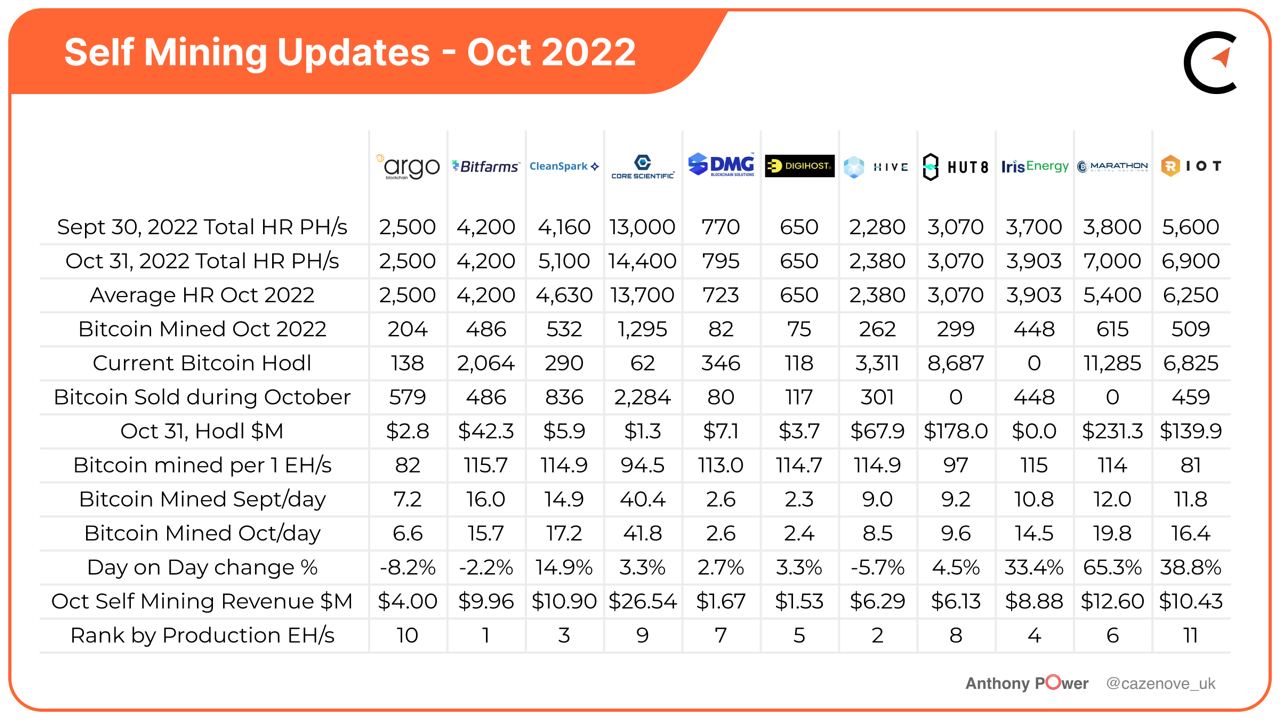

Bitcoin’s hashrate hit an all-time high last month–briefly clipping north of 300 EH/s by some counts–causing the mining difficulty to increase 17%. An increase in difficulty, of course, only added strain to overleveraged miners whose troubles became public knowledge in October.

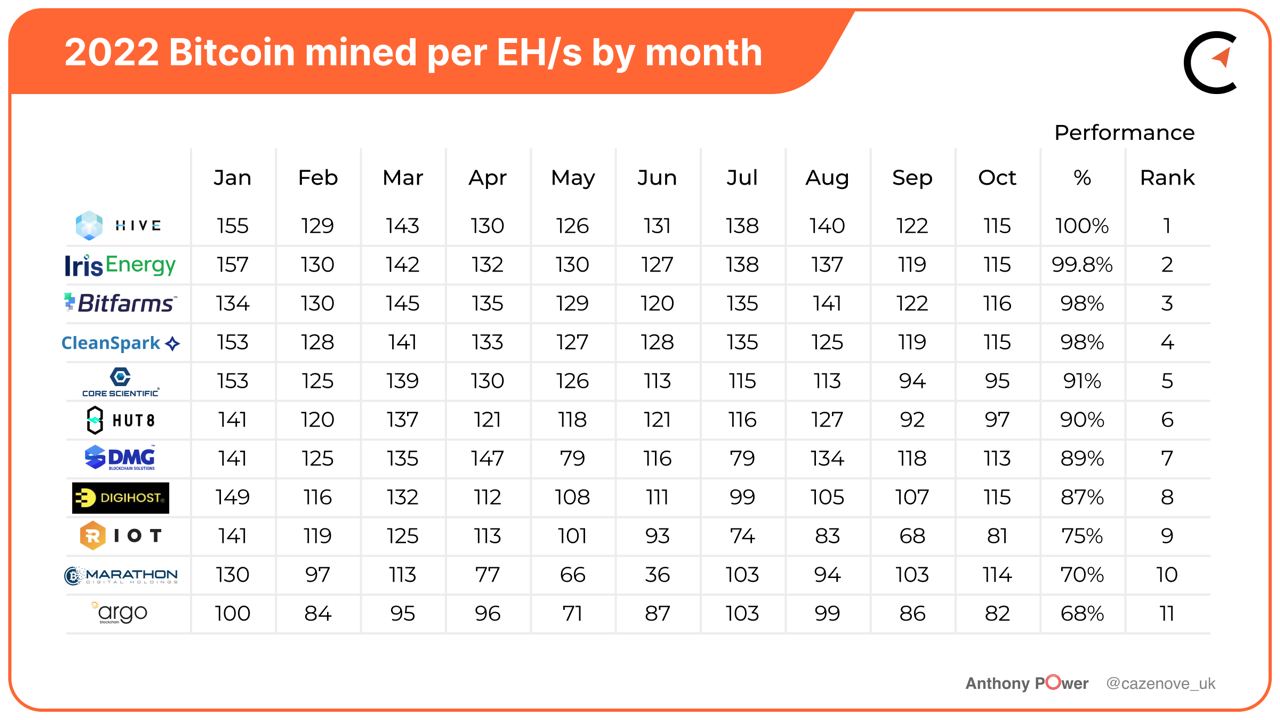

Luckily, warmer summer weather gave way to cooler autumn temperatures. Production for many miners increased as curtailment ended. Familiar faces rounded out the top three miners, with Bitfarms, Hive Blockchain and CleanSpark taking the top three respectively, followed by Iris Energy.

These four miners have been extremely consistent over the past 12 months. When considering the year-to-date performance by EH/s, Hive Blockchain remains in top spot, with the smallest of margins from Iris Energy, Bitfarms and CleanSpark.

Special mentions during October should also be given to DMG Blockchain, Digihost Technology and Marathon Digital who mined a record 615 Bitcoin and achieved a total operational hash rate of 7.0 EH/s by the end of the month.

Argo Blockchain (ARBK)

Argo Blockchain was in need of a good October, and although the gross mining margin increased from 25% to 32%, the company only managed to mine 204 Bitcoin in month. With an operational hashrate of 2.5 EH/s equivalent to $4 million in revenue, Argo’s production remains insufficient to its debt servicing obligations.

Read: October brings more debt woes to miners who edge closer to bankruptcy

Argo Blockchain sold 579 Bitcoin during the month to pay for operational expenses and currently has a hodl of 138 Bitcoin, as at October 31, 2022, which when added to November’s expected mining output, may be insufficient to meet their total monthly direct and operational costs.

Watch: Mining Equity Chaos: Argo, Core, Iris and More

Bitfarms (BITF)

Bitfarms had another great month in October, producing 486 Bitcoin at a rate of 115.7 Bitcoin per EH/s–the highest rate reported by a North American listed miner last month. They sold 486 Bitcoin during the month for $9.57 million in revenues.

The company also announced it had repaid the $23 million Bitcoin backed loan to Galaxy Digital (GLXY), which should provide some respite on their monthly debt servicing payments. Bitfarms also announced that, due to current global and macroeconomic conditions, it was revising its December 31, 2022 hashrate forecast downwards from 6.0 EH/s to 5.0 EH/s

CleanSpark (CLSK)

Cleanspark set another monthly record, mining 532 Bitcoin at an average rate of 17.2 Bitcoin per day. The company increased its operational hashrate by 23% during the month to reach 5.1 EH/s.

Having already achieved its year end hashrate guidance, CleanSpark has now further raised it to 5.5 EH/s, which will be helped with the recent purchase of 3,843 new S19j Pro mining rigs from Argo Blockchain at an average price of $15.50 per terahash. CleanSpark now purchased a total of 26,500 distressed mining rigs during the current bear market.

CleanSpark sold 836 Bitcoin last month to fund operational activities and has a current hodl of 290 Bitcoin, as at October 31, 2022.

Core Scientific (CORZ)

Core Scientific produced a total of 1,295 Bitcoin at an average rate of 41.8 Bitcoin per day. The company increased its self mining hashrate to 14.4 EH/s, a monthly increase of nearly 11%. The firm now operates 143,000 ASICs for self mining activities, and a total 243,000 ASICs when including hosting operations.

The company sold 2,284 Bitcoin fund operational activities last month and has a current hodl of 62 Bitcoin. Like Argo Blockchain, Core Scientific took advantage of the debt markets to raise capital during the bull market period and are now paying the consequences as Bitcoin continues its downward trend.

Indeed, the firm announced via SEC Filing on Thursday, October 27 that the company would not be able to meet its debt repayment obligations to creditors for the end of October and November 2022, due to current levels of Bitcoin and the rising costs of energy.

The company is exploring several financing options including raising additional capital, hiring strategic advisors, and restructuring its existing finances.

Digihost Technology (DGHI)

Digihost Technology excelled in October, mining 74.58 Bitcoin at a rate of 2.4 Bitcoin per day, an increase of 3.3% on the average day rate achieved in September. They sold 117 Bitcoin during the month and have a current hodl as of month’s end of 118 Bitcoin and 800 Ethereum, valued at $3.74 million, and with additional cash available, totalling $3.42 million. They continue to operate within cash flow and remain debt free as at this update.

Digihost Technology is expecting to complete documentation and approval requirements related to the acquisition of a 60 MW power plant in North Tonawanda, New York by the end of Q4 2022, which is expecting to increase its current hash rate of 650 PH/s to approximately 1.6 EH/s–an increase of nearly 150%.

Work is also progressing with the Alabama Phase 1 build out, on time and budget and is expected to deliver an extra 33 MW of power by the end of Q1 2023, providing the company with total computing power to deliver 3.0 EH/s.

It should be noted that Digihost Technology’ share price on the Nasdaq Stock Market dropped below $1.00 for a consecutive period of 30 days, ending on Sunday, October 9. The company has a period of 6 months to achieve a share price of $1.00 for ten consecutive days to maintain compliance. It should be noted that as at today’s share prices, Argo Blockchain, Core Scientific, Greenidge Mining (GREE) and Stronghold Mining (SDIG) will also potentially be receiving notifications from the exchange.

DMG Blockchain (DMGI)

DMG Blockchain had a productive month, mining 82 Bitcoin at a daily rate of 2.6 BTC per day. They sold 80 Bitcoin in the month to cover operational expenses and have a current hodl of 346 Bitcoin valued at $7.1 Million.

The company has a current total hash rate of 790 PH/s and during the month had an average operational hash rate of 723 PH/s. The company is still on track to deliver 1.0 EH/s by the end of the year, subject to deliveries and installation of miners.

Hive Blockchain (HIVE)

Another consistent month for Hive Blockchain where they produced 262 BTC with an operational hashrate of 2.28 EH/s. The Vancoever, Canada-based firm also managed to produce a further 45 Bitcoin from mining with their GPUs, equating to a total average of 9.9 Bitcoin per day. They sold 301 Bitcoin and have now sold their remaining balance of Ethereum holdings, during the month, a current hodl of 3,311 valued at $70 million.

Interestingly, Hive still expects to receive over 1 EH/s of Hive Intel Bitcoin ASIC miners in the next 3-4 months with scheduled deliveries.

Hut 8 (HUT)

Hut 8 produced 299 Bitcoin in the month of October at a rate of 9.6 Bitcoin per day, an increase of 4.5% per day from September. They have a total operational hash rate of 3.07 EH/s, a total that excludes legacy miners, due to be replaced by the end of the year, taking their operational hash rate to 3.5 EH/s.

Hut 8 has a total of 8,687 Bitcoin, valued at $178 million, the highest current self mined hodl of all the North American listed miners held in reserve.

Iris Energy (IREN)

Iris Energy produced 448 Bitcoin at the rate of 14.5 per day, a 33% increase on the daily average rate achieved in September. They achieved this total with an average operational hashrate of 3.9 EH/s, up from 2.7 EH/s in September.

Iris Energy sold all their bitcoin mined for $8.8 million and have used this strategy since commencement, believing that increasing hash rate now, will provide the benefit of more Bitcoin mined in the future.

On November 2, 2022, the company informed the markets that unless a suitable agreement is reached with the lender on modified terms for both equipment financing arrangements, valued at $104 million, the Group does not intend to provide further financial support for the outstanding loans. As of Thursday, November 10, these payments were not met and therefore in default.

Marathon Digital (MARA)

Marathon Digital had its best monthly mining performance of the year-to-date, increasing Bitcoin production by 65% over September with 615 Bitcoin mined in total, or 19.5 Bitcoin per day. Marathon Digital, like Hut 8, have not sold any Bitcoin, this year, and currently have a hodl of 11,285 valued at $231.3 million, of which unrestricted bitcoin holdings were 3,464 BTC, valued at $71.0 million. The company has cash holdings of $52.1 million as of October 31, 2022.

During the month, Marathon Digital increased its hashrate from 3.8 EH/s to a current total of 7.0 EH/s, after 32,000 miners were energized. The company is on target to achieve a hashrate of 9.0 EH/s by the end of the year and is still quoting its goal of 23 EH/s by mid 2023.

Riot Blockchain (RIOT)

Riot Blockchain’s performance rebounded strongly against September’s numbers. The company mined 509 Bitcoin at an average rate of 16.4 per day, a 39% increase on the previous month.

This was achieved with an increased hashrate of 6.9 EH/s, having increased its deployed fleet by 9,788 S19-series miners. A further 7,912 miners are currently being prepared for deployment, which will take the operating hash rate capacity to 7.8 EH/s. Riot Blockchain is still on target to achieve their growth to 12.5 EH/s by the end of Q1 2023.

The company’s flagship site at Rockdale, Texas completed its second immersion-cooled building, Building G, with the installation of the remaining dry cooler infrastructure, internal tanks and pumping systems. The target growth currently does not include any enhancement from the use of its 200 MW of immersion cooling infrastructure.

Riot Blockchain sold 459 Bitcoin for a total of $8.7 million during the month to cover operational costs, and has a hodl of 6,825 valued at close to $140 million.