Amidst the ongoing reporting season, four of the largest Bitcoin miners in the industry, Bitfarms (BITF), Cipher Mining (CIFR), Marathon Digital (MARA), and Riot Platforms (RIOT), have unveiled their financial results, shedding light on their performances in the latest quarter (Q3) and the year-to-date positions for 2023.

A notable trend in the first nine months of 2023 is the remarkable surge in the global hash rate, soaring from 266 EH/s to 408 EH/s by September 30, 2023, representing a 53% increase. This surge has consequently led to a significant uptick in Bitcoin mining difficulty, escalating from 35.36T to 57.11T over the same period, marking a 62% increase. This dynamic indicates that miners are currently reaping far fewer rewards per EH/s than at the beginning of the year, emphasizing the critical need for Bitcoin miners to expand their hash rate, with the most efficient miner machines, in tandem with the global hash rate to maintain a competitive edge.

Adding to this equation is the impressive growth of the Bitcoin price, itself, registering a remarkable 113% increase year to date. These combined factors underscore the evolving landscape of Bitcoin mining and the strategic imperatives for miners to adapt to changing market conditions.

Quarterly and Year to Date Reporting

Even though the Bitcoin price has increased 63% from its opening on January 1, 2023 at $16,547, to close at $26,967 on September 30, 2023 miners have struggled to get anywhere close to making a profit. Of the four miners in the table below only Marathon Digital were able to highlight a profit in both the recent quarter and the nine months, ending September 30, 2023. In fairness, this was achieved by benefiting from an $82.6 million gain from the recent extinguishment of debt. The other three Bitcoin miners recorded accounting losses for both periods.

The main reasons for these losses incorporated throughout 2023 are due to the significant levels of depreciation recorded for the first nine months, with BItfarms recording $63 million, Cipher Mining $42 million, Marathon Digital $109 million, and Riot Platforms $190 million.

It should be noted that Riot Platforms have two other significant businesses, a hosting business at their Whinstone facility in Texas, which currently does not provide a positive contribution to the organization and an Engineering business that provides a gross margin of 8%. The remainder of the article will focus on the self mining element of the business, for which Riot Platforms provides segmental reporting analysis.

Another useful financial metric to determine performance of the company is the Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) which provides a clear view of a company’s operational profitability by excluding non-operating expenses. By eliminating non-cash charges and extraordinary items, Adjusted EBITDA offers a more accurate representation of core business performance, aiding investors and analysts in assessing a company’s operational efficiency and financial health.

This metric enhances comparability between companies, facilitates strategic decision-making, and is particularly valuable for businesses with significant non-cash expenses, allowing stakeholders to gauge sustainable earnings and cash flow generation.

All four miners provided a positive EBITDA over each reporting period, highlighting that from a more traditional cash accounting perspective, the businesses are currently operating in a viable capacity.

The cost of mining one Bitcoin

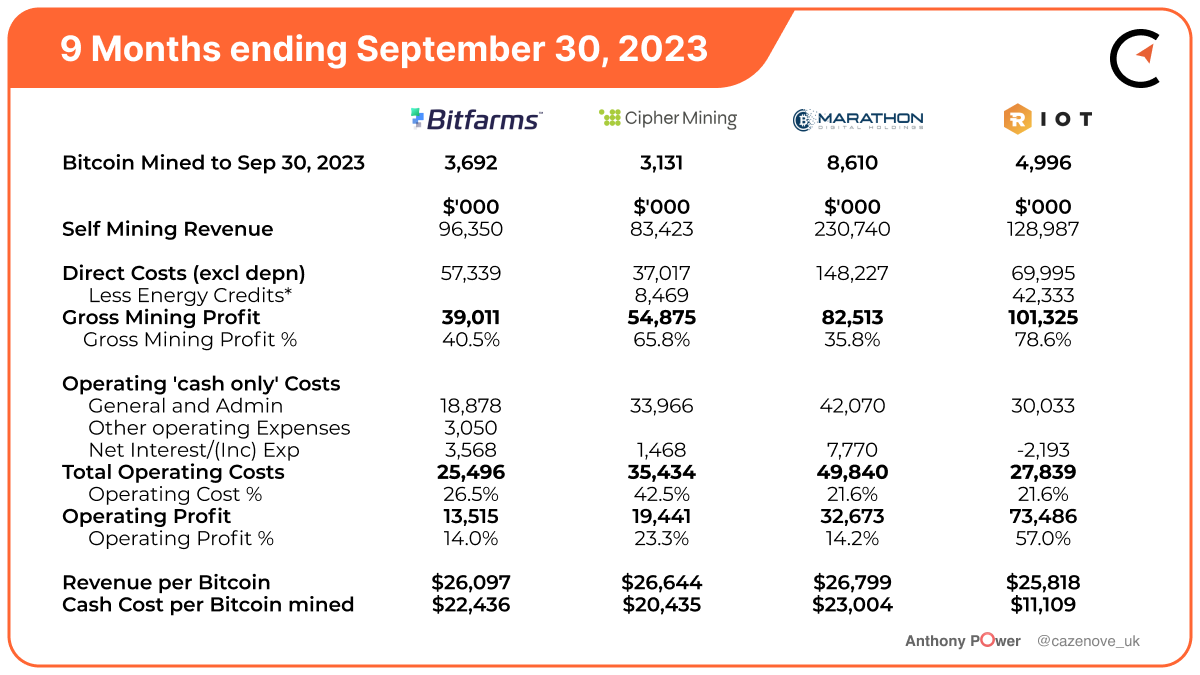

A useful metric to compare financial performance in each of the Bitcoin mining companies, is to consider the cost of mining one Bitcoin. For this exercise only direct and operational cash costs have been included from the Income statement.

Cipher Mining and Riot Platforms have both reported their ‘power sales/curtailment credits which have been included as an offset the electricity costs, in the gross margin calculation, in the relevant period. Riot Platforms operating costs, and power curtailment credits have been appropriately apportioned against their self mining and hosting businesses.

The table focuses on the first nine months of the year and breaks the costs down by their relevant classification. Cipher Mining have one of the lowest electricity rates of all the North American listed miners at 2.7c kWh, and when you consider the company also received credits for power sales, they were able to achieve a gross margin of 65.8% for the full reporting period and 66.1% for the quarter ending September 30, 2022.

Riot Platforms entered into a long-term power purchase agreement (PPA) to provide for the delivery of 345 MW of power to its Rockdale Facility. Any power used above this total is priced at the current market spot rate. The benefit of the PPA is that it enables the company to strategically curtail mining operations and participate in programs which significantly lower their cost to mine Bitcoin. The company actually achieved a total of $66.1 million in power curtailment credits during the first nine months of the year and this enabled them to achieve a gross margin of 78.6%. As the majority of credits are attributed to the months between June and September, the gross margin achieved during the last quarter was actually 123.4%, effectively meaning the credits achieved for curtailment were actually higher than the energy costs incurred in Bitcoin mining.

Bitfams managed to achieve a credible 40.5% gross margin for the nine months and 38% for the last quarter, due to the increased mining difficulty. The company prioritized a strategy to reduce their debt which had reached a level of $160 million in June 2022. Their debt has since been reduced to $7.9 million as at October 31, 2023. However, in the reporting period, the company incurred net interest of $3.56 million which brought the operating profit to 14%. One area the company is keen to address is miner efficiency. They currently have an average efficiency of 35 W/Th and with an expectation that the hash rate will grow to 7.0 EH/s by the end of Q1 2024 it is expected that this current machine efficiency will improve.

Marathon Digital achieved a gross margin of 35.8% in the first nine months. Their energy cost of approximately $66.7 MWh includes a hosting fee as well as the electricity cost. The company managed to increase the hash rate in 2023 and increased the margin to 39.1% in the last reported quarter. Operating profit was also improved in the last quarter when compared with year to date, increasing to 22% from 14.2% caused by the increased production of Bitcoin as hash rate energized reached 19.1 EH/s in September 2023.

Balance Sheet Metrics

In the Bitcoin mining space, a robust balance sheet is vital for financial resilience. Given the industry’s capital-intensive nature and market volatility, a strong balance sheet ensures miners can weather operational challenges, invest in cutting-edge technology, and capitalize on market opportunities, fostering long-term sustainability and competitiveness.

Current Ratio

The current ratio is a crucial financial metric as it assesses a company’s short-term liquidity and ability to meet immediate obligations. Calculated by dividing current assets by current liabilities, a higher current ratio indicates a healthier liquidity position. A strong current ratio is indicative of sound financial management and enhances confidence in a company’s ability to navigate short-term challenges.

Marathon Digital and Riot Platforms have significant strength in this metric with a ratio of 11.33 and 7.23 respectively, providing assurance to stakeholders that they can manage any short to medium term downside with regards to increased difficulty or energy pricing or a reduced Bitcoin price.

Bitfarms and Cipher Mining both have a ratio above 1.0 meaning both should be able to effectively meet their current liabilities over the next 12 months.

Enterprise Value

The Enterprise Value (EV) is calculated by adding a company’s market capitalization, debt, minority interest, and preferred shares, then subtracting cash and cash equivalents. It provides a comprehensive valuation of a company.

By taking the enterprise value and subtracting the Bitcoin held in treasury and then dividing this by the ‘plugged-in’ hash rate for each company, you obtain an effective cost value for each EH/s.

In the table below it’s clear to see that Bitfarms appears to be significantly undervalued to the other three miners in terms of hash rate value, and more so when compared to a peer miner in size like Cipher Mining

One metric should not be taken in isolation when comparing companies, and a broader array of measures, such as profitability, machine efficiency and operational performance should also be included when carrying out due diligence.

Hash Rate Growth

As the global hash rate and mining difficulty increases, it’s important for the Bitcoin miners to have growth strategies in place. In the year to date so far, Marathon Digital has grown their hash rate by 177% achieving 19.4 EH/s in the month of October, including the recent joint venture in Abu Dhabi. This hash rate growth comes at a cost to a company and Marathon Digital has used some of their ‘at the market’ (ATM) shelf offering to grow its hash rate. The company has a further 4.0 EH/s plugged in at their Garden City site, in Texas, awaiting energisation and is already looking at future potential sites in Paraguay and Africa to achieve an operational hash rate in excess of 30 EH/s during 2024.

Bitfarms and Cipher Mining have also significantly grown their hash rate but are barely keeping up with the mining difficulty growth in 2023. Whilst Bitfarms has utilized their ATM to grow hash rate and pay down their debt, Cipher Mining have managed to grow their hash rate by an impressive 67% whilst only diluting their share capital by 1.4%.

Riot Platforms have had a challenging year, having lost buildings F and G, which utilizes 1.9 EH/s of immersion cooling technology, for the majority of 2023. Their hash rate is currently 21% higher than at the start of the year and they have diluted nearly 40 million shares to help cover the costs at the Whinstone site, and also construction at their Corsicana facility in Navarro County, Texas. They recently acquired 33,280 state-of-the-art Bitcoin mining rigs, procured from leading manufacturer MicroBT. The purchase, valued at $162.9 million, is aimed at bolstering Riot Platforms’ self-mining capacity ahead of Bitcoin’s anticipated halving cycle in mid-2024, taking the total hash rate to 20/1 EH/s.

Operational Metrics

The table below highlights some of the useful metrics for each of the Bitcoin miners. The current hash rate reflects the hash rate currently ‘plugged in’. All four miners have been slowly building their ‘hodl’ during the year, in readiness for the halving in April 2024.

a. Treasury Management

Marathon Digital has the largest Bitcoin hodl of all the North American Public Miners with 13,396 Bitcoin valued at $464.4 million as at October 31, 2023 and with an available cash balance of £101.2 million. Riot Platforms have 7,345 Bitcoin held in their treasury, valued at $254.6 million and a further $290.1 million held in cash. Both these mining giants have significant resources at their disposal to navigate through the next halving and have the opportunity to purchase any distressed assets from Bitcoin miners who have not planned appropriately.

Bitfarms have slowly increased their Bitcoin hodl during 2023 and have 760 Bitcoin valued at $26.3 million with cash and equivalents of $46.8m, whilst Cipher mining have 516 Bitcoin valued at $17.9 million with a further $3.3 million in cash and cash equivalents.

b. Bitcoin Production by EH/s

Bitfarms have consistently performed extremely well in this metric, finishing with the highest amount of Bitcoin produced by each EH/s for the majority of months in 2023, averaging 83.7 Bitcoin per EH/s. Marathon Digital have in recent months improved their productivity and have a current year to date average of 71.8.

Although both Cipher Mining and Riot Platforms Bitcoin production has been lower in 2023, compared to peer miners, due to their energy strategies adopted at their Texas facilities, where they have curtailed their energy in receipt for energy credits. These credits effectively reduce future energy costs, providing a significant uplift in gross margin.

c. Bitcoin Utilisation

The utilization metric considers the amount of bitcoin produced as a % of the amount of bitcoin expected to be produced if machines were energized 24/7. As one would expect from reviewing the previous metric, Bitfarms also has the highest average utilization, of the four miners with an impressive 93% year to date. Marathon Digital constantly had to curtail energy when domestic demand was required, achieving an average rate of 90%. Cipher Mining, although implementing its energy strategy still maintained an average of 86%, and Riot Platforms who received over $66m in power curtailment credits in 2023, had a utilization rate of 57%.

General and Administrative Costs

General and administrative (G&A) costs encompass overhead expenses like salaries, bonuses, stock compensation, legal and professional fees, travel and subsistence costs, and administrative supplies. It’s crucial to control them as they directly impact a company’s profitability. Efficient management of these costs ensures optimal resource allocation, maintaining financial health, and enhancing competitiveness by directing funds towards strategic initiatives rather than excessive administrative overhead. This fosters a lean and agile operational structure, contributing to sustained business success.

To compare the four miners in the table below I have considered the G&A cost as a % of the total self mining revenue. Marathon Digital has the lowest cost to revenue with 24%, followed by Bitfarms (27%) and Riot Platforms (31%).

Cipher Mining has a total of 75% of their revenues utilized by G&A costs. The increase was driven by an increase of $9.9 million of payroll and payroll-related costs due to increased headcount and bonus expense. The company also incurred a $2.0 million accrual for the cost of resolving legal claims recorded during the nine months ended September 30, 2023.

Stock Based Compensation

Stock compensation aligns employee and shareholder interests, motivating and retaining key talent. It serves as a performance incentive, fostering commitment and driving organizational success. Additionally, it enhances executive accountability and ties compensation to long-term stock performance, aligning with the investor’s goal of sustainable value creation.

In the table below the stock compensation has been highlighted as a percentage of the total revenues. Whilst not a cash cost, like the rest of the G&A costs, stock compensation is still a real cost to the company, as shares awarded and vested are a form of dilution.

In the nine months of 2023, Cipher Mining has recorded in their accounts $28.7 million in stock compensation representing 34% of the total revenues earned. Bitfarms, Marathon Digital and Riot Platforms levels of stock compensation are in the 6-7% of revenues range, which is more consistent with other large technology companies such as Alphabet Inc (GOOG), Meta Platforms (META) and Microsoft Corporation (MSFT).

Share Price Performance in 2023

While Bitcoin has surged by 114% this year to date, the highlighted Bitcoin mining stocks have outperformed, showing stronger growth. Cipher Mining soared by 409%, Riot Platforms by 187%, Marathon Digital by 168%, and Bitfarms by 161% since January 1, 2023.

Yet, in the last three months, a divergence is evident. Bitcoin miners’ shares fell by an average of 22%, contrasting with Bitcoin’s 27% price increase during the same period. This recent shift suggests a potential decoupling between Bitcoin and mining stocks, marking a nuanced phase in their historical correlation.

Summary

These four mining companies appear strategically positioned for the impending halving. Marathon Digital and Riot Platforms, each possessing treasuries exceeding $500 million, are poised for stability and potential opportunities in 2024.

In a scenario of stagnant Bitcoin prices, miners with high energy costs and suboptimal productivity may face early shutdowns, creating opportunities for well-capitalized companies to capitalize on distressed assets.

While Bitfarms and Cipher Mining lack extensive treasuries, their low power costs and efficient productivity bolster their resilience, allowing them to make strategic decisions on mining machines well ahead of the halving event.