Spring in North America has arrived, and with it another round of monthly updates from major listed Bitcoin miners.

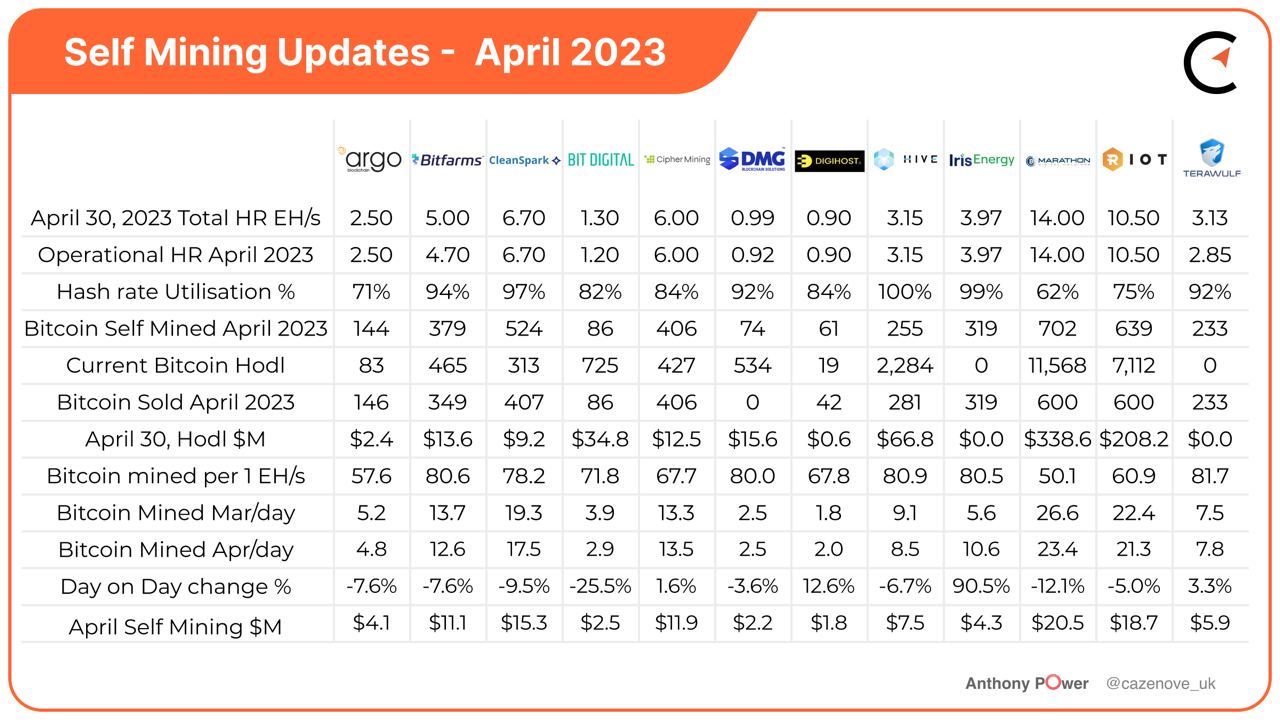

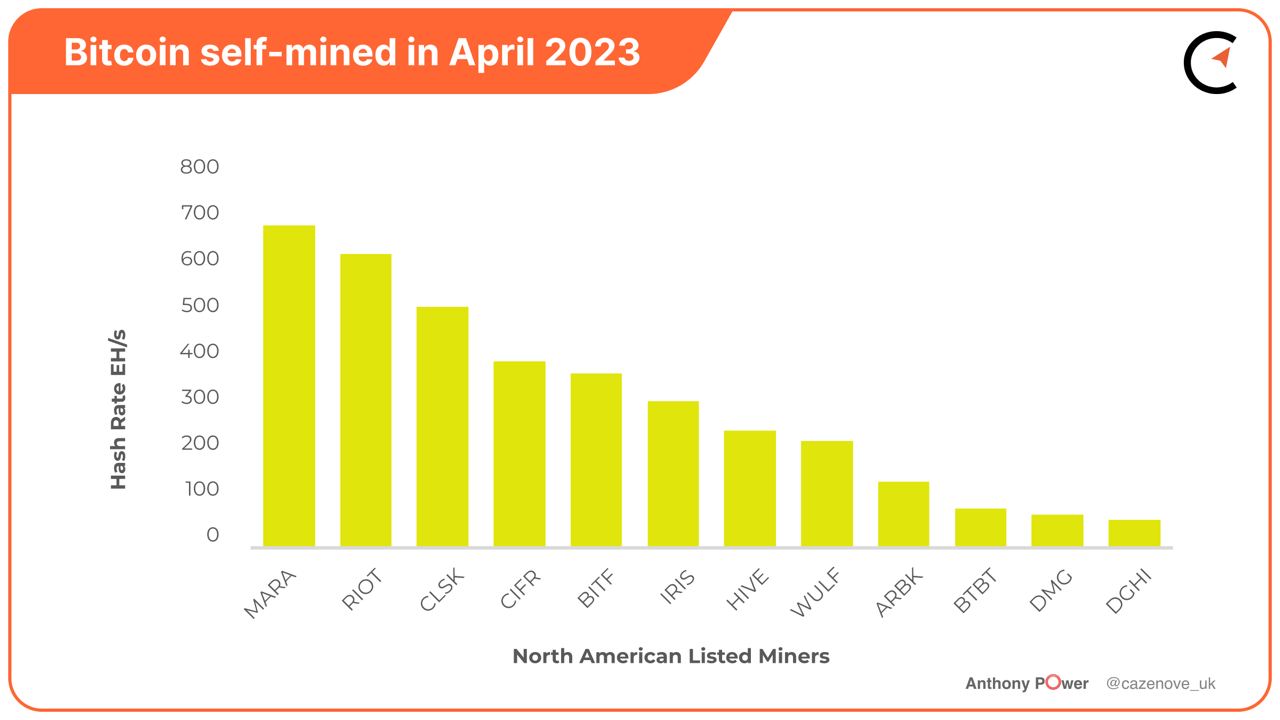

Most miners were able to increase their operational hashrate over the period, notably Iris Energy (IREN) achieving an impressive operational hashrate of 5.5 EH/s on May 3, 2023, whilst Marathon Digital increased their operational rate by 2.5 EH/s to 14 EH/s, Cipher Mining (CIFR) to 6.0 EH/s, Bitfarms (BITF) to 5.0 EH/s and TeraWulf (WULF) to a new operational rate of 4.2 EH/s (includes 0.5 EH/s of hosting hashrate).

As always, an increase in hashrate saw an increase in difficulty with an approximately 4% bump.

Two positive notes for miners must be mentioned: the strong price of Bitcoin performance since January 1–up 75.5% year-to-date and the arrival of hefty transaction fees on-chain derived from so-called ‘Ordinals.’ For example, early signs from Marathon Digital’s wallet suggest that they are currently mining significant blocks and during the first eight days are achieving an average close to 50 Bitcoin per day. Indeed, the average transaction fee stands at $22 at time of writing, according to Blockchair.

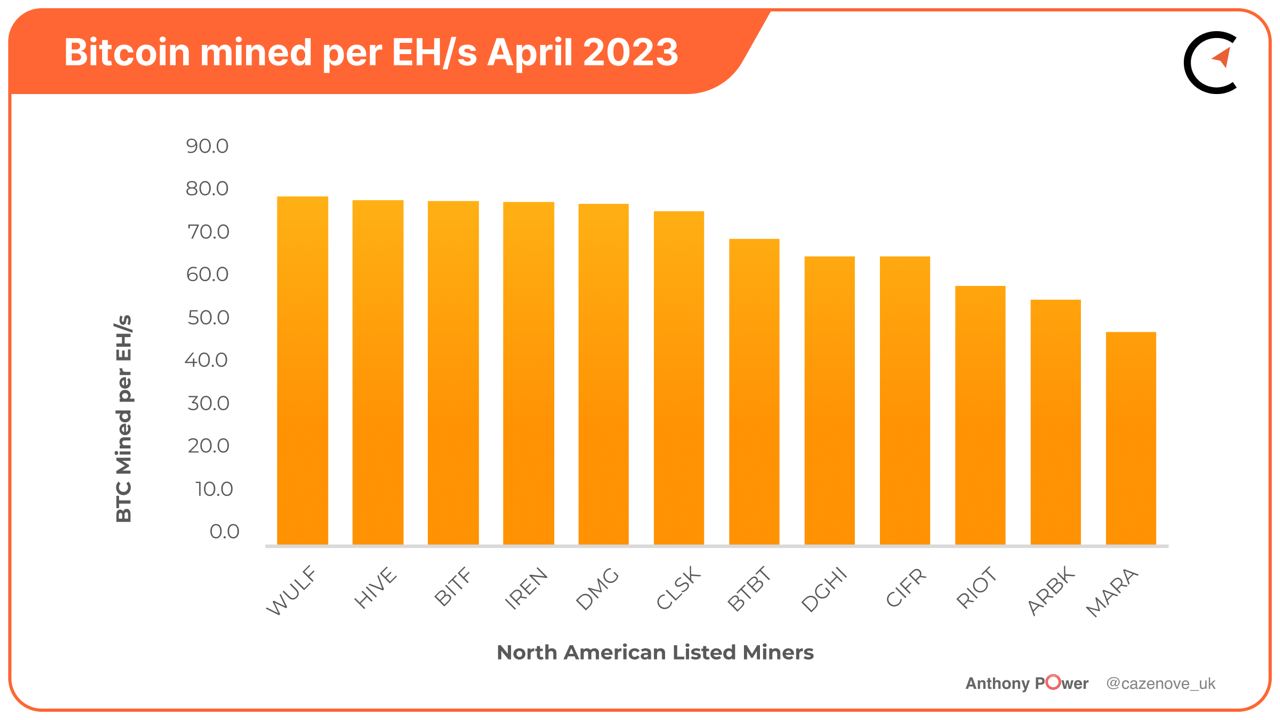

Lastly, a strong performance by TeraWulf, achieving 81.7 Bitcoin per EH/s, saw them eclipse Hive Blockchain, Bitfarms and Iris Energy. In terms of hashrate utilization, Hive Blockchain achieved nearly 100%, during the month, closely followed by Iris Energy (99%), CleanSpark (97%) and Bitfarms (94%).

Marathon Digital and Argo Blockchain had a poor month in terms of production and achieved only 62% and 71%, in terms of utilization, respectively.

Bitfarms

April proved to be a good month for Bitfarms, achieving 5.0 EH/s with 2,100 miners energized at the Rio Cuarto Farm facility in Argentina, whilst also regaining their compliance under Nasdaq listing rules.

Bitfarms mined 379 Bitcoin, at a rate of 12.6 per day, which was 7.6% lower than their 13.7 per day due to the increase in mining difficulty and the 9 day shutdown at the Rio Cuarto site. On a more positive note the company purchased a further 6,200 new Bitmain and MicroBT miners, to fit out the first warehouse, utilizing the power agreement where prices are expected to be below $0.03 per KWh.

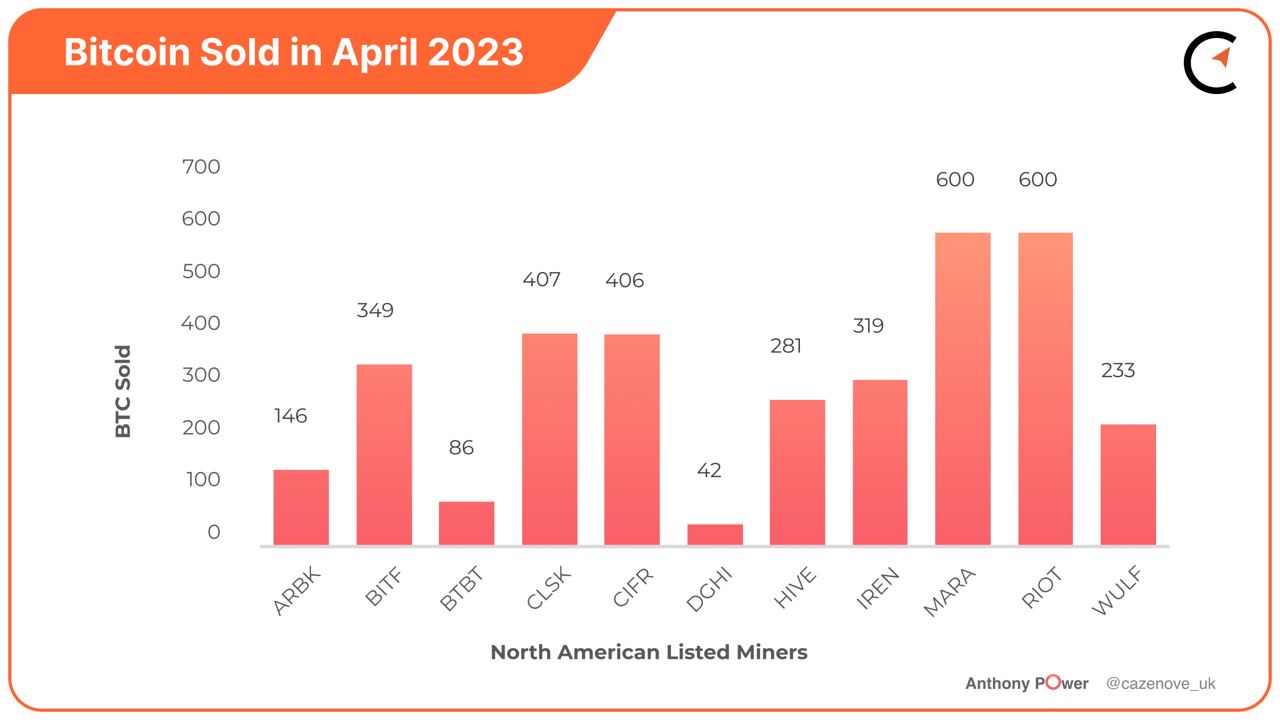

The company was cash flow positive during April which enabled them to increase their treasury position to 465 Bitcoin equivalent to $11.1 million after selling 349 Bitcoin.

Cipher Mining

Cipher Mining currently has 59,000 mining machines deployed across its 4 sites, with Odessa, the largest, achieving 5.0 EH/s. This provided the company an impressive total of 6.0 EH/s during the month of April equating to an overall increase of 114% in 2023, alone.

They produced 406 Bitcoin at a rate of 13.5 Bitcoin per day, increasing their previous month’s daily rate by 1.6%. Cipher mining sold their full monthly production maintaining a hodl of 427 Bitcoin valued at $12.5 million as at April 30, 2023.

On May 4th, 2023 Cipher Mining issued a Form S-3 outlining the proposal to potentially sell 187 million of stockholder shares.

Hive Blockchain

The data in the table for Hive Blockchain currently reflects the amount of Bitcoin self-mined through the use of ASIC mining operations. The company produced 255 Bitcoin, at a daily rate of 8.5 Bitcoin per day, which was 6.7% lower than the 9.1 per day achieved during the previous month, predominantly caused by the difficulty adjustment. They were rewarded a further 18 Bitcoin for mining alternative coins, through the use of their GPU miners. They achieved the highest utilization rate of 100% and in terms of Bitcoin mined per EH/s were second to Terawulf.

In terms of Bitcoin operational hashrate they achieved an increase from 3.06 EH/s in March to 3.14 EH/s in April, an increase of 2.6% as they received further Buzzminers into its data centers.

The company was able to achieve a 24% increase on their high performance computing revenues for the month of April.

On April 14th, 2023 it was announced that Sweden is preparing to abolish tax incentives for data centers in July, which could result in the end of crypto mining in the country, as energy costs may well spike 60 fold (6,000%). Even though European energy prices have increased in the past year, due to war in Ukraine, it has still remained profitable to mine crypto in the northern regions of Norway and Sweden. The new tax will certainly impact both the current and any future investment in the country, forcing existing miners to consider relocating to cheaper countries. It should be noted that Hive Blockchain has yet to formally release an update on this issue.

Iris Energy

On December 6, 2022 Iris Energy provided an investor update entitled “Everything changes, everything remains the same.” The company, having recently defaulted on loans valuing $103 million to their US lender New York Digital Investment Group (NYDIG), and returning the leveraged mining machines equating to 3.6 EH/s, outlined a plan of how to recover their hashrate.

On May 3, 2023 less than 6 months later, the company announced their operating hashrate had reached a planned target of 5.5 EH/s, utilizing 180 MW of power, approximately 97% of which is directly from renewable energy sources–a remarkable turnaround.

Iris Energy mined 319 Bitcoin in April at a daily rate of 10.6 Bitcoin per day, an increase of over 90% on the daily rate achieved during the previous month, whilst achieving a gross margin of 54%. This increase was achieved, increasing the hashrate by a further 2.4 EH/s, with a further 2,311 machines in transit made up of S19j Pro and S19 XP’s. They achieved a hashrate utilization of 99% only bettered by Hive Blockchain, during the month of April.

The company energized the 600MW bulk power substation and the 100 MW primary substation at its Childress site. The first phase, a 20 MW data center, is now fully operational.

It was also announced that Mike Alfred, a director of Iris Energy purchased a further 125,000 shares during the last 30 days, taking his purchases to 555,461 ($1,790,210) since March 13, 2023.

Marathon Digital

Marathon Digital had a good month in terms of hashrate deployment, adding an additional 2.5 EH/s in operational hashrate at their Applied Digital’s facilities and both Ellendale and Jamestown sites in North Dakota, taking the total to 14 EH/s. They have a further 3.9 EH/s installed taking their total installed hashrate to 17.9 EH/s, 78% towards their target of 23 EH/s, due to be completed mid 2023.

During April the company produced 702 Bitcoin at a daily rate of 23.4 Bitcoin mined per day, a drop of 12.1% on the previous month. Although the operational hashrate had actually increased by 22%, the reduction was due to the impact of mining difficulty, energy curtailment across its sites and the ‘luck’ factor. The company effectively produced 50.1 Bitcoin per EH/s, significantly less than the 81.7 Bitcoin per EH/s achieved by TeraWulf. They also achieved a utilization rate of 62%.

Marathon Digital sold 600 Bitcoin during the month to pay for operational costs and increased their treasury hodl to 11,568 Bitcoin with a value, at April 30, 2023, of $338.6 million. The company also ended the month with $123.5 million in unrestricted cash and cash equivalents.

TeraWulf

TeraWulf increased its mining capacity to 4.0 EH/s in April, an increase of 21% on the previous month’s total of 3.3 EH/s. The company mined a total of 239 Bitcoin of which 233 Bitcoin was produced by self mining and the remaining 6 Bitcoin, received as profit share, for hosting 500 PH/s. They were able to increase their daily mining rate to 7.5 Bitcoin per day, an increase of 47.2% on the previous month, achieving the highest amount of Bitcoin per EH/s of all the publicly listed miners, in April.

The company is well on track to achieve its target of 5.5 EH/s having fully energized its 50 MW at the Nautilus facility, the first Bitcoin mining facility powered by 100% nuclear power in the U.S. It is also due to complete construction on Building 2 at the Lake Mariner facility, providing an additional 50 MW of self-mining capacity, during Q2, 2023.

The one area that sets Terawulf aside from the majority of the North American Bitcoin miners is the blended cost currently achieved across its two sites. In April this was approximately $0.030/kWh producing a gross mining margin of nearly 74%.