Investors have a good problem on their hands when it comes to Bitcoin miners: there’s a lot to choose from.

The most popular, Marathon Digital (MARA) and Riot Platforms (RIOT), are often covered in mainstream media articles or even on Mining Memo. But what about the half dozen plus of miners slightly smaller, with just as much punch, if not more, than the two most well known brands?

As such, let’s compare the ‘mid-tier’ Bitcoin mining companies as categorized by: 1) An operational Bitcoin mining hash rate between 3.0 EH/s and 10 EH/s and 2) a Market Capitalization in excess of $200 million.

The miners that fulfilled both these criteria were as follows:

- Bitfarms (BITF)

- Cipher Mining (CIFR)

- CleanSpark (CLSK)

- Hive Blockchain (HIVE)

- HUT 8 (HUT)

- Iris Energy (IREN)

- Terawulf (WULF)

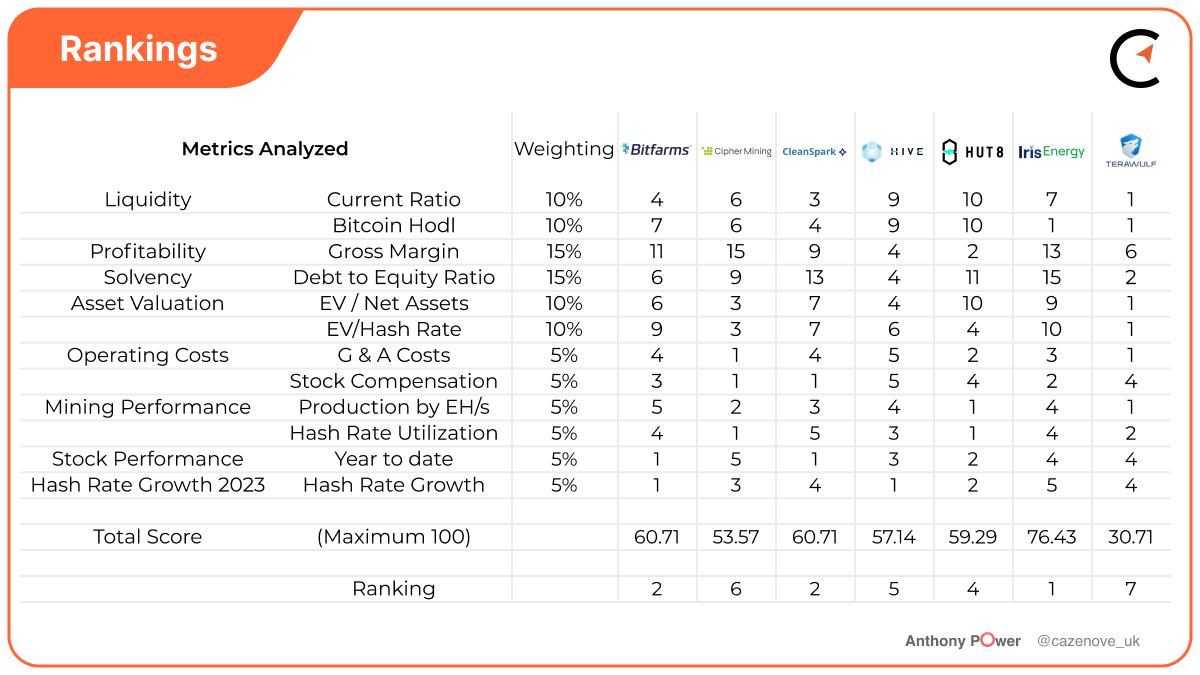

The metrics used for comparison will consider liquidity, profitability, debt, operating cost, asset cost, mining performance and stock performance, and were taken from the various SEC filings, company presentations and monthly updates. Most importantly, this article has been prepared for content purposes only and in no way to be considered as financial advice.

Check out our monthly mining updates for more information and links to certain events.

Balance Sheet Strength

There is sufficient available data to suggest that the Bitcoin price moves in cycles, and ensuring a strong balance sheet is maintained, can help Bitcoin mining companies weather the economic downturns and market disruption. By maintaining healthy levels of cash, they can continue to operate and pursue growth opportunities even during difficult times, and at the same time instill confidence in investors and other stakeholders, signaling that the company is financially stable and well-managed.

The year 2022 highlighted the importance of maintaining a strong balance sheet in the Bitcoin mining sector. Core Scientific (CORZQ) and Compute North both miscalculated the cost of energy and the impact of the Bitcoin price, during the bear cycle entered Chapter 11 to seek protection. Argo Blockchain (ARB.L, ARBK) was also close to entering Chapter 11 but at the 11th hour were forced to sell their flagship facility, Helios, to Galaxy Digital, seven months after energisation, to reduce their debt position and provide some much needed cash flow.

Read: Miners face millions in debt payments as revenues dry up

Bitfarms and Iris Energy utilized the debt markets in an attempt to grow their hashrate, almost to their detriment, too. Fortunately, they both had a little more success in navigating through safely with Bitfarms reducing their debt position from a high of $160 million (mid 2022) to a current level of $21 million, whilst continuing to grow their hashrate.

Iris Energy structured their debt through a number of Special Purpose Vehicles (SPV), thereby restricting the debt to the collateral of mining machines held within the SPV. As the price of Bitcoin dropped the value of machines also fell and it finally reached a point where the company found it more beneficial to default on the debt and return the machines to the lender. Using Bitmain deposits to purchase new machines, they were able to grow their hashrate to a current operational rate of 5.5 EH/s, as at May 3, 2023, achieving this feat in less than 6 months, and with zero debt on the balance sheet.

Liquidity

Cash flow management, for which we can determine relative new technology businesses, often requires significant investment in operational expenses before they can generate revenue. The liquidity provides the business with the flexibility to respond quickly to new opportunities or unexpected challenges. Investors are more likely to invest in businesses with strong liquidity positions, as they perceive these businesses to be less risky and better positioned to weather market fluctuations.

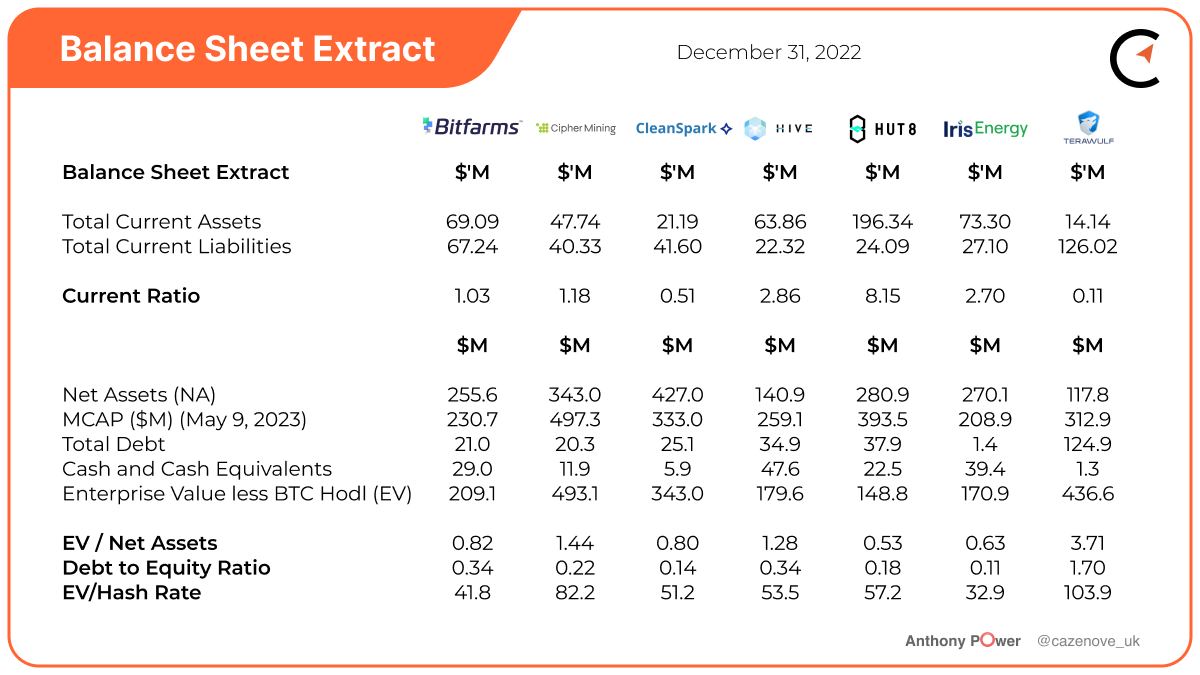

For these mid-tier miners a good liquidity metric to consider would be the Current Ratio which is calculated by dividing a company’s current assets by its current liabilities, with a ratio of one or higher indicating the company has sufficient current assets to cover its current liabilities, over a given period, 12 months. It’s therefore very easy to calculate when using readily available financial statements, making it a widely used and accessible metric for assessing liquidity.

From the table below, Hut 8 stands out from the other miners with current assets covering current liabilities by a factor of 8.15x, due to their large Bitcoin hodl. Hive Blockchain and Iris energy also have sufficient coverage at 2.86x and 2.7x, respectively. Terawulf and CleanSpark have lower than 1.0 ratios, meaning they have insufficient short term assets to cover their short term liabilities. However, both would probably raise the fact that they are fully utilizing all available assets in the business to achieve growth and this is supported as they currently have the highest planned hash rate growth of over the current calendar year.

Enterprise Value (EV)

The EV metric offers a more comprehensive and holistic view of a company’s worth, incorporating its market value, debt, and cash position as can be shown in the following example:

If you were to buy a company with a valuation of $1,000 and there was $200 of cash in the bank and a loan outstanding of $100, the EV could be calculated as follows; Market Capitalization of $1000 less the $200 in cash, and add the $100 of debt, providing an EV of $900.

For the comparison I have included a company’s Bitcoin Hodl as ‘cash and cash equivalents’ to provide a level playing field. If you look at Hut 8, where the EV less Bitcoin Hodl is $148.8 million and compare that to the value of the Net Assets in the company of $280.9 million, you have a company for every $0.53 of value you’re getting $1 of assets. Terawulf has $125 million of debt on the balance sheet and no Bitcoin hodl and therefore in terms of EV, for every $3.71 you’re getting $1 of assets.

Debt to Equity Ratio

The Debt to Equity ratio helps investors understand how much debt the company has compared to the money invested by shareholders. Iris Energy has a low ratio of 0.11 which tells us that for every dollar of equity, the company has 11 cents of debt.

A high debt ratio can be seen as a potential concern or risk, but it’s not necessarily always bad. TeraWulf has a significant amount of debt compared to its equity which indicates that the company has borrowed a large portion of its capital to finance its expansion. Although the downsides are financial risk, making the company vulnerable to economic downturns, as we saw in 2022 for a number of Bitcoin miners, interest payments will reduce the profitability, and creditworthiness, where the debt ratio may lead to a lower credit rating, thereby making it more expensive to raise additional funds in the future. Time will tell to see if the Bitcoin price remains more stable and provide TeraWulf the opportunity to reduce their current level.

EV/Hash Rate

This ratio provides a simple calculation to determine the implied cost of 1 EH/s for each company, as at December 31, 2022. Iris Energy again tops the metric with a cost of $32.9 million per EH/s compared to TeraWulf and Cipher Mining, where 1 EH/s has a cost of $103.9 million and $86.5 million, respectively.

Gross Mining Margin

The gross mining margin helps assess a company’s ability to generate profits from its core operations. In Bitcoin mining, the majority of direct costs included in this measure are related to the energy costs for each miner, making the metric a useful method of comparison.

Cipher Mining had limited financial data to analyze as they started self-mining Bitcoin in the final quarter of 2022 whilst achieving a margin in excess of 75%. They have just released their Q1 2023 update and the margin achieved was an impressive 62%.

In 2023, TeraWulf mined bitcoin at a blended rate of between 3 and 3.5 cents per kWh, and in their latest April 2023 update the company recorded mining each Bitcoin with an average energy cost of $7,602, thereby achieving an impressive gross margin of 74%.

In the final quarter of 2022, Iris Energy was able to produce a Bitcoin for an average electricity cost of $10,249 achieving a 46% gross mining margin. The remaining miners also had positive margins between 13% and 29%.

Operational Costs

In terms of operating costs, this article focuses on general and administration (G&A) costs and stock compensation. In times of bear cycles, companies should be considering all options to reduce costs. Bonuses and stock compensation are all discretionary items that companies use to attract senior management and employees and reward them for performance and ensuring their goals are fully aligned with the strategic goals of the company.

From the table below, it should be recognized that Cipher Mining and TeraWulf only recently started self-mining Bitcoin and therefore their levels of G&A costs are significantly high in proportion to revenues achieved through mining.

In terms of stock compensation, the average for the technology sector when analyzing the likes of Alphabet Inc, Microsoft Corporation and Meta Platforms was less than 8% and only Hive Blockchain, Hut 8 and Terawulf come close to that figure in the table below. In 2022, Cipher Mining posted $41.5 million whilst CleanSpark included $37.4 million, for stock compensation, on top of sizable G&A costs.

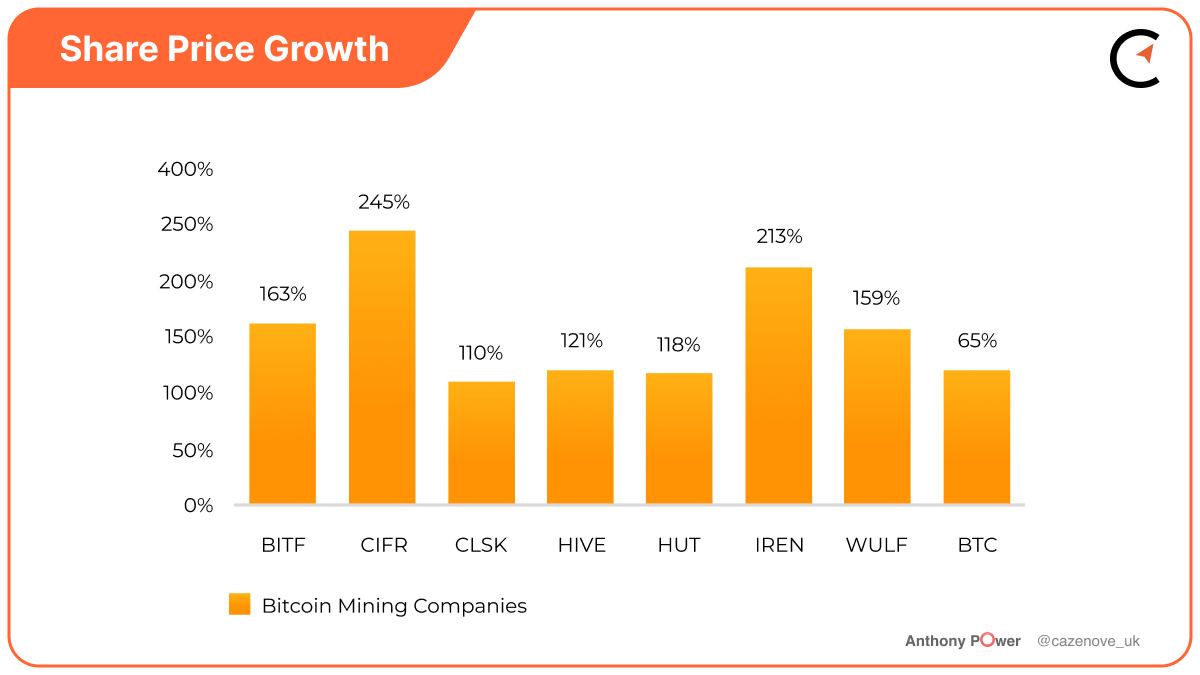

Share Price

The price of Bitcoin has increased by 65% since the beginning of 2023, whilst the Bitcoin miners have actually fared better with Cipher Mining increasing its share price by 245% and Iris Energy recovering some of the downturn in 2022 with an increase of 213%. Although this appears to be, on first reflection, significant rises, it should be noted that a number of these companies share prices are still effectively 70-80% lower than the highs achieved in 2021.

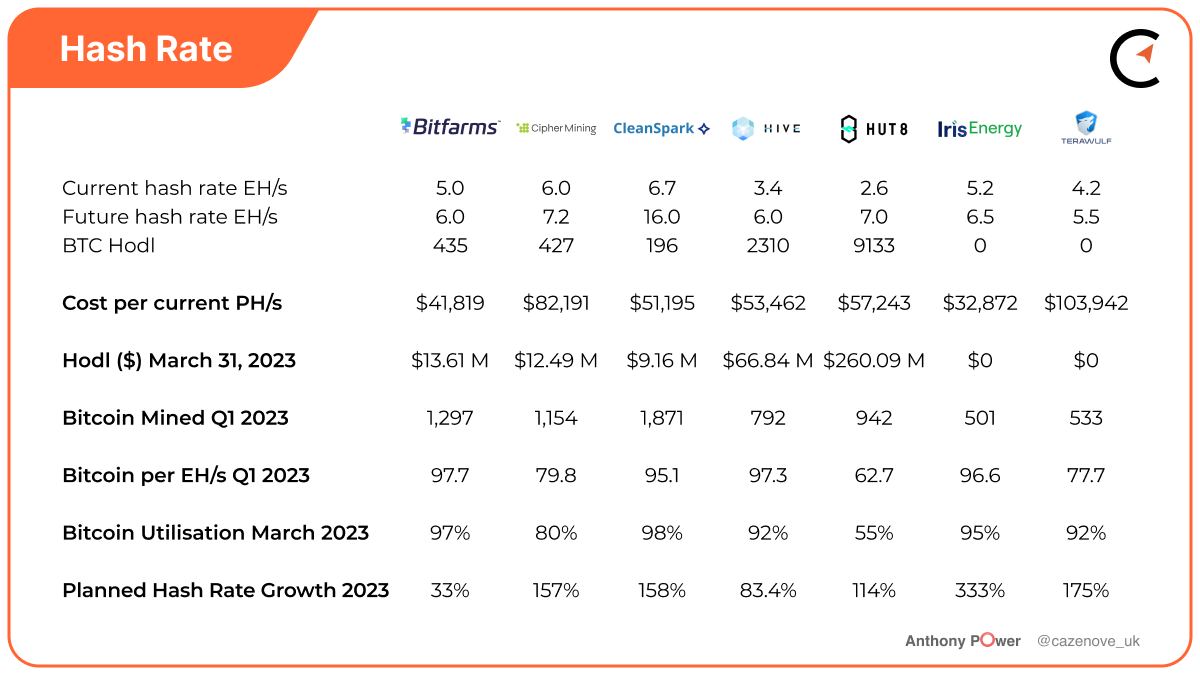

Bitcoin Mining Hashrate

CleanSpark were the only miner to actually achieve their original planned hash rate growth in 2022 and have laid the gauntlet down again with a further 9.8 EH/s, and increase of 158% during the current year, and after their recent order for 45,000 S19 XPs mining machines due for arrival in August and September, who’s going to bet against them achieving their goal. Iris Energy has a challenging 2022 where they handed back 3.5 EH of mining rigs to their lender for defaulting on the loan. However, they have already achieved 5.5 EH/s and have provided a target of 6.5 EH/s, an increase of 333% in 2023, by adding a further 20 MW at their Childress site in Texas.

Bitfarms have a more modest planned growth of 1.5 EH/s (33%) to reach their target of 6.0 EH/s, which considering less than a year ago the company had $160 million of debt on the balance sheet with a falling Bitcoin price to navigate.

Once the merger between Hut 8 and U.S. Data Mining Group (USBTC) is formally approved, the new company has an operational hash rate target of 7.02 EH/s, which should provide some comfort to shareholders.

Special mentions should be given to Cipher Mining and TeraWulf who are both likely to achieve their operational hash rate targets of 7.2 EH/s and 5.5 EH/s well before the end of 2023.

Performance

Bitcoin production per EH/s and Bitcoin utilization are two metrics that have been regularly used to determine a miners performance. Bitfarms, Hive Blockchain CleanSpark and Iris Energy have dominated these performance tables for the last 18 months providing a real consistency in delivery.

Hut 8 have well documented their issues with their former energy provider, Validus, at the North bay, Ontario site. They have recently updated the issues at their Drumheller site where high energy input levels have been causing equipment failures that have materially reduced their operations to a level of 15% of the installed hashrate at the site

Ranking Process

Having considered a number of metrics, it’s time to collate them and weightings to determine the importance of each metric. Each miner is then provided a score for each metric which when added provides a total score to determine a suitable ranking.

Iris Energy, having had the opportunity to remove over $103 million of debt from its balance sheet, consistently scored well across the majority of metrics, achieving a score of 76.4 out of a total 100. The next five miners, led by Bitfarms and CleanSpark, were very close in total score, and one or two metrics could have easily changed the overall rankings.

TeraWulf, whilst relatively a new miner, in comparison, finished with a score of 30.7 and should not be overlooked. They currently have the lowest published energy cost of all the North American listed miners and have had amazing growth in 2023. They do have a significant amount of debt on the Balance Sheet and should the price of Bitcoin remain close to $30,000, the company has a plan to start significantly reducing that debt to a more manageable level as the next halving approaches in 12 months time.

Although operationally, Hut 8 have a relatively challenging 12 months, their Balance Sheet strength has clearly been a source of relief and enabled them to navigate without having to utilize the debt markets.