Is your hardware ready for the halving? That’s the latest question miners are asking themselves with ten months to go before the programmatic reduction in Bitcoin issuance which occurs about every four years.

We’ve already seen a few of the North American Bitcoin miners place significant orders of the most efficient mining machines on the market, particularly Cleanspark’s multiple S19 XP orders.

“The industry has been going through a big upgrade cycle . . . energy consumption is maintaining at the same level, but at the same time, the global hashrate, or the amount of compute power that’s applied to Bitcoin mining, has grown substantially,” Fred Thiel, Chairman and Chief Executive Office of Marathon Digital (MARA), the largest self mining Bitcoin company in North America, told Bloomberg.

Thiel later stressed the importance of miners having the most efficient machinery, with the average miner operating at just 40 joules per TH/s. Marathon Digital’s fleet, on the other hand, averages at about 24 joules per TH/s.

Of course, the capital expenditure on units can’t be overlooked either.

Consider two purchases, one during the peak of the bull market and one during the depths of the bear market: Stronghold Digital’s (SDIG) 9,080 Bitcoin miner purchase in December 2021, at a cost of nearly $84 per TH/s with a power efficiency of 29.5 joules per TH/s versus that to the latest order of 12,500 S19 XP miners purchased by CleanSpark (CLSK). The company incurred a cost of $23 per TH/s for a machine with a power efficiency of 21.5 joules per Th/s.

Simply put, it likely made more sense to wait to purchase units as there are more efficient miners available on the market at significantly lower prices.

Block Rewards and the halving

The current Bitcoin block reward is composed of 6.25 newly generated coins equating to $160,000 of revenue per block, at today’s price. The block reward will decrease to 3.125 Bitcoin per block ($80,000) post-halving. If the global hashrate stabilizes during this period, the cost of power to mine one Bitcoin will effectively double overnight.

Looking at our selection of publicly listed Bitcoin miners, the average cost to mine Bitcoin stands at around $12,000 per BTC. Post-halving, the average cost of mining one block would be $75,000–thereby providing a small margin per Bitcoin to cover operational costs, such as general and administrative costs, including staffing, training, travel, professional and legal fees, and costs to finance, for example interest costs.

The larger miners with the most modern and efficient fleets along with the best energy rates per kWh, will be best placed, post halving.

Q1 Gross Mining Margin

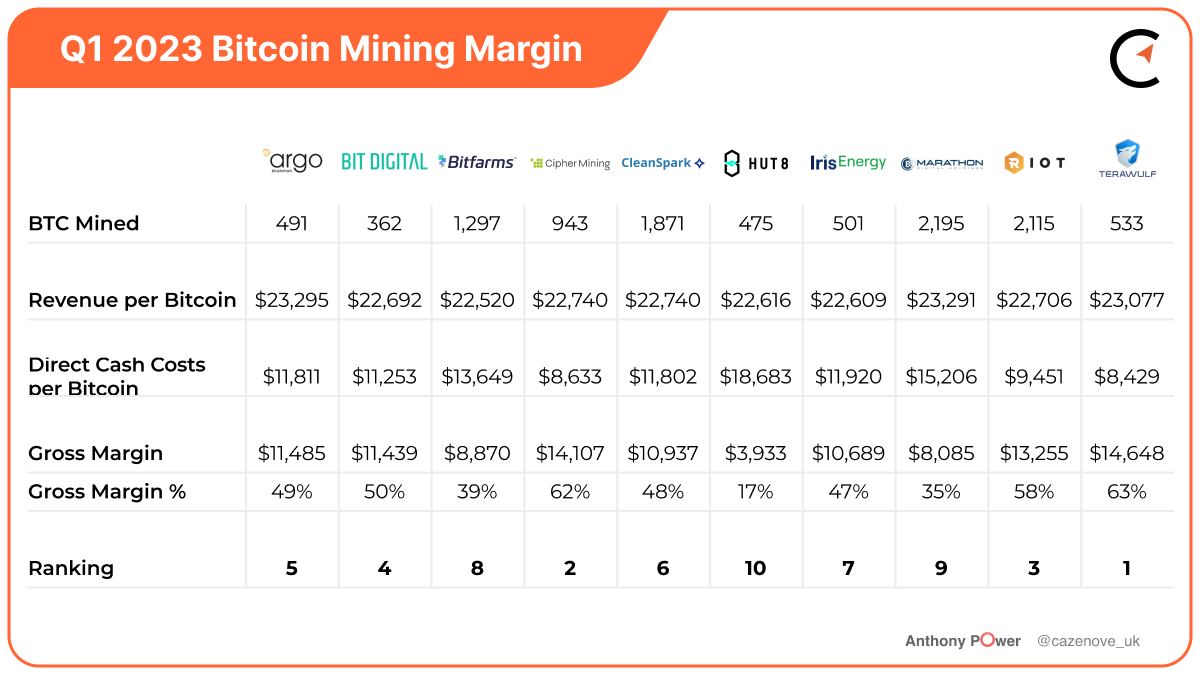

The table below highlights the revenue and direct costs, i.e. electricity costs, and direct labor associated with producing one Bitcoin.

Terawulf (WULF) delivered a gross margin of 63% benefiting from their 5 year agreement, providing 50 MW and home to 16,000 self-miners, at the nuclear-powered Nautilus Cryptomine facility in Pennsylvania. The power cost at this, the first nuclear facility to power Bitcoin, is $0.02/kWh. Terawulf can also add a further 50 MW of mining capacity, in the facility that is expected to reach 300 MW, potentially becoming one of the largest carbon free mines in North America. The latest monthly mining update from Terawulf highlights a current blended electricity cost of approximately $0.028/kWh–increasing the gross margin to 77%.

Cipher Mining (CIFR), having only commenced self-mining in the last quarter of 2022, but are already achieving good margins of 62% with Riot Platforms (RIOT) at 58%, benefiting from the $1.9 million of energy credits attributed to self-mining, at Whinstone facility in Q1 2023.

The majority of the remaining miners are achieving closer to 50% gross margins, but even these margins will need to improve if the price of Bitcoin remains at current levels. It should be noted that Marathon Digital’s direct cost also includes the cost of hosting as well as electricity, and assuming this represents 15% of the cost, it would imply a margin closer to 45%.

Iris Energy included their cost of electricity on their monthly mining update and in May the cost per Bitcoin was $11,992 providing the company with a gross margin of 55%–a sharp increase from the 47% margin achieved during Q1 2023.

Hut 8 (HUT) have well documented their issues with their energy provider at the North Bay Facility in Ontario and the more recent electrical failures at its Drumheller site. However, with increased energy prices, and a fleet of miners that probably needs updating, the company achieved a gross margin of 17%.

Summary

If you consider the price of Bitcoin remains the current levels going into ‘the halving’, then a significant number of Bitcoin miners will be forced to power down or power off completely when energy costs become unaffordable, as it would not provide any meaningful contribution to operation costs/overheads.

Cleanspark (CLSK) and Marathon Digital are due to energize their large orders of S19 XP mining machines over the next quarter, and with energy costs appearing to slowly track back to levels seen in 2021, their margins will improve and put them in a stronger position, along with Terawulf and Cipher Mining, in readiness for the next halving in 2024.