2021 was quite the ride for the mining industry. Financial analysts predicted $100,000 Bitcoin prices. Miners touted huge purchase orders and deployments. And stock prices seemingly couldn’t go downard.

By the end of that year, however, Bitcoin dropped–reaching a price of $46,100 from a previous high of $69,000 just weeks before.

The trend only intensified in 2022. What started like a year of promise ended with high profile bankruptcies, collapses and capitulations. In part one of this article series, we’ll go over some of the most important mining stories to remember from 2022.

Buying Bitcoin with cash reserves

Bitcoin miners were still bullish early on in 2022. In fact, some miners bought Bitcoin inside of just mining it. For example, on January 10, 2021 Bitfarms (BITF) announced it had purchased 1,000 Bitcoin at an average price of $43,200, increasing its Bitcoin holdings, at the time, by 30%.

Argo Blockchain (ARBK) followed suit and purchased 172.5 Bitcoin during the second half of January 2022. Although the price was not disclosed, the Bitcoin price range during the period was between $30,000 and $36,000.

With the bear cycle in full low and Bitcoin falling in price throughout the first two quarters of 2022, both these miners would end up selling their coins at a significant discount, to improve their liquidity.

Raising capital in a bear market

Bitcoin mining at scale is still predominantly in its infancy and even some of the older operators like Hive Blockchain (HIVE) and Hut 8 (HUT) have only been mining for around five years. Having gone through a full Bitcoin cycle, normally a period of four years, they’ve had the knowledge and experience of navigating through each of the cycles. Both miners have little debt on the balance sheet, have been cautious with their growth strategies, and probably have sufficient runway to navigate the remainder of the bear cycle.

Many miners utilized the dilution lever during 2021 and a few started to take advantage of a more mature debt market in 2022, with competitive rates making it accessible to borrow large sums to pay for growth in facilities and hash rate. Argo Blockchain, Bitfarms, Iris Energy (IREN) and Marathon Digital (MARA) all borrowed significant sums from lenders such as Galaxy Digital (GLXY), New York Digital Investment Group LLC (NYDIG) and Silvergate Capital Corporation (NYSE:SI). Loans were generally collateralized with either Bitcoin, mining rigs and infrastructure.

Read: Miners face millions in debt payments as revenues dry up

The continued bear cycle and fall in price of mining rigs has now put a number of these miners in a precarious financial position, with some major Bitcoin miners recently informing the market that they only have limited cash flow to manage more than a few more weeks.

The most notable example being Core Scientific (CORZ), one of the largest miners in the world with over 24 EH/s of co-location and self mining. Core announced on December 21 their voluntary filing for Chapter 11 after considering all the available options. The company has been having significant cash flow problems caused by the increased costs of energy and the reduction in the price of Bitcoin. Interestingly, the company plans to continue mining Bitcoin while they sort out their finances.

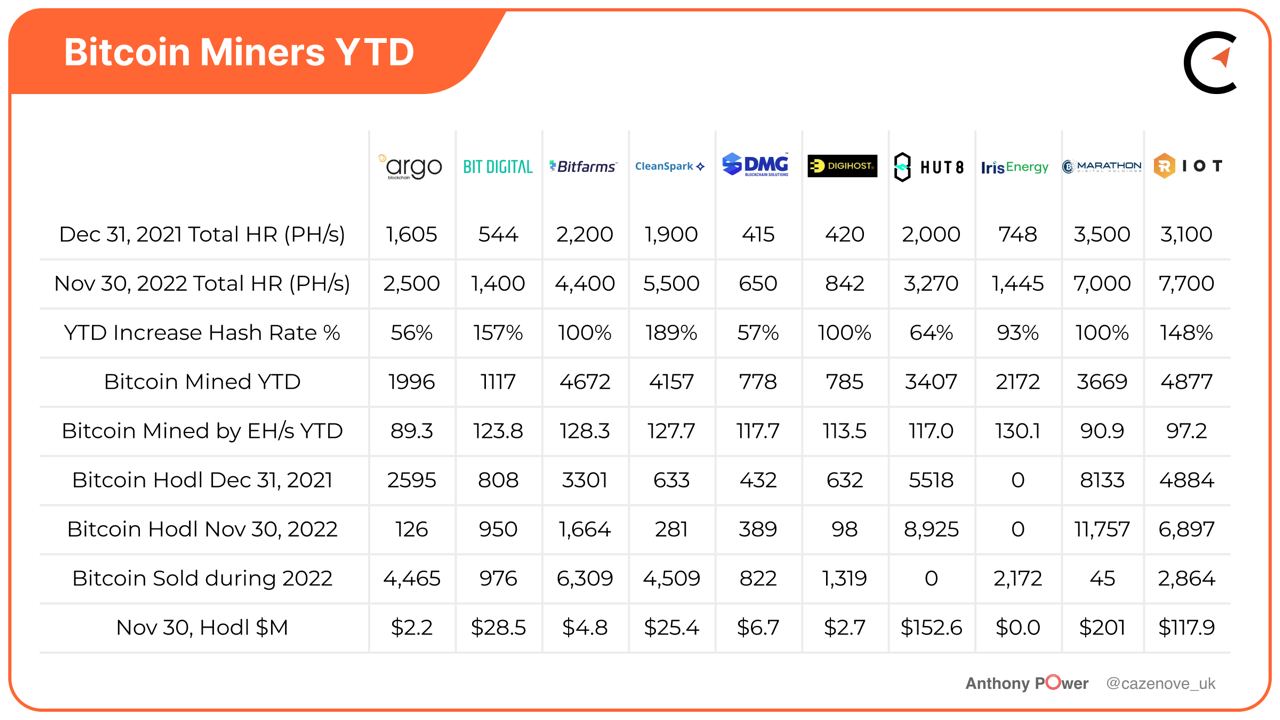

EH/s in 2022

Despite the Bitcoin price falling 68% and Bitcoin miner share prices falling on average 91% from their 52 week high prices, this downturn hasn’t prevented miners from growing their hashrate, during the year. Most of the miners in the table below have managed to grow by at least 100% year to date.

- CleanSpark managed to grow their hash rate from 1.9 EH/s at the start of the year to 6.0 EH/s, or about 62,000 miners under their direction.

- Bit Digital (BTBT) and Riot Blockchain receive special mentions for their increase in hash rate in 2022, by 157% and 148%, respectively.

Iris Energy is one interesting backwards case, as they recently defaulted on their ASIC collateralized loan with NYDIG. They were limited on the recourse of the default because of their financial planning and use of a special purpose vehicle (SPV) to shield the liability from the main company, leaving NYDIG with a debt exceeding $103 million and miners effectively worth $65-70 million. What impact this will have for miners wishing to use this debt lever in the future, is unknown.

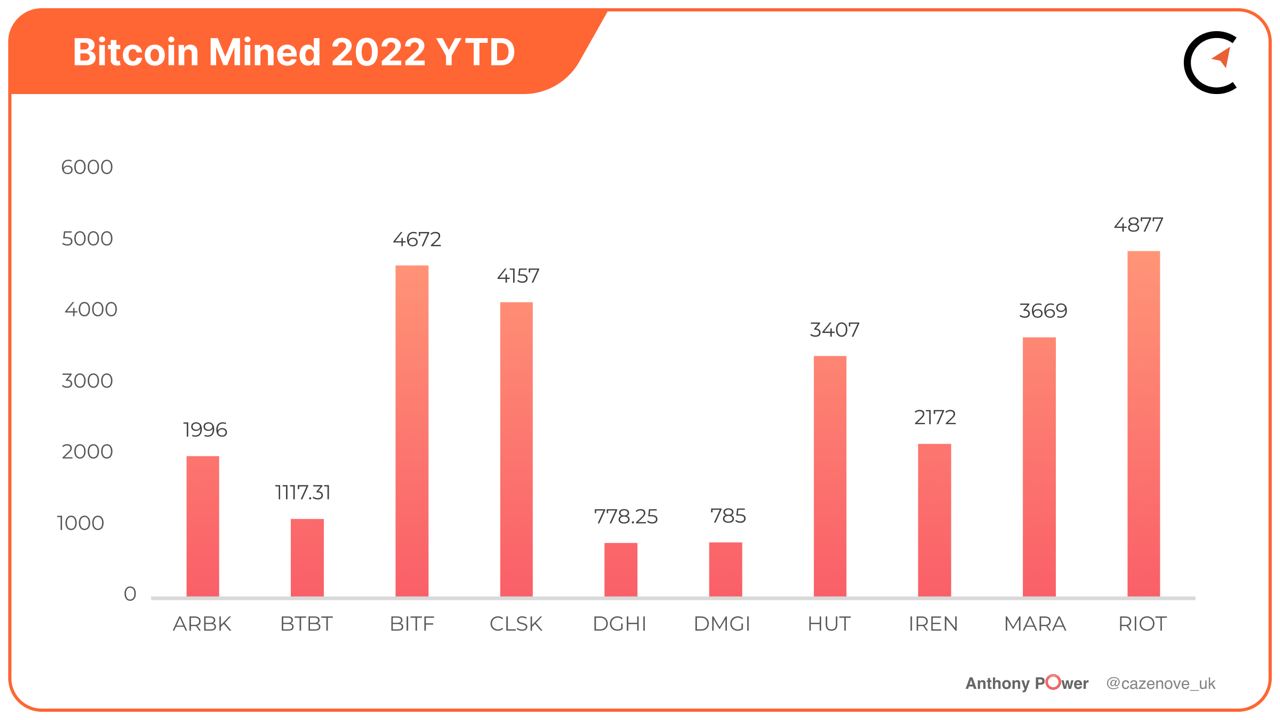

Bitcoin mined in 2022

Riot Blockchain produced the most Bitcoin in 2022 with a total of 4,877. This total was achieved with having to regularly curtail their energy throughout the year. Fortunately, unlike most of the miners in the table above, the company signed a fixed power purchase agreement (PPA), contracted to April 2030.

Bitfarms came close with 4,672 mined as at November 30, but announced on December 21, 2022 that they had achieved another milestone with their 5,000th mined Bitcoin for the year.

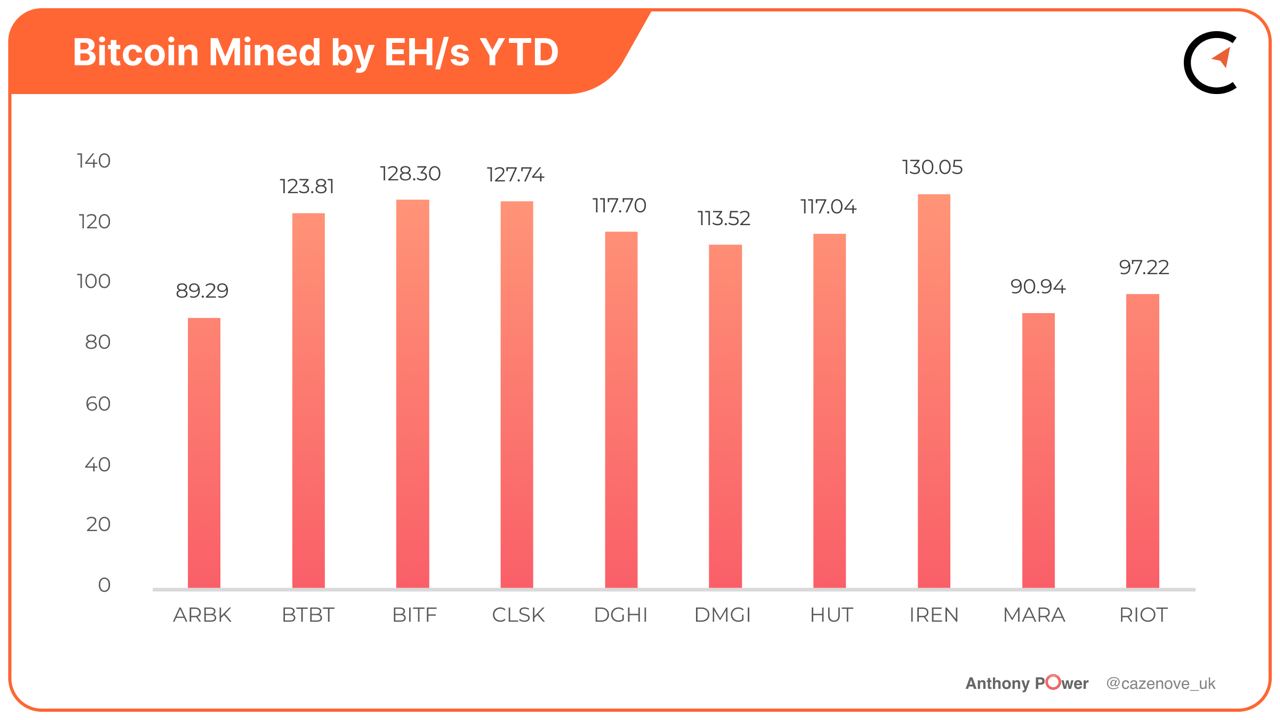

CleanSpark has had a great year in terms of growth and Bitcoin production achieving 4,157 Bitcoin year to date at a rate of 127.7 Bitcoin per EH/s. This hash rate was only bettered by Iris Energy and Bitfarms who have both continued to provide consistency of mining output throughout the year achieving 130.1 EH/s and 128.3 EH/s respectively.

Hodl

The 2021 bull cycle saw many of the North American miners hodl their Bitcoin at all costs. As the price continued to fall in 2022, miners with significant loan agreements were effectively forced into selling their Bitcoin to cover their debt interest and capital repayments.

Bitfarms sold 7,309 of their hodl, a figure which includes the 1,000 Bitcoin they had purchased in January. They have started to repay the capital on their loans with highest interest rates and greatest leverage, thereby helping to improve and strengthen their balance sheet.

CleanSpark and Iris Energy both adopted a different strategy to the majority and sold their Bitcoin regularly throughout both cycles, to cover their operational costs and grow their hash rate, purchasing the latest S19 and S19j Pro miners.

Photo by Behnam Norouzi on Unsplash