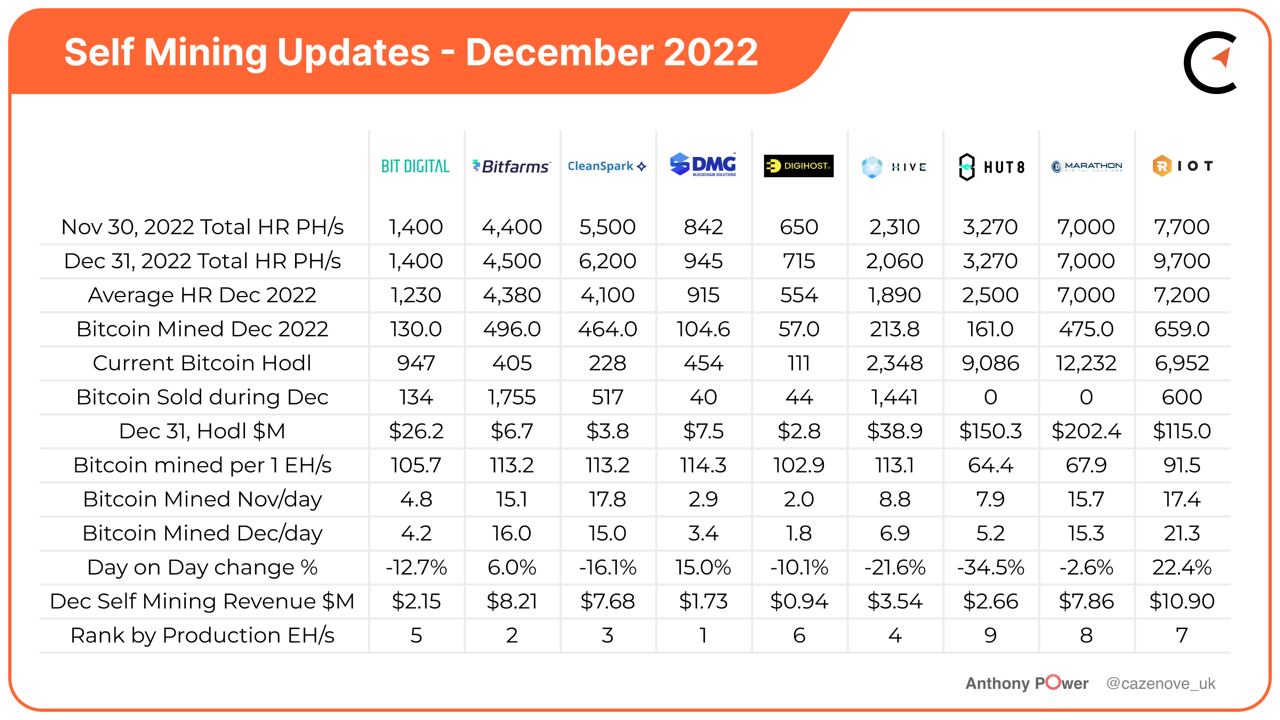

December proved to be a busy month for Bitcoin miners, holidays notwithstanding. Bitcoin’s price fell 3.6% during December, from $17,168 to $16,547. Miners were cushioned by this continued price pressure by a favorable 7.3% decrease in mining difficulty, finishing the month 4.3% lower than the previous month.

Highlights

DMG Blockchain (DMGI) continued their good November performance and ended 2022 by having the highest monthly performance by a miner in terms of production by operational EH/s, for December too. They successfully mined 100 BTC in a calendar month for the first time and were very close to achieving their end of year planned hashrate total of 1 EH/s.

Strong monthly operational performances from Bitfarms (BITF), CleanSpark (CLSK) and Hive Blockchain (HIVE), made up the next three places.

Further recognition should also be given to Hive Blockchain, who received $3.15 million of income from their energy price hedging and grid balancing strategy. Riot Platforms (RIOT) , previously Riot Blockchain, generated $4.9 million in additional power credits in December as well. If you were to convert these amounts into Bitcoin it would have provided the companies with an equivalent additional 190 and 290 Bitcoin, respectively. Hut 8 also took advantage of curtailment for an undisclosed amount of revenue.

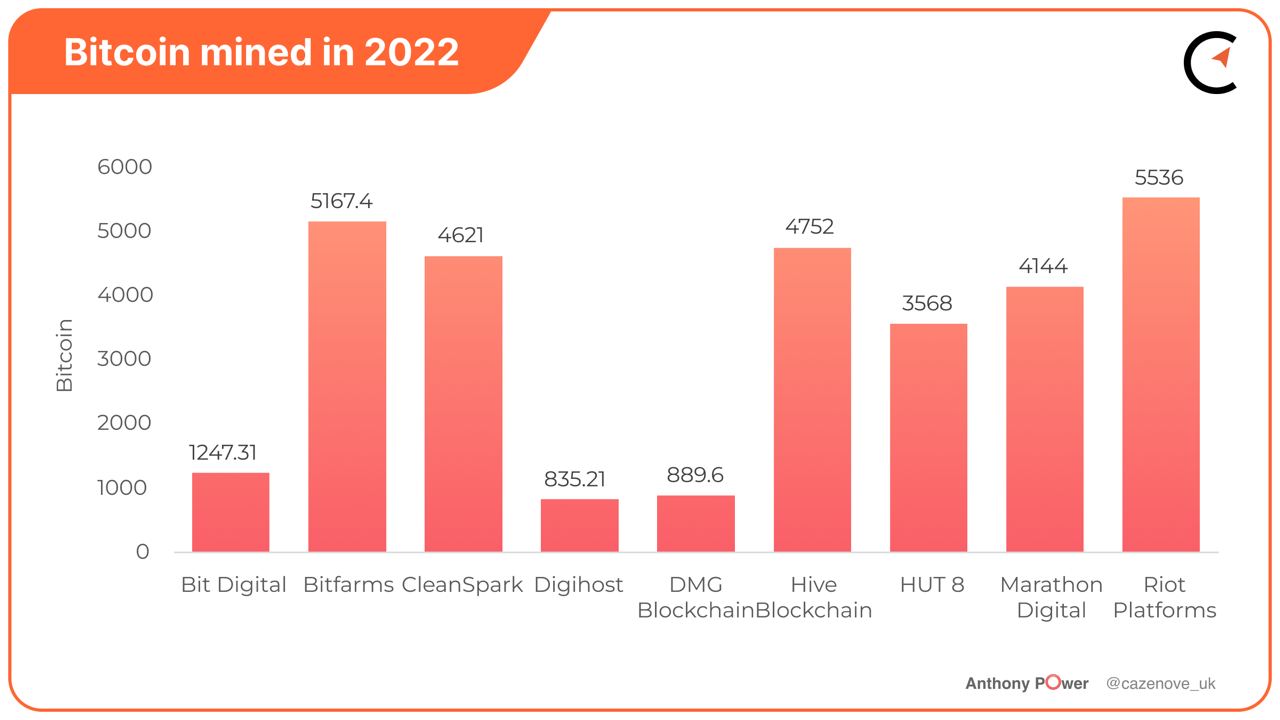

In terms of Bitcoin mined in 2022, Riot Platforms produced a total of 5,536 Bitcoin for the year. Bitfarms mined 5,167 Bitcoin and Hive Blockchain produced 4,752.

Bit Digital (BTBT)

Bit Digital produced 130 Bitcoin in December, or 4.2 Bitcoin per day, a drop of 10% from November monthly total. The company was able to utilize 35% of the 38,593 bitcoin miners achieving a total operational hash rate for the month of 1.23 EH/s.

The company sold 130 Bitcoin during December to pay for operational commitments and has a total hodl of 946.6 Bitcoin and 8,799.9 Ethereum providing a current value of $26.2 million, as at December 31, 2022.

On December 22, 2022, the company announced that it had formally commenced Ethereum staking operations, for which it will be compensated in Ethereum tokens. Bit Digital has currently staked approximately 25% of its $12.1m Ethereum and tokenized ETH Hodl, and plans to continue staking the rewards and all of its position in Ethereum, over time.

On January 9th, 2023 the company received a notice from Nasdaq informing the company that it did not satisfy certain continued listing requirements. The company has responded that if necessary, a reverse stock split will be processed to regain compliance.

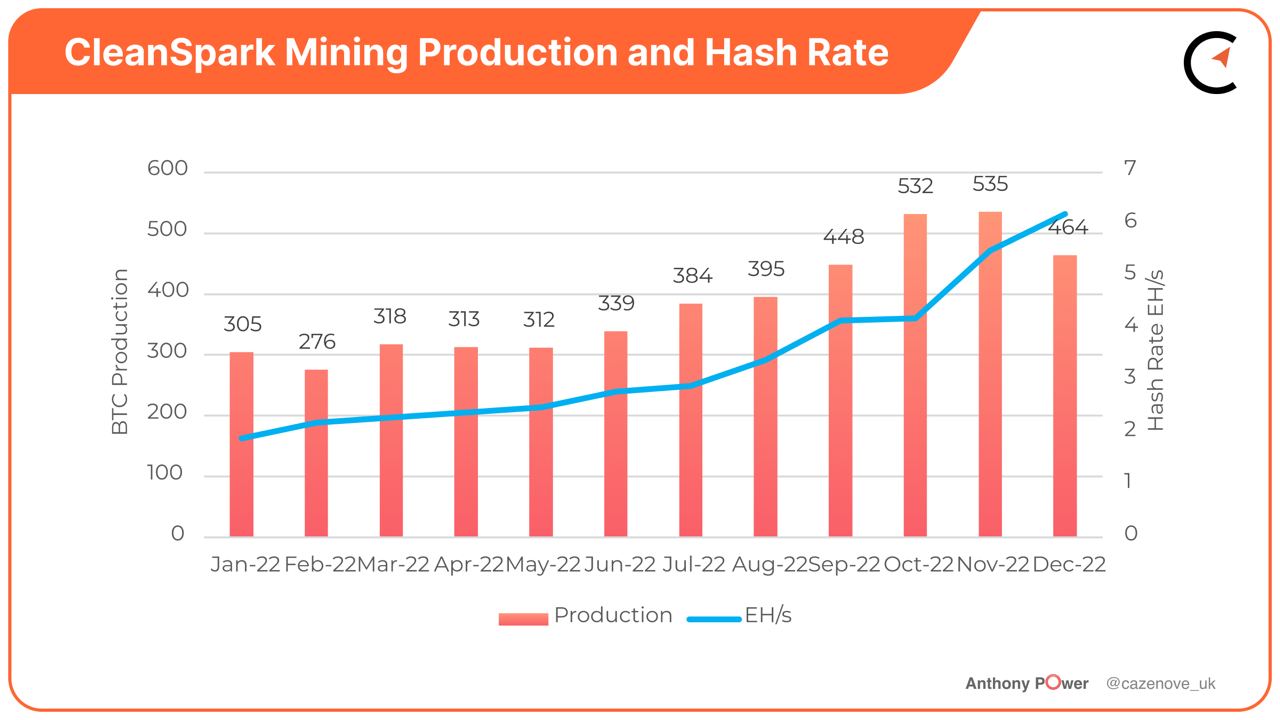

CleanSpark (CLSK)

The table below highlights how CleanSpark had an amazing 2022 and ended the year with an operational hash rate of 6.2 EH/s, an increase of 225% over the closing hash rate for 2021. The company have fully utilized the opportunities available in this bear market to grow and expand their mining operations

The company produced a total of 464 Bitcoin in the month of December, for a total of 4,621 Bitcoin in 2022. Their daily average mining rate of 15 Bitcoin per day was 16.1% less per day when compared to the previous month.

This reduction was due to the severe weather causing the company to effectively shut down operations in Georgia for the majority of the last week in December. Although the company also utilizes immersion cooling technology at its Norcross facility, which was not impacted by the weather, the company made a decision to curtail energy. The operational hashrate therefore dropped to 4.1 EH/s

CleanSpark sold 517 bitcoins in December for a total of $8.1 million to fund operational activities. CleanSpark has a current hodl of Bitcoin, as at December 31, 2022. The company has a strategic plan of achieving 16.0 EH/s by the end of 2023 with 13.5 EH/s planned from increasing current facilities and only 2.5 EHs coming from new opportunities.

Digihost Technology (DGHI)

Digihost Technology mined 832 Bitcoin in 2022, a 60% increase on the total achieved in the previous year and increased its operational hash rate to 715 PH/s. The company produced 57 Bitcoin in December 2022, at a rate of 1.8 Bitcoin per day, a reduction of 10.1% on the average day rate achieved in November, caused by the severe weather in Western New York, forcing the company to curtail their energy during the last week of December.

The company sold 44 Bitcoin during the month and has a current hodl as of 111.32 Bitcoin and 800 Ethereum, valued at $2.8 million. In addition, the company held cash of approximately $1.82 million at the end of December, providing a total liquidity of $4.62 million. By selling a portion of its mined Bitcoin each month, Digihost Technology has continued to operate within cash flow and remain debt free, consistent with the management's commitment to avoid equity dilution, where possible.

Digihost Technology is finalizing the documentation and approval requirements related to the acquisition of a 60 MW power plant in North Tonawanda, New York in December. Hashrate should increase to 1.7 EH/s, if closed by the end of Q1 2023.

The company was able to energize 100 PH/s of miners at its Alabama site, during December, which continues on schedule and to budget, and is expected to deliver an extra 22 MW of power by the end of Q1 2023. Once energized, this additional 550 PH/s will take the total computing power to deliver 2.25 EH/s.

DMG Blockchain

After the success of November’s mining update DMG Blockchain had another great month in December, producing a total 104.96 Bitcoin at a daily rate of 3.4 BTC per day–an increase of 15% over the previous month’s Bitcoin production. They sold 40 Bitcoin in the month to cover operational expenses and have a current hodl of 454 Bitcoin valued at $7.5 million.

The company has increased its hashrate to 945 PH/s and during the month had an average operational hash rate of 915 PH/s. The company is still awaiting a final delivery from Bitmain for a further 42 PH/s and also plan to purchase more machines utilizing accumulated credits with Bitmain. Once these orders have been received and energized, it should take the hashrate to the companies planned growth of 1.0 EH/s.

DMG Blockchain has provided a cautious outlook for 2023 due to current market conditions and will be carrying out more testing on immersion cooling before phasing this technology into its current infrastructure, beyond the original mid-2023 timeframe. The company has also provided an update on its future growth and has deferred its hashrate to 2.0 EH/s, to beyond 2023.

Hive Blockchain

Hive Blockchain produced 213.8 Bitcoin in December at a daily rate of 6.9 Bitcoin per day, a reduction of 21.9% on the previous month. This was primarily due to the company switching off their GPU miners and participating in energy price hedging and grid balancing strategy, achieving $3.15 million of income.

The company had an average operational hashrate of 1.89 EH/s during the month, providing 113.2 Bitcoin per EH/s and ended the month with a hashrate 2.06 EH/s. The company sold 1,742 Bitcoin during the last quarter to increase its cash reserves in readiness to fund planned expansions. ASIC miner prices have actually dropped nearly 90% from their highs and are providing great opportunities for companies with good cash flow to buy new machines at discounted prices.

Hive Blockchain received 3,400 new generation Bitcoin ASIC miners in December which should start to reduce the company’s average cost of producing Bitcoin, and improve gross mining margins. They have already installed 2,050 Bitmain S19j Pro miners and expect the remaining miners to be installed this week.

The company also announced the installation of a first batch of 1,423 HIVE BuzzMiner Bitcoin miners, out of the total production quantity of 5,800. Powered by Intel’s Blockscale, the machines are planned as replacements for older legacy ASIC and GPU mining equipment.

Hut 8

Hut 8 (HUT) had a disappointing month, producing 161 Bitcoin in the month of December at a rate of 5.2 Bitcoin per day. A significant decrease of 35% from the daily rate of 7.9 Bitcoin per day achieved during November and the lowest of 2022, the dropoff was primarily due to the high energy prices. Indeed, Hut8 curtialed production at its 2.5 EH/s Alberta facility. During the self-curtailment period, the company was able to sell energy back to the grid, but have not disclosed the amount.

On a positive note Hut 8 did not sell any Bitcoin during 2022 and increased their total hodl to 9,086 Bitcoin, a 65% increase on Bitcoin held at the end of 2021, with a value of $150.3 million as at December 31, 2022. It should be noted that all the Bitcoin held on their balance sheet is unrestricted and not leveraged against any debt, like many of their peer miners. The value of their Bitcoin currently represents over 80% of the company’s market capitalization. The company continues to remain bullish on Bitcoin from a long term strategy.

Operations at the North Bay facility in Ontario remain suspended as mediation proceedings continue with the energy provider Validus Power Corp.

Marathon Digital (MARA)

Marathon Digital produced 475 Bitcoin for the month of December, averaging 15.2 per day, a small decrease of 2.6% on the November rate of 15.7 per day.

The company mined a total of 4,144 Bitcoin for 2022–considerably lower when compared to the 5,536 Bitcoin mined by peer miner Riot Platforms in 2022. Issues with delays, energy curtailments and legal and bankruptcy filings by host companies have been regularly highlighted throughout the period.

Marathon Digital does have an impressive hodl of 12,232, with 7,815 Bitcoin unrestricted. This increase in the unrestricted Bitcoin was due to the company reducing the amount of revolver borrowings from $30 million to $0 in December. The company also has a healthy cash balance of $103.7 million at December 31, 2022.

The Las Vegas-based firm has approximately 69,000 active miners, producing approximately 7.0 EH/s. An additional 2.1 EH/s is currently pending energization after an additional 1,000 S19 XPs were successfully installed in Texas during the month of December.

Riot Blockchain (RIOT)

Riot Platforms, Inc produced a monthly mining record of 659 Bitcoin in December at an average rate of 21.3 per day, a 22.4% increase on the previous month. This was achieved with an increased hashrate to 9.7EH/s, having increased its deployed fleet of 88,556 miners.

The company received $4.9 million in power credits as a result of curtailment activity, equivalent to approximately 290 Bitcoin. If you were to add this to their total mined for the month, Riot Platforms would have mined 131.8 Bitcoin per EH/s. Severe weather during December also impacted the company in their buildings supporting immersion technology resulting in 2.5 EH/s being offline whilst sections of piping were required to be replaced.

Riot Blockchain continued its strategy of selling a portion of the mined Bitcoin and sold 600 Bitcoin for a total of $10.2 million during the month to cover operational costs. The company currently has a hodl of 6,952 Bitcoin, valued at close to $115 million on December 31, 2022..

Riot Blockchain is still on target to achieve their growth to 12.5 EH/s by the end of Q1 2023.