followed in August with the remainder.

With a max hashrate of 141 TH/s and efficiency rating of 21.5 joules per terahash (J/TH)–and added to their recent purchase in April 2023 of 45,000 brand-new units of the Antminer S19 XP bitcoin mining machines–the units will make CleanSpark one of the most efficient North American listed miners.

Bit Digital (BTBT)

Bit Digital had a great month, producing 113.2 Bitcoin at a rate of 3.7 BTC per day. An increase of 27.2% per day compared to the previous month. The New York-based firm maintains a fleet of just over 11,500 mining machines producing an operational hashrate of approximately 1.2 EH/s.

The company sold 83.8 Bitcoin and the majority of their treasury holdings of $38.6 million are made up of 453.6 Bitcoin and 10,996 Ethereum. They also have cash and cash equivalents of $15.4 million as of May 31, 2023 which puts them in good financial position and having the ability to expand at the current machine miners price levels.

The company finalized agreements to purchase 6,600 new mining units with a total maximum hashrate of approximately 680 PH/s, which is in addition to the 2,500 mining units for operations recently set up in Iceland via a two-year hosting agreement with GreenBlocks EHF (GreenBlocks).

For potentially more revenue growth, Bit Digital had approximately 6,692 Ethereum actively staked as of May 31, 2023, with a further 5,024 Ethereum (157 nodes) deposited and due to come on line by the end of June 2023. The company earned aggregate staking rewards of approximately 21 ETH during the month of May.

Cipher Mining (CIFR)

Another good mining update from Cipher Mining who produced 493 Bitcoin during May at a rate of 15.9 BTC per day, an increase of 17.5% on the month of April. Revenues totalled $13.4 million. This was the first month where the company was able to fully operate throughout at 6.0 EH/s.

During May, Cipher Mining sold 513 Bitcoin which was used for operational costs and growing the business. The company announced that the first 3,120 Canaan rigs have already shipped, giving the company every opportunity to achieve its goal of 7.2 EH/s by the end of Q3.

DMG Blockchain (DMGI)

Even though transaction fees were significantly higher in May, DMG Blockchain was unable to take advantage and produced 70 Bitcoin at a rate of 2.3 per day–a fall of 8% on the previous month.

The cause of this fall in average daily rate was predominantly due to the company having an unexpected heat dome last month which affected their hashrate for approximately one week, providing an average of 780 PH/s.

Another factor affecting production was the multiple lighting strikes on the transmission line that feeds the substation, which resulted in a number of power outages. Unfortunately with lighting strikes, companies are not allowed to turn their power back on until the utility company physically sends people to inspect the line, and ensure it is not damaged.

DMG Blockchain sold 34 bitcoin during the month to pay for operational costs and increased its hodl to 570 Bitcoin with a value of $15.5 million.

Hive Blockchain (HIVE)

Hive Blockchain yet again had another consistently good month, producing a total of 305 Bitcoin via use of its ASICs and GPU machines, achieving an average daily rate of 9.8 BTC, an increase of 15.7% on the previous month and earning the company $8.3 million in revenues.

The company sold 639 Bitcoin to pay for operational and capital costs and retained a Bitcoin hodl of 1,950 coins with a value of $53.1 million.

Hive Blockchain also announced that they are starting to receive shipments of ASICs, from an order previously announced, which will provide an additional 1.26 EH/s EH/s and grow the company’s hashrate towards the interim goal of 4 EH/s, whist the company actively evaluate opportunities in the market for their year end goal of 6 EH/s.

Hut 8 (HUT)

Hut 8 is still having significant issues with its Drumheller site in Alberta, where the repair and restoration of damaged equipment continues and is taking longer than previously expected. The company is also considering options which include the relocation of 7,000 units from the North Bay site in Ontario.

During May, Hut 8 produced 147 Bitcoin at a rate of 4.7 Bitcoin per day, an increase of 7.8% when compared to the previous month. They sold 179 Bitocin to cover operational costs and have the second largest hodl on the balance sheet of all the listed North American miners, totalling 9,233 with a value of $251.3 million as at May 31, 2023.

Hut 8 have strived to utilize their GPU power since the Etherum merge and the High Performance Computer (HPC) team was successful in winning a significant five-year client contract at our flagship data centre in Kelowna.

Iris Energy (IREN)

May proved to be a great month not only for the increased transaction fees but also with a number of Bitcoin miners taking advantage in a timely manner to increase their hashrate. Iris Energy was certainly one who completed the growth from 1.7 EH/s to 5.5 EH/s in the space of just 12 weeks.

The company produced 508 Bitcoin in May at a daily rate of 16.4 Bitcoin per day, an increase of 54% on the previous month, achieving $13.5 million in monthly revenues–50% higher than April at a gross mining margin of 55.2%.

Iris Energy reported at its Investor Update on May 10th that the company had achieved the expansion with zero debt and $54.8 million in cash and cash equivalents as at April 30, 2023. The company is also fully funded to achieve expansion to 6.5 EH/s and work is ongoing at the Childress site on the second 20 MW data center underway, and an efficient and near-term growth pathway for remaining 560 MW. The automated power cost optimization initiatives implemented at Childress will allow seamless transition between Bitcoin mining and energy trading to optimize profitability.

During the last month an entity affiliated with Mike Alfred, a director of Iris Energy acquired a further 195,000 ordinary shares in the Company for $705,715, taking its total to 750,461 ordinary shares in the Company in aggregate since March 13 for a total of $2,495,925.

Marathon Digital (MARA)

Marathon Digital smashed their record for Bitcoin mined during a month by producing a record 1,245 Bitcoin at an average of 40.2 per day in May, a whopping 71.6% increase on the average daily rate achieved in April and taking their total monthly revenues to $33.9 million.

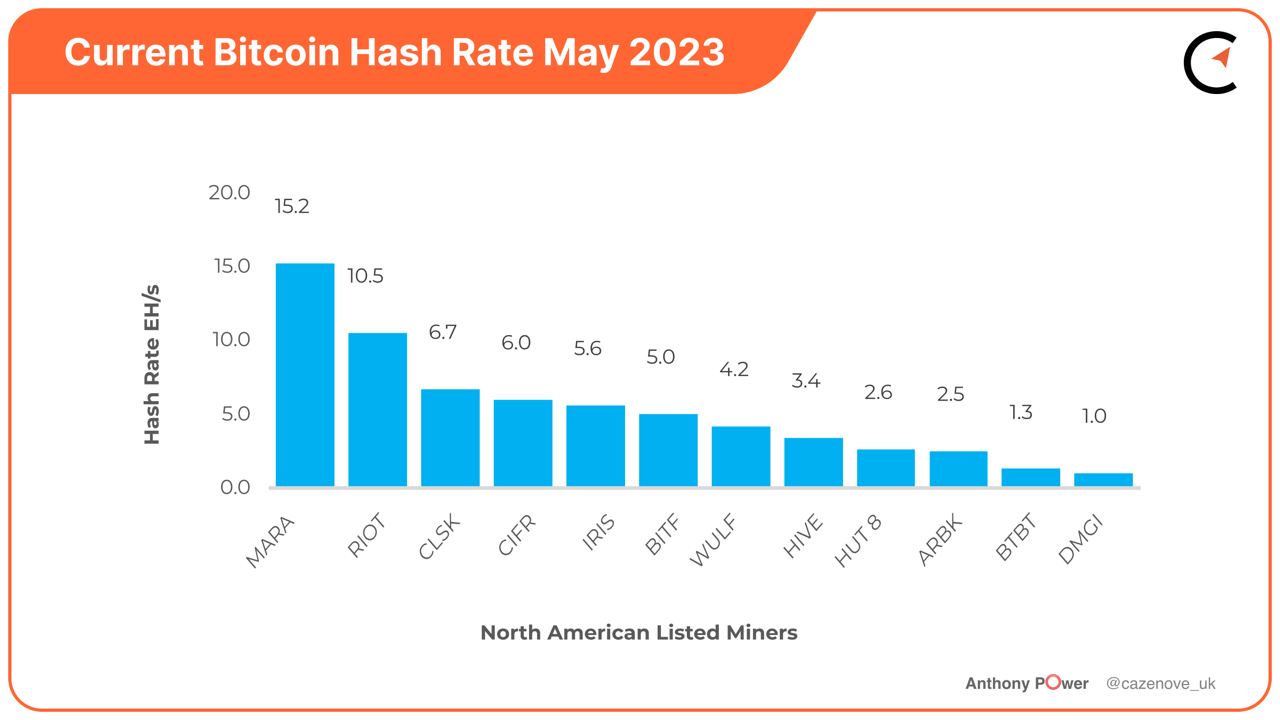

Setting aside a nice bump in transaction fee revenue, the company also was able to increase its operational hash rate to 15.2 EH during the month. Some 5,500 miners energized at Applied Digital’s facilities in North Dakota and a further 5,300 S19 XPs were energized at Applied Digital’s other facility in Ellendale, North Dakota. The remaining units energized at the Jamestown facility, where the company is deploying its first use of immersion cooling technology.

A further 4.9 EH of miner machines have been installed awaiting energization and this total of 20.1 EH now represents nearly 87% of their forecast hash rate target for mid 2023.

Marathon Digital sold 554 Bitcoin in May to cover operational costs and increased its Bitcoin held on the balance sheet by a further 6% to 12,259 Bitcoin with a current value of $333.7 million and in addition to the unrestricted cash available of $97.3 million.

On June 5, 2023 Marathon Digital announced that it has entered into a securities purchase agreement for the purchase of 15,000 shares of Series A redeemable convertible preferred stock in a private placement for a consideration of $14.25 million, for which the Company will use the net proceeds for general corporate purposes.

These preferred shares will each have voting rights and the ability to cast 500,000 for one purpose, and permits the holders to vote together with the holders of the Company’s common stock on proposals to increase the authorized shares of the Company’s common stock at the annual or special meeting of the Company’s stockholders.

Riot Platforms (RIOT)

Riot Platforms produced 676 Bitcoin during the month at an average daily rate of 21.8, a smaller than expected increase of 2.4% when compared with the daily rate of 21.3 Bitcoin achieved in April. The company, however, benefited in energy savings from the ERCOT demand response programs to the tune of $2.4 million.

Riot Platforms had a further 800 miners staged for deployment at the end of May which will bring their total to 94,976 miners deployed and a hash rate capacity of approximately 10.6 EH/s. This total excludes the 17,040 miners currently offline in Building G. The impact of the damage to Buildings F and G during the severe winter storms in Texas in December 2022 has delayed the expected achievement of 12.5 EH/s to the second half of 2023.

Mining performance

In May all the miners were able to benefit from increased Bitcoin transaction costs and improve on their previous monthly performance. Bit Digital had an excellent month producing 94.3 Bitcoin per EH/s, closely followed by Bitfarms, Hive Blockchan and Iris Energy. CleanSpark made up the top 5 achieving a rate in excess of 90 Bitcoin per EH/s. A special mention should definitely go to Marathon Digital who broke a record and mined an impressive 1,245 Bitcoin providing more evidence that they are starting to reach their planned growth, this year.

Although Core Scientific (CORZQ) are not currently in the tables above, due to their Chapter 11 process, they actually produced 1,314 Bitcoin in May with a hash rate of 14.9 EH/s providing $35.8 million of revenues, which will no doubt provide some much needed funds towards repaying their creditors.

In terms of performance year to date, Bitfarms take the current pole position with an average of 93.5 EH/s achieved over the first five months. Hive Blockchain and Iris Energy follow closely behind, with CleanSpark making up the top four.

It’s been well documented about the issues Hut 8 has had this year with its energy provider at the North Bay site in Ontario, and more recently with the electrical issues at the Drumheller site in Alberta.