Bitcoin Mining Industry Report: April 2024 Post Halving, Analysis & Operational Updates

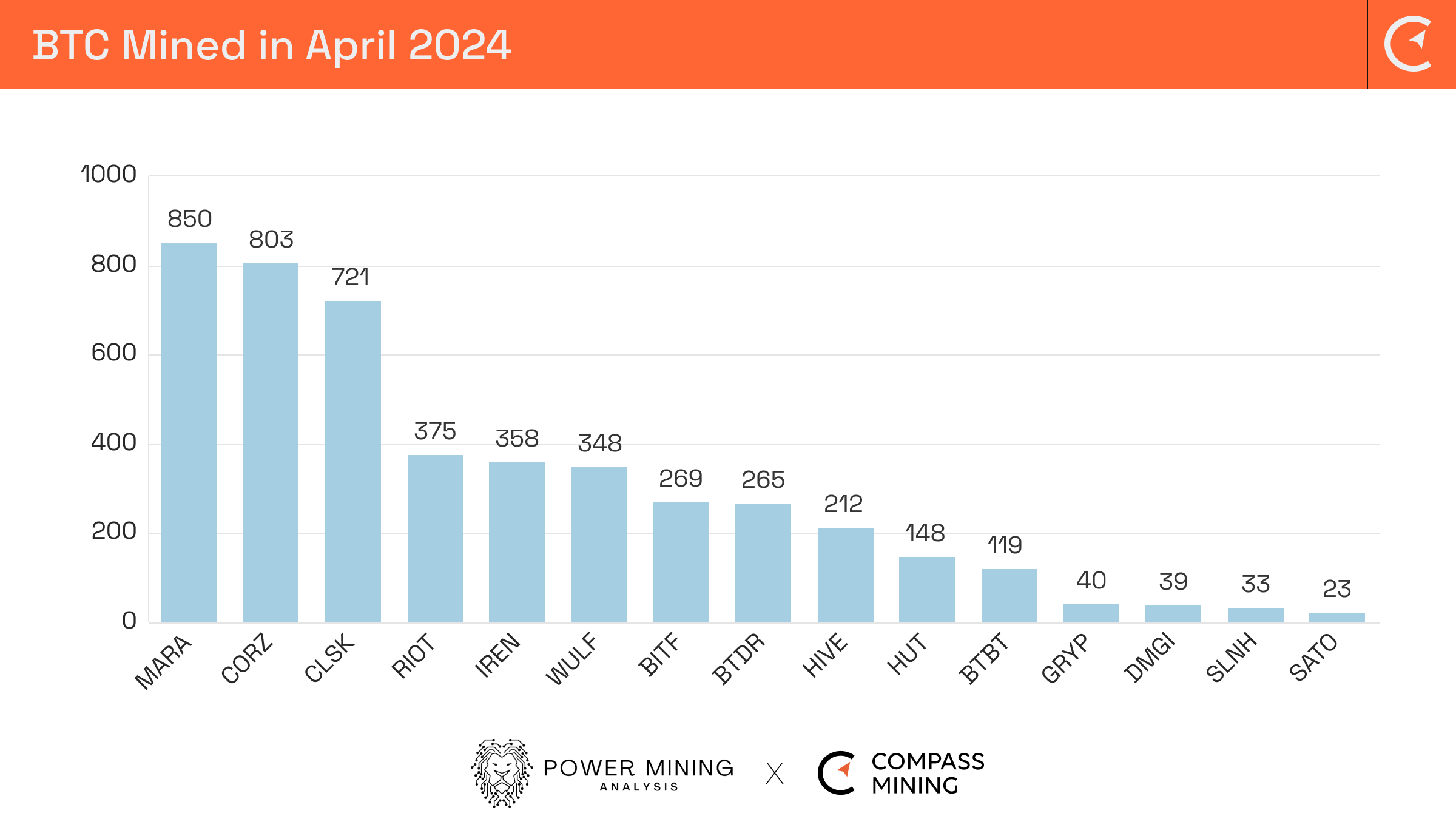

The highly-anticipated fourth Bitcoin halving occurred a little after 8:09 p.m. ET on Friday April 19, 2024. Initially, Bitcoin traded flat in the immediate aftermath of the halving, holding steady around $63,000, but finished the month at $60,636, a drop of 15% on the closing price for the previous month.

Within hours of the halving, miners intensified their efforts to secure transactions and earn fees in the limited block space available. The introduction of Casey Rodarmor’s Runes protocol allowed users to mint digital tokens directly on the Bitcoin blockchain. The surge in transactions related to Runes contributed to higher fees and saw the hash price reach a record $183 per PH per day, effectively more than three times the expected rate of between $50-$55 per day.

In the previous 3 Bitcoin cycles the first difficulty adjustment, post halving, had seen a reduction, as less efficient miners were forced to switch off. These recent additional transaction fees effectively provided further opportunities for more hash rate to go online, causing the first post-halving mining difficulty adjustment to actually increase, by 2%.

Bitdeer Technology Group (BTDR)

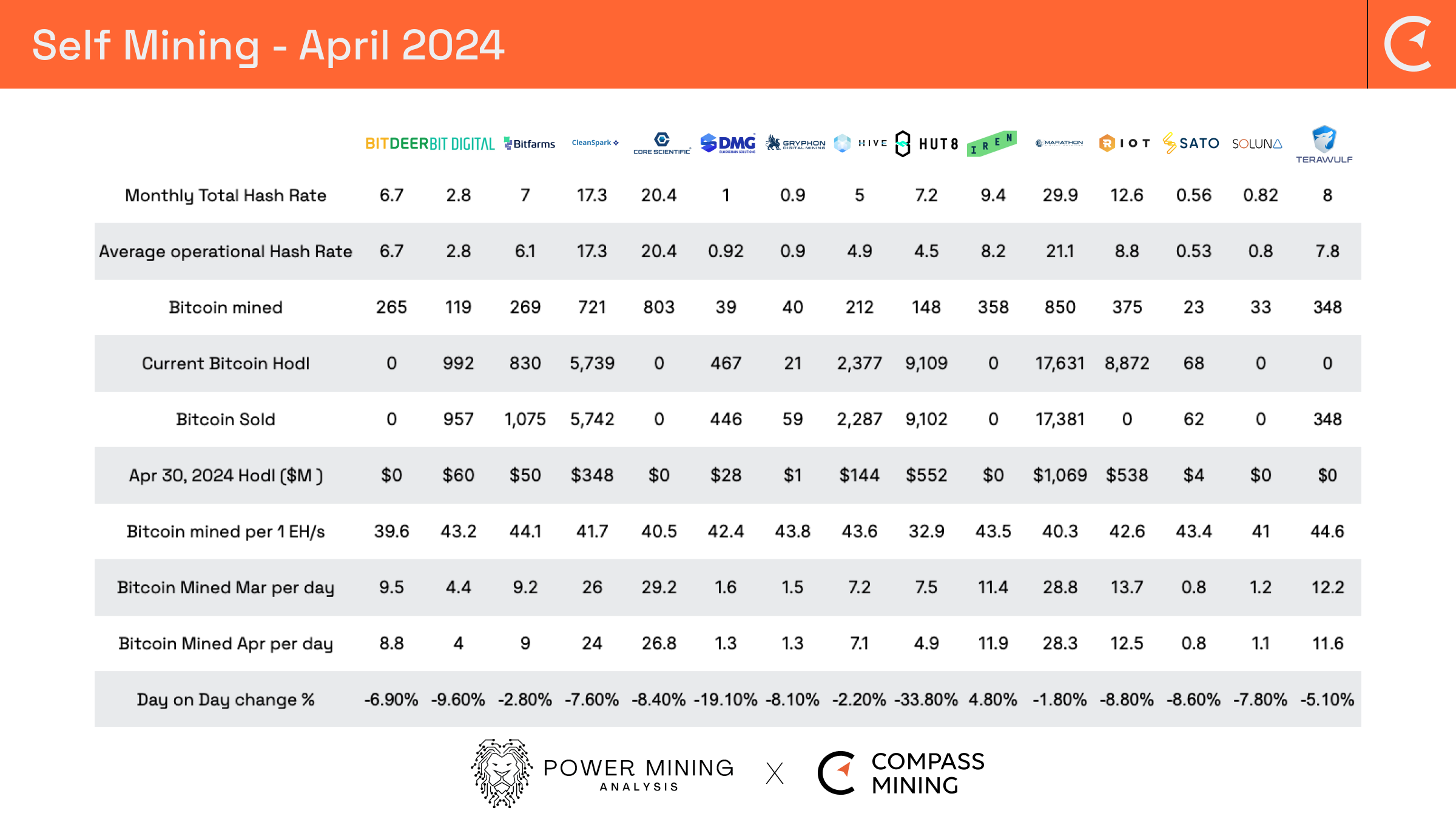

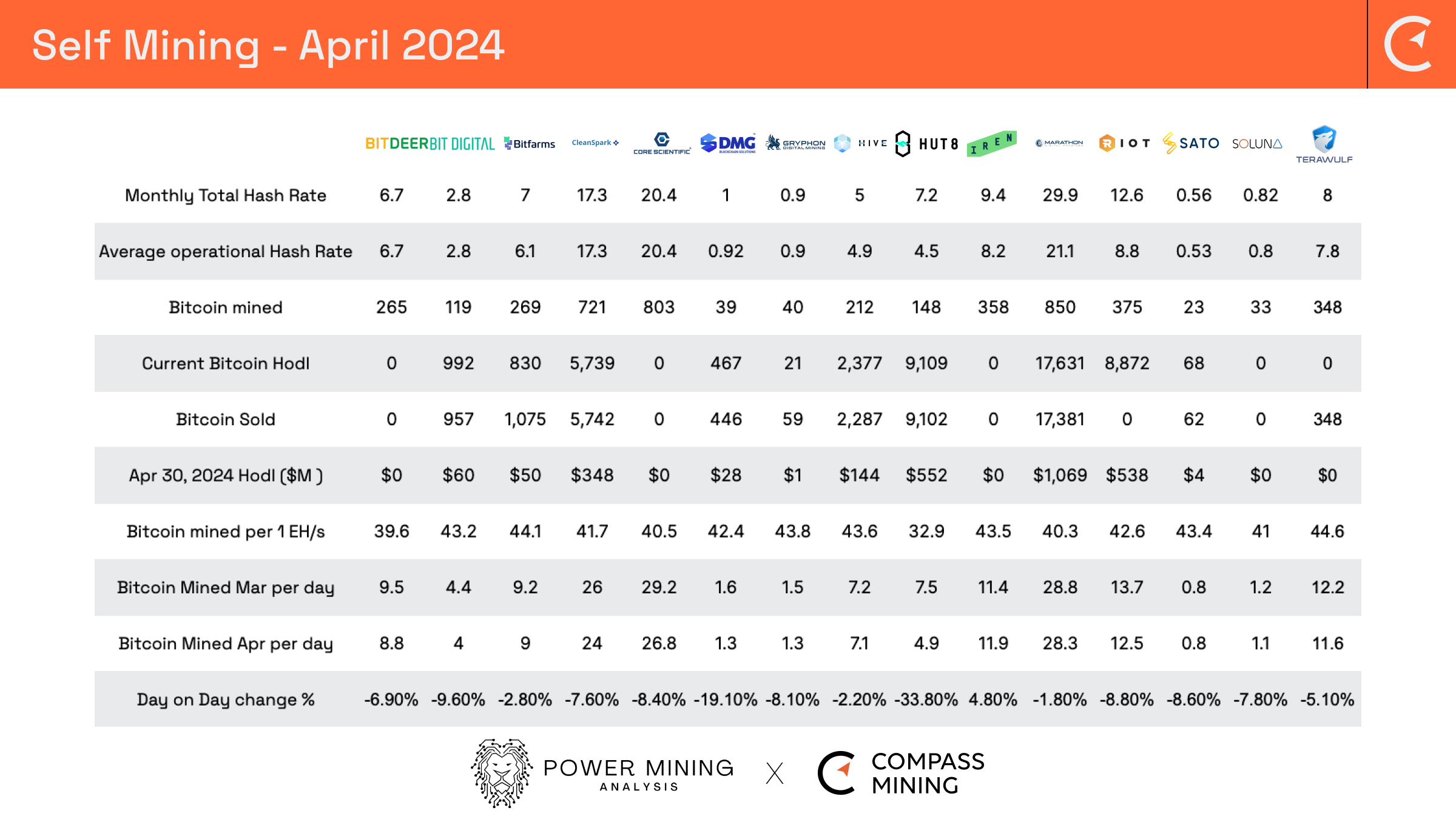

In April, Bitdeer produced a total of 265 Bitcoin, equivalent to an average rate of 8.8 Bitcoin per day. This rate reflected a smaller-than-expected reduction of 6.9% compared to the daily mining rate in March following the halving. The stable operations of the Gedu datacenter throughout April significantly contributed to this positive performance. This operational stability was made possible by a beneficial power pricing agreement, which effectively lowered costs and sustained uninterrupted activity.

The company continues to advance the construction of key data centers worldwide. In Tydal, Norway, construction of a 175MW immersion cooling data center is underway and anticipated to conclude by mid-2025. Likewise, progress persists in Ohio, United States, with the development of a 221MW datacenter, with construction slated for completion in 2025.

In Bhutan, construction of a substantial 500MW datacenter, known as the Jigmeling Datacenter, commenced in March 2024. Currently, approximately 70% of the ground leveling work for the project’s substation area has been accomplished, with full completion expected by May’s end. Additionally, groundwork for the mining datacenter area began in May 2024. The procurement plan for the substation’s electrical equipment has been finalized with a supplier, with purchases scheduled for June 2024. The Jigmeling Datacenter is on track for completion by mid-2025.

Progress continues unabated for Bitdeer’s mining Sealminer A1 machine project. Having completed all laboratory testing and preparations for batch production, the company is set to initiate small batch trial production in May and June 2024. These trial-produced mining machines will undergo stability testing within the company’s mining data centers.

Bit Digital (BTBT)

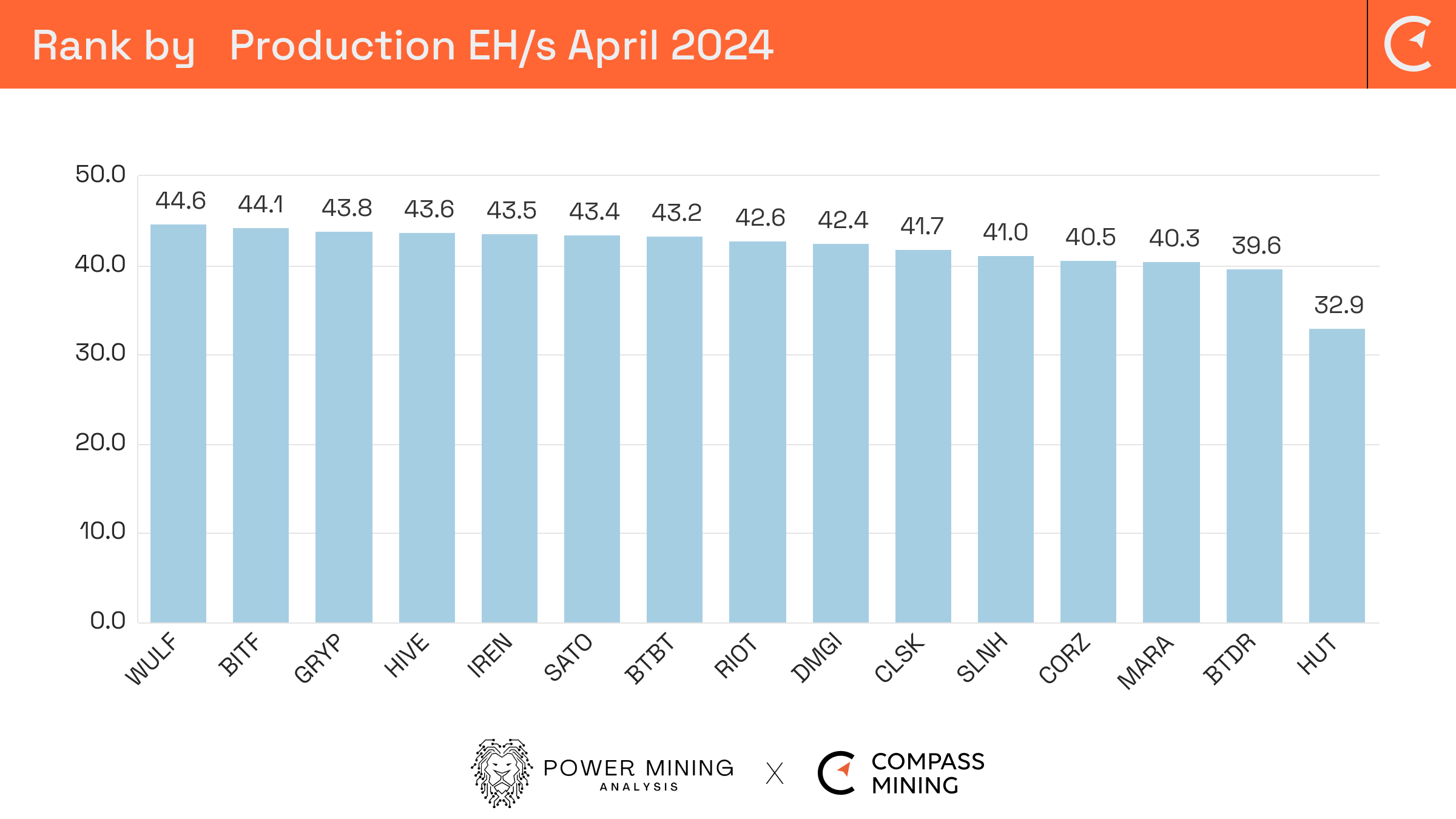

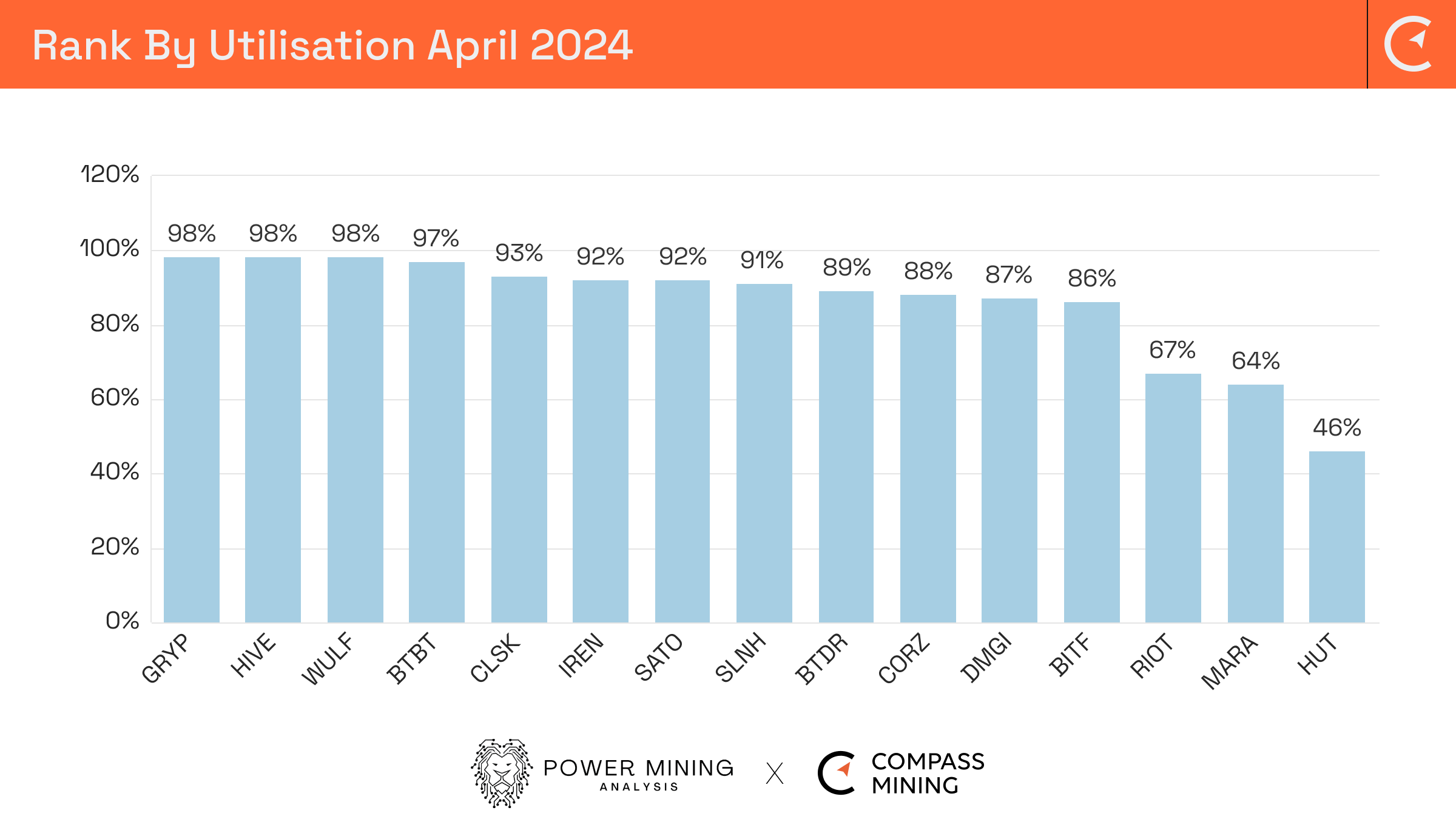

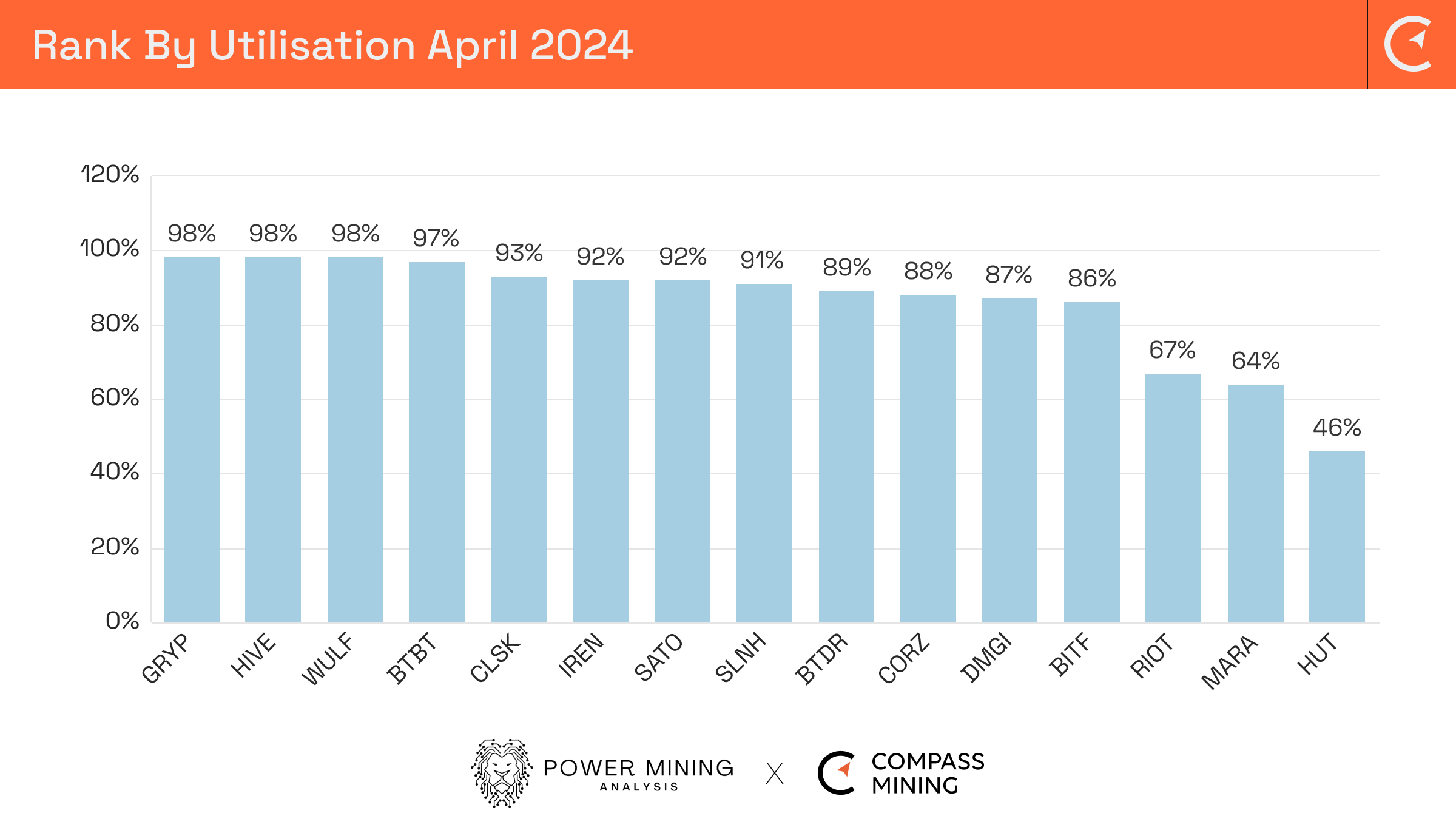

In April 2024, Bit Digital mined 119.3 Bitcoin, a reduction of 9.6% on the daily rate compared to the preceding month, primarily attributed to reduced bitcoin block rewards post-halving, effectively producing 43.2 Bitcoin per EH/s. The company maintained an active hash rate of approximately 2.76 EH/s during this period achieving a utilization of 97%.

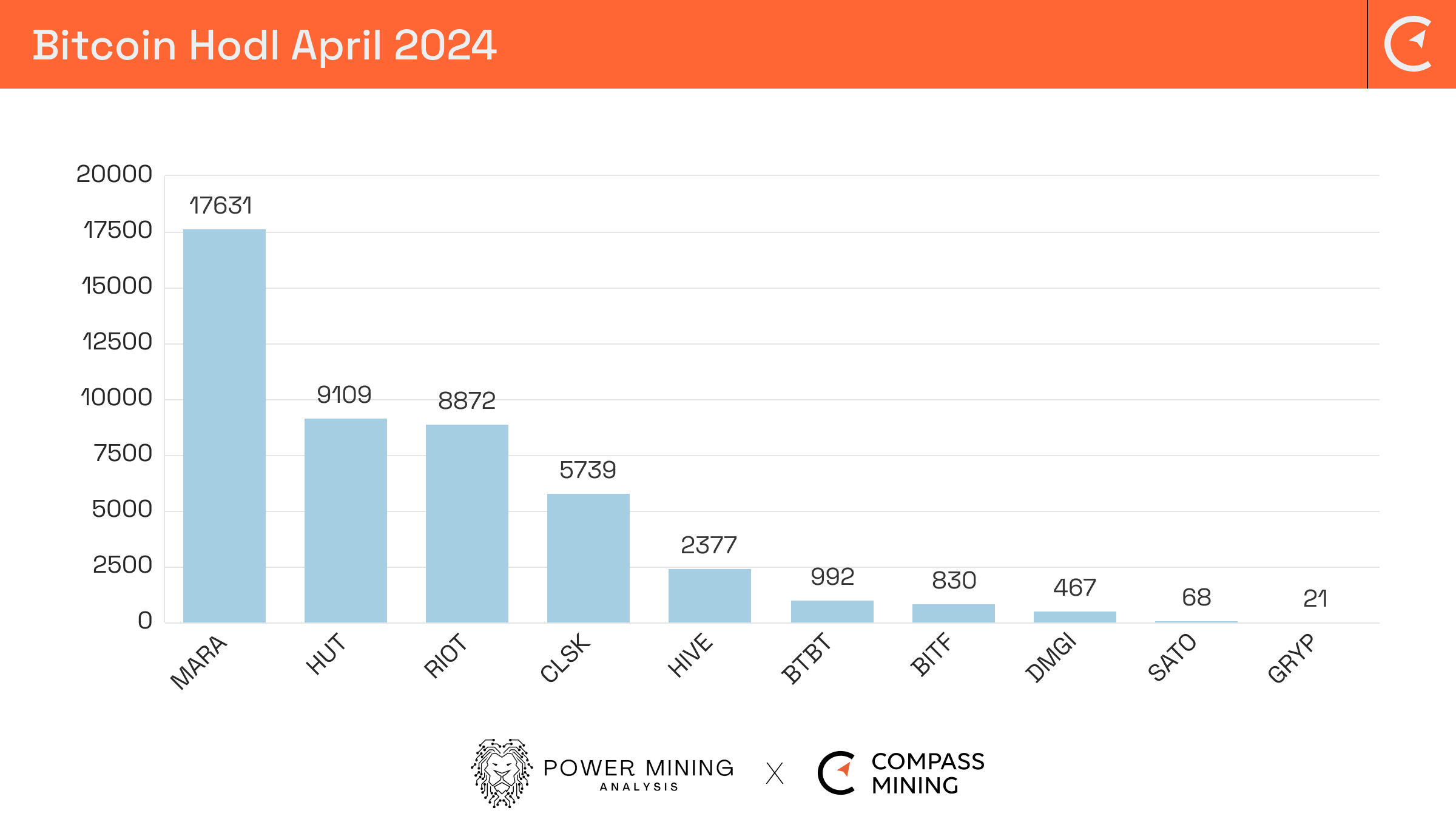

Treasury holdings included 992.4 Bitcoin and 20,241.7 Ethereum, valued at approximately $60.2 million and $61.0 million, respectively, on April 30, 2024. Additionally, the company held cash and cash equivalents totaling $43.7 million as of the same date.

As of April 30, 2024, the company had 251 servers actively generating revenue from its initial Bit Digital High Performance Computing (HPC) contract, yielding an estimated $4.1 million in unaudited revenue for the month of April. CEO, Sam Tabar highlighted that this contract will effectively double, during 2024, to reach annualized revenues of $100 million. These revenues are not correlated or impacted by the having or volatility in the Bitcoin price and provide more of a guaranteed revenue stream over a contracted period. This effectively enables the company to use these margins to grow their Bitcoin mining hash rate, due to increase to 6.0 EH/s by the end of 2024.

Bit Digital continued to stake approximately 17,184 ETH in native staking protocols, and despite a blended APY decrease to approximately 1.0% for April 2024, the company earned aggregate staking rewards of approximately 13.9 ETH, attributed to the transition in providers for native staking solutions.

Bitfarms (BITF)

During the month April Bitfarms produced 269 Bitcoin at an average daily rate of 9.0 Bitcoin, a reduction of 2.8% on the daily rate achieved in March. This performance, post halving, was due to the company increasing its total hash rate by 7% to end the month of April with 7.0 EH/s and currently on track with its fleet upgrade and expansion, targeting 21 EH/s and 21 w/TH by 2024.

Rapid miner upgrades are ongoing, with Paso Pe expected to contribute 2 EH/s at 23 w/TH upon energization. With these deployments, the company anticipates achieving around 10 EH/s and 28 w/TH by May, remaining aligned with its mid-year goal of reaching 12 EH/s and 25 w/TH by Q2 2024.

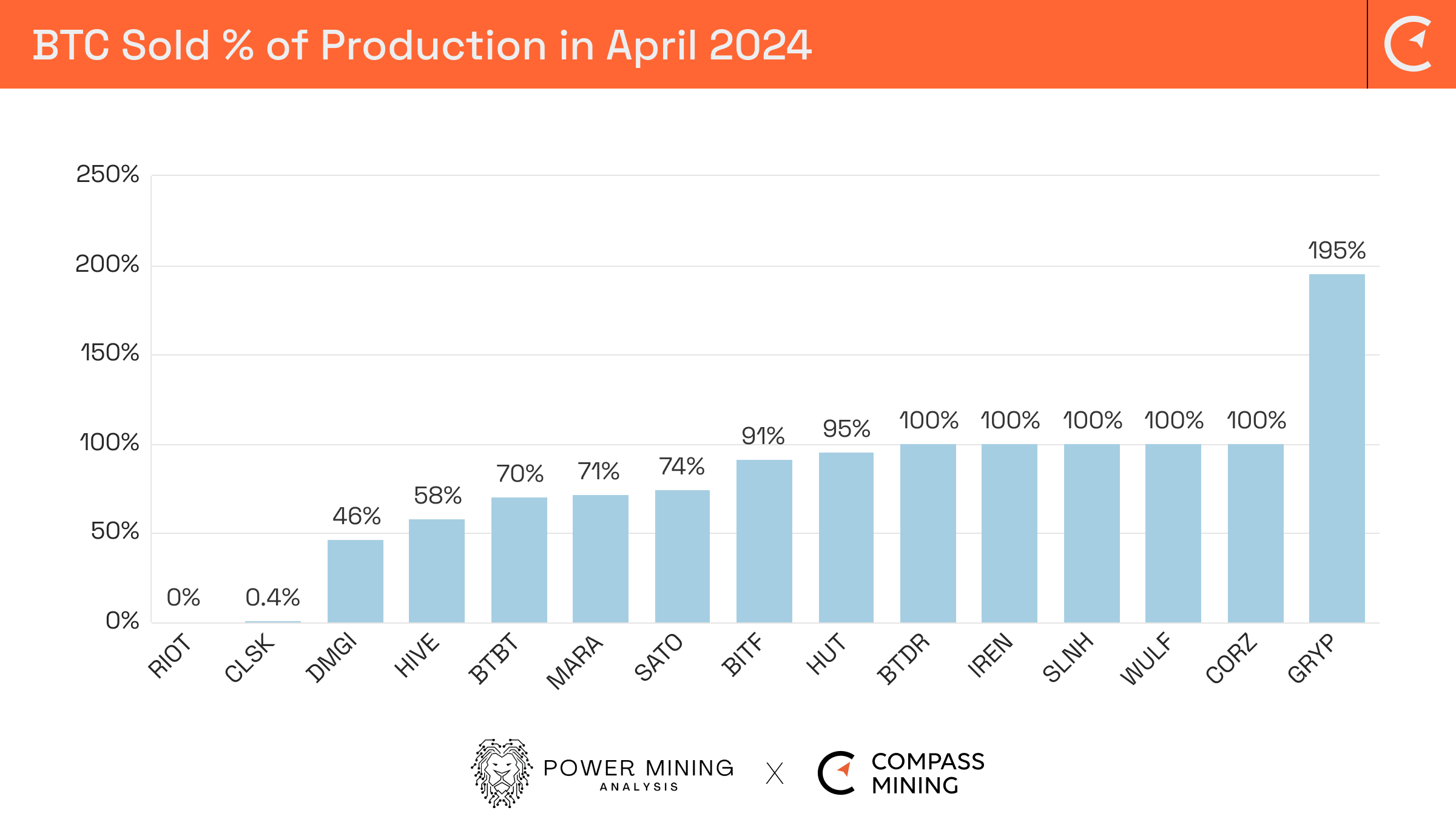

Bitfarms sold 245 Bitcoin for revenues of $16.1 million, in April, to cover capital and operational requirements, adding 24 to their hodl now totalling 830 Bitcoin with a value of $50 million as of April 30, 2024. The company also secured a significant $23.7 million VAT, plus interest, refund in Quebec, reducing electricity costs and capital expenditures by 15%. This favorable outcome not only provides immediate cash flow but also promises long-term operational and capital cost reductions.

On Monday May 13, 2024 Bitfarms announced the termination of Geoffrey Morphy from his roles as President, CEO, and director, effective immediately. Mr Morphy has recently filed a $27 million lawsuit against the company for breach of contract and wrongful dismissal. Nicolas Bonta, Chairman and Co-Founder, has been appointed interim President and CEO, whilst the CEO executive search nears completion, with a new appointment expected in the coming weeks.

Core Scientific (CORZ)

Adam Sullivan, the Chief Executive Officer, announced the achievement of over 20 EH/s of energized self-mining hash rate during the month of April, following the successful deployment of S21 miners and the temporary energization of previous-generation miners at profitable data centers.

The company mined a total of 803 Bitcoin in April at an average daily rate of 26.8 Bitcoin, a reduction of 8.4% on the daily rate achieved in March. In the 24 hours following the halving, Core Scientific maximized their self-mining operational hash rate, yielding a total of 57.3 Bitcoin within this timeframe. This compares to an average of 30 Bitcoin per day in the three days pre halving.

Strong cash flow facilitated the repayment of $19 million in debt related to mechanics’ liens and initiated the completion of 72 megawatts of partially built infrastructure at the Denton, Texas data center. Sullivan emphasized ongoing efforts to enhance productivity and efficiency, targeting an average miner energy efficiency of 25.8 joules per TH/s.

Additionally, discussions with potential hosting clients for the high-performance computer offering are underway, aiming to bolster revenue and growth prospects, ultimately enhancing shareholder value. Two months ago Core Scientific announced an agreement to supply CoreWeave with up to 16 MW of data center infrastructure for the support of AI and HPC workloads in a long-term hosting contract. The agreement holds the potential to generate revenue exceeding $100 million.

DMG Blockchain (DMGI)

DMG Blockchain produced 39 Bitcoin during the month, at an average daily rate of 1.3 Bitcoin, a reduction of 19.1% on the rate achieved during March, with an operational hash rate of 0.92 EH/s.

In an effort to maximize profitability post-halving, the company enhanced the efficiency of its legacy fleet through software optimization, reducing energy consumption from 28.4 J/TH to approximately 26 J/TH, resulting in a corresponding decrease in hashrate from 1 EH/s to approximately 0.85 EH/s. This significantly contributed to the reduction in hashrate observed in April compared to the previous month.

Additionally, DMG Blockchain initiated the installation of its first batch of 4,550 units of new Bitmain T21 miners, which upon full deployment and operation, are expected to yield 0.86 EH/s with a miner efficiency of 19 J/TH. The company remains on track to complete the installation and operation of its T21 fleet within the current quarter. The initial contribution of the installed T21 miners to April’s overall hashrate was negligible.

As of April 30, 2024, DMG held a Bitcoin balance totaling 467 Bitcoins at a valuation of $28 million.

Gryphon Mining (GRYP)

During the month of April the company mined 40 Bitcoin at an average daily rate of 1.3 Bitcoin, a reduction of 8.1% on the daily rate achieved in March. The company highlighted the initiation of their improvement program, which involved the acquisition and installation of a batch of advanced Bitmain S21 200 TH/s machines to enhance their mining fleet. This effort resulted in the company achieving a new all-time high in average hashing power at 914 PH/s, effectively providing a mining rate of 43.8 Bitcoin per EH/s, along with a new all-time best in average mining efficiency at 28.7 J/T and a utilization of 98%.

The company also noted that the new machines are currently exhibiting a 43% increase in efficiency compared to the ones they replaced. Throughout the month, Gryphon earned bitcoin valued at approximately $2.6 million, based on an average bitcoin price of $66,183, with record-setting days in terms of the value of bitcoin mining transaction fees.

Gryphon Mining have highlighted an ambitious growth hash rate target of 10 EH/s by the end of the year, focusing considerable time on the opportunities to find value in merger and acquisition, post halving, as mining economics become more challenging for some producers.

Hive Digital (HIVE)

In April Hive Digital reached a milestone in terms of hash rate, achieving 5.0 EH/s and producing 212 Bitcoin at an average daily rate of 7.1 Bitcoin, a small reduction of 2.2% on the rate achieved in March. The company actually managed to achieve an operational hash rate for the month of 4.9 EH/s providing 43.6 Bitcoin mined per EH/s and a utilization rate of 98%. With the addition of further Bitmain S21 Antminers, the company expects to achieve 5.5 EH/s by the end of June, targeting a breakeven price point of $45,000 after the recent Bitcoin halving.

The company sold 58% of its monthly production adding 100 Bitcoin and taking their total hodl to 2,377 Bitcoin (2,400 as at May 6), with a value of $144 million as of April 30, 2024. This strategy reflects the company’s anticipation of rising Bitcoin demand, particularly post-launch and approval of spot Bitcoin ETFs.

Hive Digital’s focus remains on maximizing cash flow return on invested capital per share while minimizing shareholder dilution. The company is optimistic about generating operating income, upgrading ASIC chips for energy-efficient Bitcoin mining, and progressing in high-performance computing (HPC) for Artificial Intelligence (AI) data services, diversifying revenue streams, positioning itself at the forefront of cryptocurrency and AI industries.

HUT 8 Corp (HUT)

Hut 8 produced 148 Bitcoin in April 2024 at an average daily rate of 4.9 Bitcoin, a reduction of 33.8% on the daily rate achieved in March. This reduction in part is due to the transition of mining machines to new sites.

CEO Asher Genoot noted the team’s adeptness in maximizing deployed hashrate amid the halving backdrop. Notably, Salt Creek saw the energization of 63 megawatts, housing nearly 18,000 miners, elevating self-mining hashrate to 5.5 EH/s per second.

Genoot also highlighted the seamless transition of miners from Kearney and Granbury to Salt Creek, demonstrating operational efficiency. Additionally, Cedarvale, a 215 MW site in Ward County, Texas, was partially energized for partner Ionic Digital.

Hut 8’s Managed Services business remains pivotal for growth amidst post-halving market conditions. Key highlights include the successful online launch at Salt Creek and partial energization at Cedarvale, with a focus on cost-efficiency and profitability.

The company sold 141 Bitcoin, representing 95% of the monthly production and increased their hodl to 9,109 Bitcoin representing a value as of April 30, 2024 of $552 million.

IREN (IREN)

April proved to be another great month for IREN in terms of achieving a new high hash rate of 9.4 EH/s and producing the 5th largest monthly total Bitcoin of the North American Public miners achieving 358 Bitcoin, at an average daily rate of 11.9 Bitcoin, an increase of 4.8% on the daily rate form the previous month. The company is currently expected to achieve the milestone of 10 EH/s in May with fully funded growth to 20 EH/s by the end of the current year.

Iren’s enhanced AI Cloud Services agreement with Poolside has meant the company doubling its GPU capacity to 816 NVIDIA H100 GPUs. They are also considering ‘on-demand’ and testing the cloud market, which will bring additional pay as you use revenues from their GPUs. The anticipated annual hardware profit achievable from 816 GPUs is $14-$17 million, with a projected 24-month payback period, solidifying financial viability and strategic growth prospects.

Riot Platforms (RIOT)

Riot Platforms mined 375 Bitcoin during the month of April, at an average rate of 12.5 Bitcoin per day, a reduction of 8.8% on the rate achieved during March. The company was able to increase both its energized and operational hash rate to 12.6 EH/s and 8.8 EH/s. Additionally the company was able to implement their energy strategy, achieving a total of $2.1 million in power sales and demand response credits.

On April 18th, 2024, Riot Platforms announced the successful activation of the substation at its Corsicana Facility. CEO Jason Les expressed pride in the team’s efforts over two years, culminating in this milestone. With a 400-megawatt capacity, the facility is on track to reach 31.5 EH/s self-mining hash rate by 2024. Upon full development, the Corsicana Facility will boast a 1 GW capacity, positioning it as the world’s largest Bitcoin mining site.

The initial phase, powered by the newly energized substation, will add 16 EH/s to Riot’s capacity by 2024. Building A1 already houses the first batch of miners, with deployment continuing until reaching a capacity of 3.7 EH/s. Buildings A2, B1, and B2 will progressively come online, adding another 12 EH/s.

The company added all 375 Bitcoin to its treasury taking the total hodl to 8,872 Bitcoin, providing a valuation of $538 million as of April 30, 2024.

SATO Technology (SATO)

In April, SATO generated 23 Bitcoin, averaging 0.8 per day, representing an 8.6% reduction from the previous month. Of this, 74% (17 Bitcoin) were sold, with 6 Bitcoin added to the company’s hodl, totaling 68 Bitcoin valued at $4.1 million, plus $651,208 in cash, for a treasury position of $4.7 million.

SATO strategically boosted operations by acquiring Bitmain S19K Pro, T21, and S21 rigs for Data Center One, elevating operational hashrate by 17 PH/s. Future rig acquisitions aim to improve mining efficiency, targeting a potential 1 EH/s capacity at Data Center One, financed through operating cash flow and other financial instruments.

CEO Romain Nouzareth highlighted April as SATO’s third Bitcoin halving epoch, emphasizing the company’s proactive stance in increasing Bitcoin holdings, resulting in expanded mining hashrate. SATO’s focus remains on bolstering operational hashrate and optimizing facility efficiency to enhance shareholder value.

Soluna Holdings (SLNH)

In April Soluna Holdings produced 33 Bitcoin at an average rate of 1.1 Bitcoin per day, a reduction of 7.8 % on the average daily rate achieved in March, with a total operational hash rate of 804 PH/s.

On May 8, 2024, Soluna Holdings announced a collaboration with a leading global GPU-server OEM and AI infrastructure-as-a-service provider. Soluna Cloud, its new subsidiary, will deliver NVIDIA H100 GPU clusters for large-scale AI projects, leveraging renewable-powered data centers. CEO John Belizaire expressed enthusiasm for the partnership, citing its alignment with Soluna’s mission to promote sustainable AI.

The collaboration expands Soluna’s offerings to include comprehensive AI software solutions. The deployment of H100 GPUs will generate substantial annual revenue for Soluna Cloud, with opportunities for growth anticipated as demand for sustainable AI solutions rises.

TeraWulf (WULF)

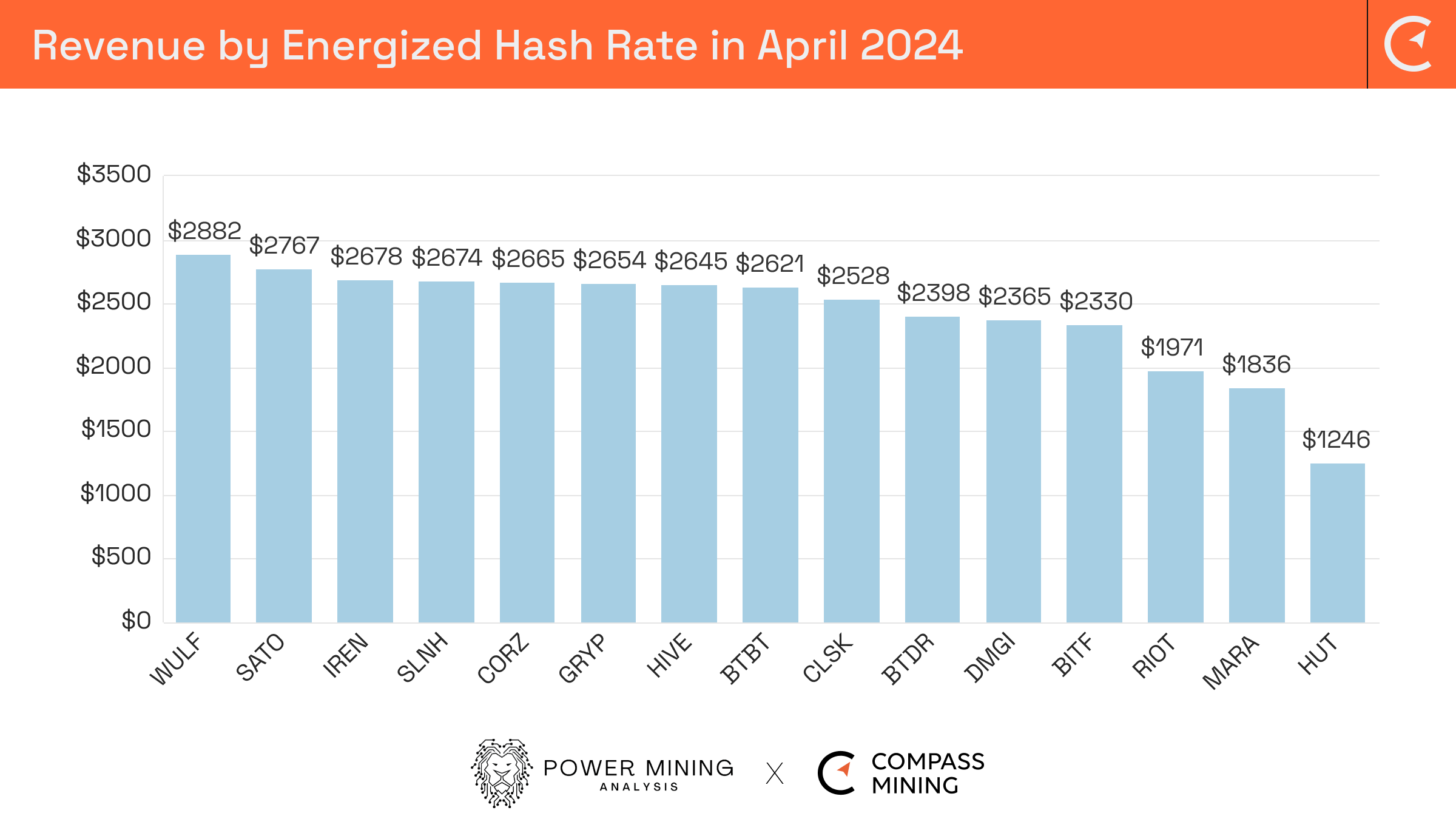

During the month of April, TeraWulf mined 348 Bitcoin at an average daily rate of 11.6 Bitcoin, a reduction of just 5.1% on the rate achieved in the previous month, due to increase in average operational hash rate for the month to 7.8 EH/s. This impressive total placed the company at the top of the production tables in terms of Bitcoin produced per hash rate deployed with 44.6 per EH/s achieved.

TeraWulf’s power cost averaged $16,058 per Bitcoin, equating to approximately $0.038 kWh, excluding expected demand response or ancillary services proceeds. Additionally, the older generation miners at Lake Mariner were replaced with roughly 3,000 S19k Pro miners, increasing the total count at Lake Mariner to around 4,100 S19k Pro miners.

Construction of Building 4 (35 MW) at the Lake Mariner facility remains on schedule for completion by mid-2024, which is poised to boost TeraWulf’s total operational capacity to approximately 10.0 EH/s.

Additionally, as previously disclosed, the Company is finalizing the design for a large-scale, HPC/AI initiative at the Lake Mariner site. The company has secured an initial 2 MW block of power, capable of accommodating thousands of state-of-the-art graphics processing units (GPUs) and has upgraded its internet interconnection to meet the bandwidth demands of AI, implemented closed-loop liquid cooling systems, and ensured power supply redundancy of 100% to support the project.

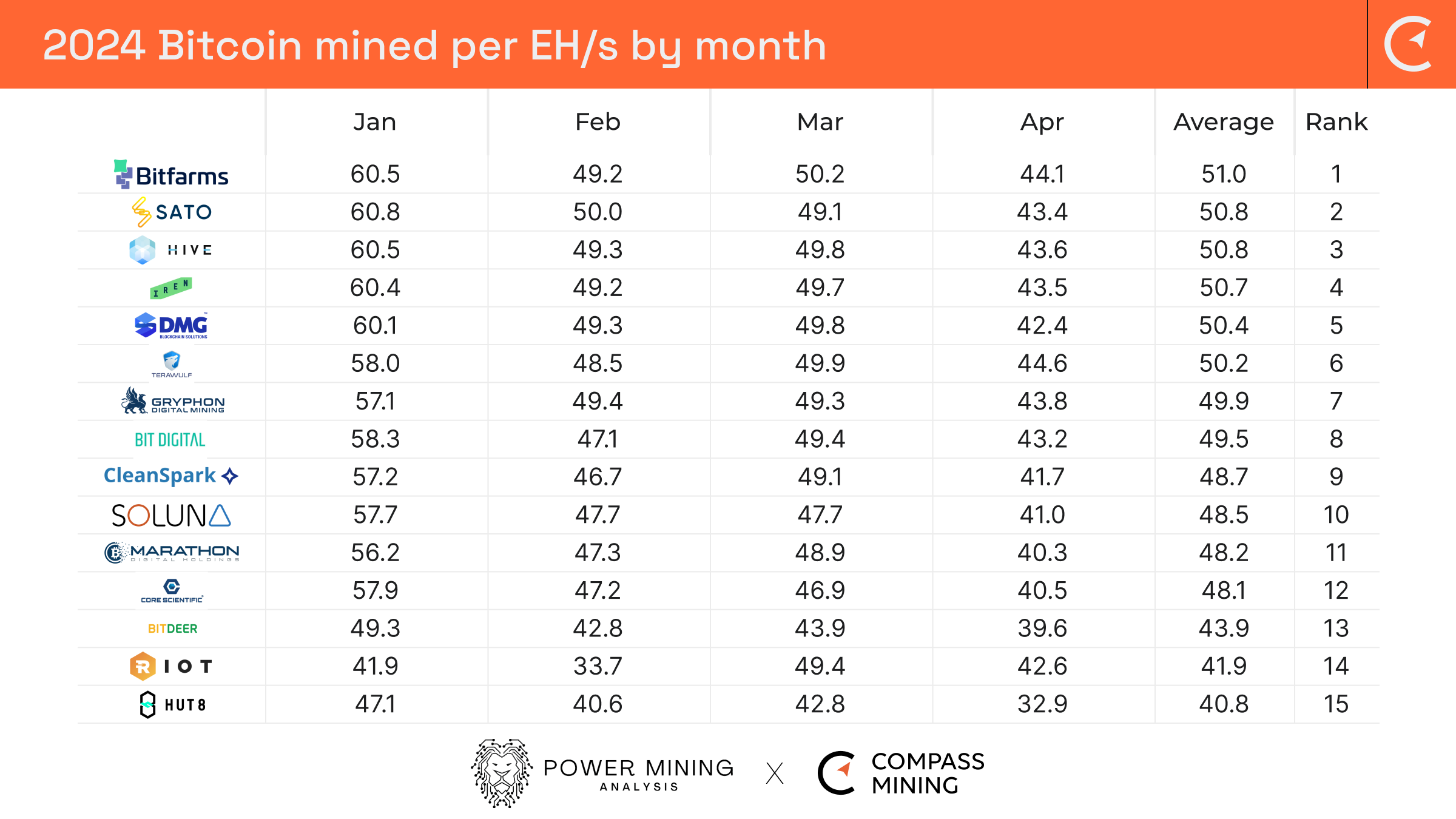

Miner Performance Year to Date

The table below provides the production by EH/s for each of the first four months of 2024 and to highlight which miners are consistently able to mine the most from their miner machines. It should come as no shock to see the likes of Bitfarms, Hive Digital, IREN and SATO Technology occupying the first four positions. In 2023 the same four miners also finished in those same positions with Bitfarms and Hive Digital finishing first and second.

Bitfarms has continued to show that same consistency under the leadership of Chief Mining Office Ben Gagnon, a notable feat when you consider the company operates in 4 countries with 11 sites. The gap between the miners in the first 12 positions is separated by less than 6%. The companies trailing towards the lower end of the table would be significantly closer if they had included their operational hash in some of their monthly mining updates.